Exxon Mobil Corp (XOM) on Tuesday announced it will cut planned capital spending by 30% this year as the coronavirus pandemic outbreak curtails energy demand and pushes oil prices down.

Capital investments for this year will be reduced to $23 billion, from the planned $33 billion. Cash operating expenses will be cut by 15%, the largest U.S. oil producer said in a statement. In addition, Exxon Mobil will seek to preserve its dividend payout to shareholders. Crude prices have plunged almost 60% this year.

“The long-term fundamentals that underpin the company’s business plans have not changed — population and energy demand will grow, and the economy will rebound,” said Darren Woods, chairman and chief executive officer of Exxon Mobil. “Our capital allocation priorities also remain unchanged. Our objective is to continue investing in industry-advantaged projects to create value, preserve cash for the dividend and make appropriate and prudent use of our balance sheet.”

Woods added that Exxon Mobil was projecting a 20% to 30% short-term decline in global oil demand. The Texas-based oil producer said it expected to maintain the ability to return to normal operations as demand recovers.

The largest capital spending reduction will affect the Permian Basin, the heart of the U.S. shale boom, where short-cycle investments can be more readily adjusted to respond to market conditions, Exxon Mobil said. The reduced activity will affect the pace of drilling and well completions until market conditions improve. While the deepwater discoveries offshore Guyana remained an integral part of the company’s long-term growth plans.

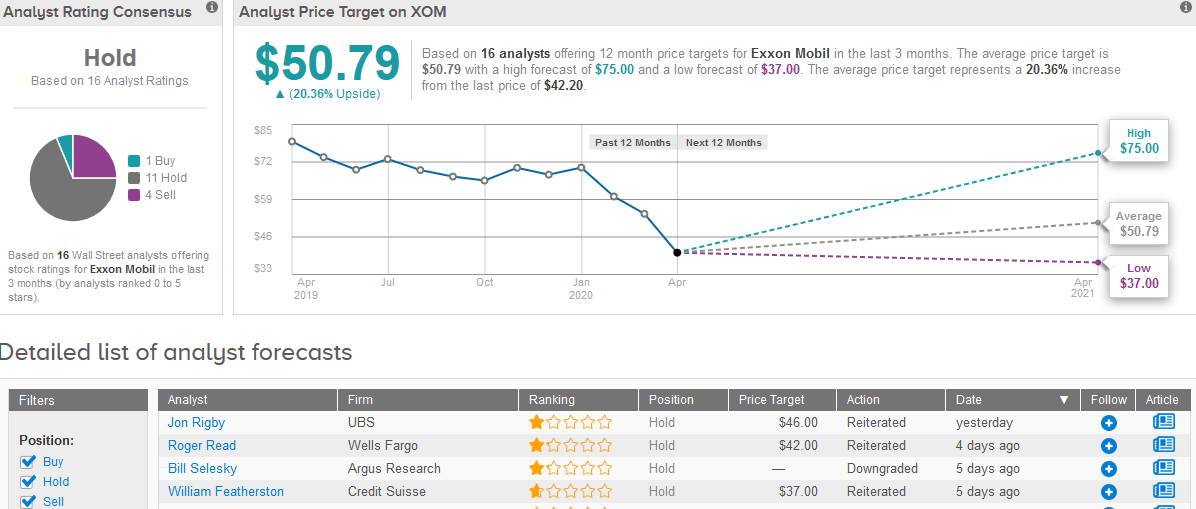

The company’s shares rose 4% in midday trading in New York. Wall Street analysts are hesitant to recommend Exxon Mobil as the consensus tells investors to Hold the stock. The consensus rating is based on 11 Holds, 4 Sells and 1 Buy. The $50.79 average price target projects 21% upside potential over the next year. (See Exxon Mobil’s stock analysis on TipRanks)

In March, RBS Capital analyst Biraj Borkhataria lowered Exxon Mobil to Sell from Hold cutting the price target to $40 from $55 previously.

“Exxon Mobil has historically been one of the most successful super-majors at investing through the business cycle and taking advantage of downturns by lowering its cost structure and high-grading its asset base”, according to Borkhataria.

Related News:

Carnival Shares Get Some Relief After Saudi Fund Buys Stake

Billionaire Steven Cohen Picks up These 2 Stocks on the Dip

3 “Strong Buy” Penny Stocks With Over 50% Upside Potential