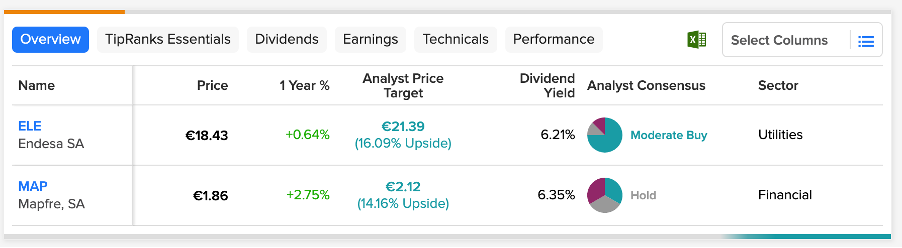

Energy company Endesa, SA (ES:ELE) and insurance player Mapfre, SA (ES:MAP) from Spain offer investors a good balance of dividend income and capital gains.

Analysts predict that the share prices of both stocks will rise by approximately 15%. Moreover, both companies are good dividend payers offering attractive yields.

When investors are focusing on any particular market, like Spain, the TipRanks’ tools become the guiding lights to screen and pick the best among the rest. Tools like Trending Stocks, Stock Comparison, and Stock Screener provide investors with a complete range of analyses to make an informed decision.

Let’s discuss the two stocks in detail.

Endesa SA

With a customer base of around 10 million, Endesa is the leading electric company in Spain.

The Spanish government has introduced a new windfall tax on the big energy companies to protect consumers from rising energy prices. This tax will impact the earnings of Endesa for the next two years. The tax will hit net profits by €250 million to €300 million in 2023 and 2024.

Nonetheless, the company is on track to achieve its target of €2.2 billion – €2.3 billion in net earnings for the full year of 2022. The numbers are reduced to €1.5 billion and €1.8 billion in 2023 and 2024, respectively.

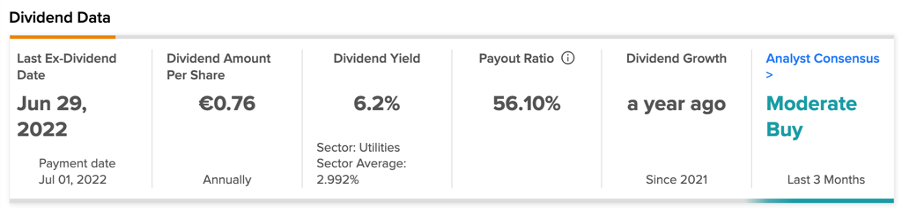

The company’s dividend picture is solid, with a generous dividend yield of 6.2%. The utility sector average is nearly 3.0%. The company follows a dividend policy under which it will distribute 70% of its net profits to its shareholders. Even though the earnings forecast has been cut and the payouts could reduce in the future, the company is still among the leading dividend payers in Spain.

Endesa Stock Recommendations

Endesa stock has a total of eight recommendations on TipRanks, which include six Buy, one hold, and one Sell ratings. Overall, the stock has a Moderate Buy consensus rating.

The ELE target price is €21.4, which represents a 16% upside from the current level.

Mapfre, SA

Mapfre is an insurance company with a presence in Spain and 80 countries worldwide. The company offers life, health, accident, property, and casualty insurance.

The company’s stock gained around 17% in the last three months, driven by its results for the first nine months of 2022. During this period, the company’s revenue increased by 10.6%, mainly due to improved pricing in reinsurance, currency gains, and its multi-channel operational strategy. On the flip side, attributable profits were down by 7%, hit by higher business expenses.

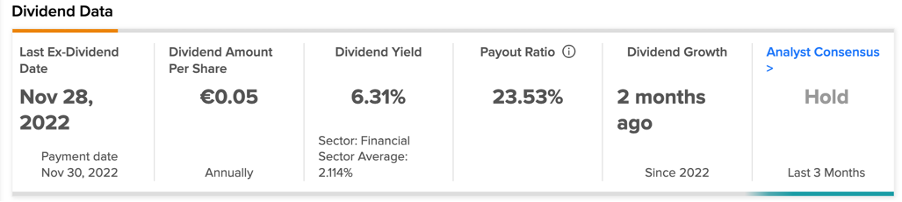

Peeking into the dividends, the company is a safer bet for income investors. The dividend yield is 6.3%, against the sector average of 2.1%. The company has a 50% payout target, which makes its dividends sustainable.

Mapfre has a solvency ratio of 2.19 as of June 2022, which indicates its efficiency in meeting its long-term obligations. A ratio of this level ensures consistent returns for the company’s shareholders.

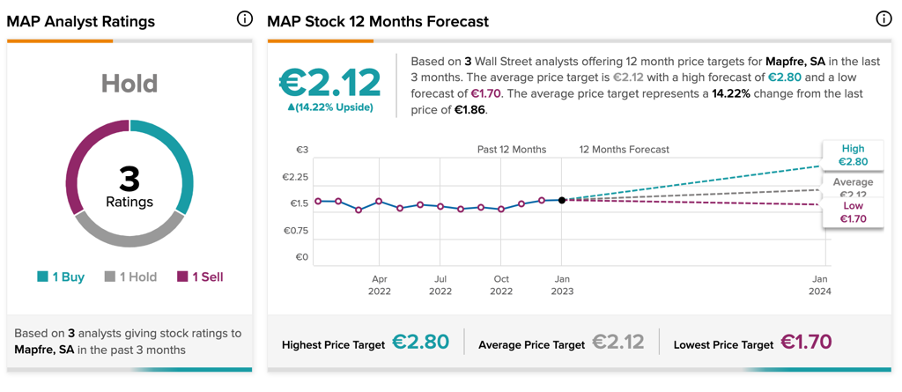

Mapfre Stock Forecast

Mapfre’s average stock forecast is €2.12, which implies an upside of 14.2% on the current trading level.

The stock has a Hold rating on TipRanks, based on one Buy, One Hold, and one Sell recommendation.

Conclusion

These companies from the Spanish market offer stability to investors with higher target prices and dividend payments.

Join our Webinar to learn how TipRanks promotes Wall Street transparency