E.ON SE (EONGY) expects to post an earnings increase this year as Europe’s biggest energy network operator sees revenue coming from its takeover of Innogy.

The German energy firm expects adjusted earnings before interest and tax (EBIT) to rise to 3.9-4.1 billion euros in 2020 from 3.2 billion euros last year. Adjusted net income for this year should come in at 1.7-1.9 billion euros, up from 1.5 billion.

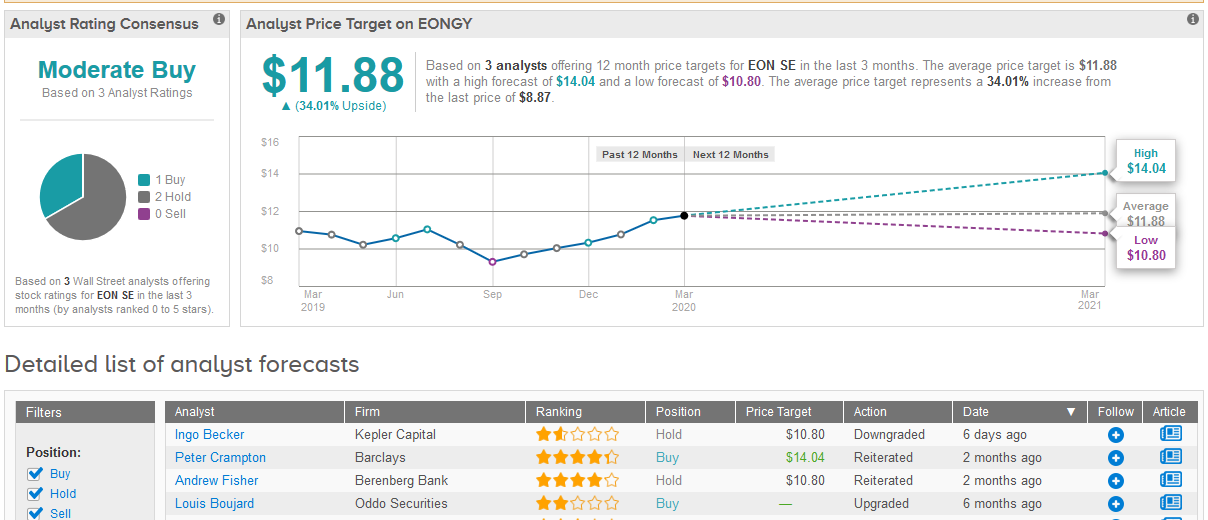

Overall 2 analysts, assigned a Hold rating to E.ON’s stock and 1 a Buy rating in the last three months, adding up to a Moderate Buy consensus rating. The 12-month average price target of $11.88 showcases a potential upside of 34% from current levels. (See E.ON’s stock analysis on TipRanks)

“Focusing our investments on energy networks and embedded energy infrastructure for customers will enhance E.ON’s future resilience and ability to weather crises,” E.ON CFO Marc Spieker said.

From the Innogy integration, E.ON expects synergies of €740 million from 2022 onward and €780 million from 2024 onward. Shareholders will be paid a dividend of €0.46 per share for 2019. The company plans to grow dividends by 5% annually up to 2022.

“Overall, the energy industry doubtless won’t be as hard hit as other industries,” E.ON CEO Johannes Teyssen said. “But we will still expect the crisis to leave its mark on our bottom line.”

Related News:

Alphabet Stock Looks Undervalued at Current Levels, Says Top Analyst

Follow the Top 25 Financial Bloggers with TipRanks

With One Day to Go Before Micron’s Earnings, this Bull Cuts Estimates