To help aid its investigation into Big Tech, investigators from the House Judiciary Committee last week wrote to Alphabet’s (GOOGL) Google, Apple (AAPL) and Amazon (AMZN), requesting documents which they believe will help provide information on whether these companies have broken any laws. Primarily, the committee is looking into whether Big Tech practices are harming customers or violating antitrust law, but are not necessarily looking into privacy (as other bodies are).

When it comes to Google, the House is looking into a wide-range of antitrust concerns, including 25 businesses within the company. While the scope is large, Evercore’s Kevin Rippey is not too concerned as “only four of these areas of concern relate to the core search business,” which represents about 75% of the enterprise value.

As a result, Rippey maintains an Outperform rating on GOOGL stock, with a $1,350 price target, which implies about 10% upside from current levels. (To watch Rippey’s track record, click here)

“So long as the House’s efforts are focused on businesses other than Search, the magnitude of material financial risk may prove less than feared,” Rippey opined. “The Committee seems more focused on the company’s ad tech complex…as well as the sharing of data between the Chrome, Android, Cloud, and advertising business lines.” Chrome will be a priority for the Committee, as it mentioned the browser four times in letter to the company.

Besides Chrome, Rippey believes “Android and the app store remain areas of vulnerability.” Given the app store’s “monopoly control over app distribution,” Rippey thinks that app stores “are a key area of vulnerability under existing anti-trust law.”

For better or worse, this is not Google’s first time in an antitrust investigation. Last year, the company was fined $5 billion by the European Commission for Android-related antitrust violations. And with Big Tech is routinely and increasing receiving negative attention from presidential candidates in the Democratic party, this investigation is surely not the end of regulators’ focus on the tech giant.

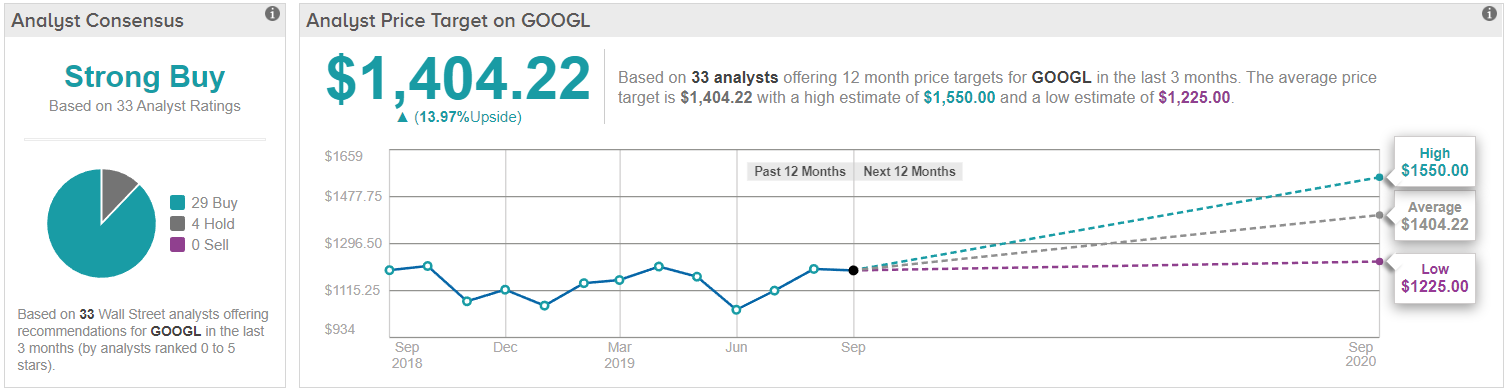

But like other tech companies, Alphabet stock continues to be one of Wall Street’s favorites. TipRanks analysis of 33 analysts ratings on the stock shows a consensus Strong Buy, with 29 analysts rating the stock a Buy and four who giving it a Hold. The average price target among these analysts stand at $1,404.22, representing a 14% upside from current levels. (See GOOGL’s price targets and analyst ratings on TipRanks)