Expedia Group Inc. (EXPE) announced plans to raise $3.2 billion to shore up its financial buffers as the online travel operator grapples with a steep drop in demand due to the coronavirus-related travel restrictions.

The financial plan consists of a $1.2 billion private placement of perpetual preferred stock and about $2 billion in new debt financing. The equity injection is provided by investment funds managed by affiliates of Apollo Global Management, Inc. and Silver Lake, two of the world’s leading alternative asset investors, Expedia said.

“We have one mandate – to conserve cash, survive, and use this time to reconstruct a stronger enterprise to serve the future of travel,” said Barry Diller, Chairman at Expedia. “We are unable to make any predictions as to when travel will rebound but we emphatically believe that it will, for….’if there’s life, there’s travel.'”

Following the closure of the fund-raising transactions expected on May 5, David Sambur, Co-Lead Partner of Apollo’s private equity business, and Greg Mondre, Co-CEO and Managing Partner of Silver Lake, will join Expedia’s Board of Directors. J.P. Morgan and Moelis & Company LLC are acting as joint financial advisors and placement agents.

Shares soared 9% to $67 in midday trading in the U.S. taking this year’s plunge so far to 40%.

In a separate statement, the company named Vice Chairman Peter Kern as its chief executive officer and said it would slash its dividend, while also implementing cost-cutting measures. Expedia will instate furlough and reduced work week programs as well as voluntary reduced work weeks, which will be effective through August 31.

In addition, Expedia’s Chairman, Chief Executive Officer and board members will forgo cash compensation for the remainder of the year. The online travel operators’ senior executives will be taking a 25% salary reduction this year.

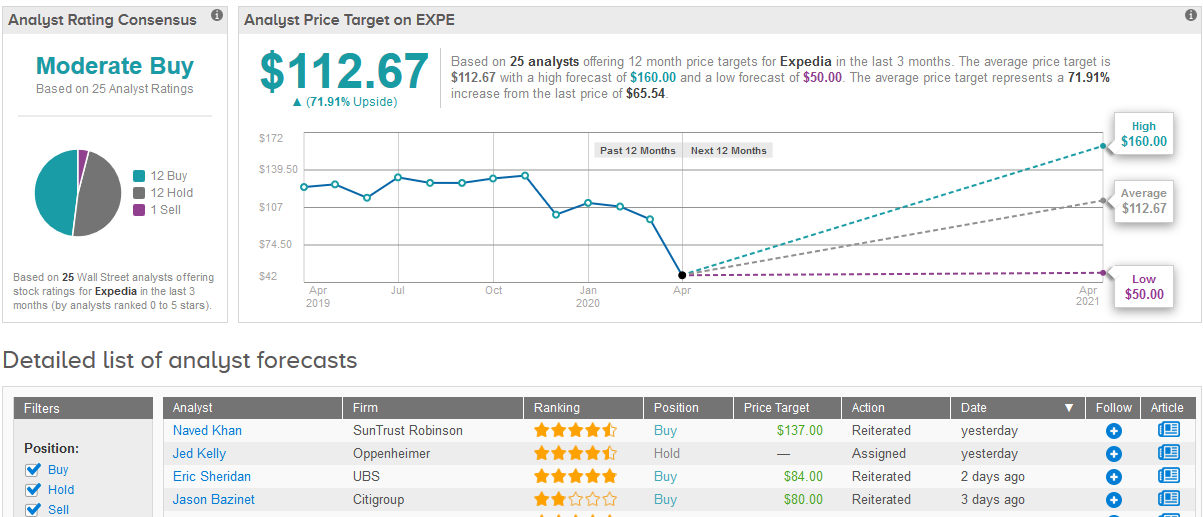

Wall Street analysts have a Moderate Buy consensus rating on Expedia’s stock based on 12 Buys, 12 Holds and 1 Sell. The $112.67 average price target means investors could be reaping a 72% gain should the target be met in the coming 12 months (See Expedia stock analysis on TipRanks).

Related News:

Target Online Sales Go Through the Roof as Shoppers Stay Home

Kimberly-Clark Sales Jump to $5 Billion Boosted by Tissue Sales

Snap Announces $750M Note Offering Following Stellar Q1 Earnings