The coronavirus hasn’t spared the mega-caps, and social media giant Facebook is a case in point. Among its FAANG peers, year-to-date, Facebook (FB) has suffered the most, shedding 24% of its value. Should the sharp pullback raise concern among investors?

Not at all, says SunTrust Robinson’s Youssef Squali. Despite the new macro environment’s impact on future estimates and a recent price target reduction, the 5-star analyst maintains that FB remains in good health. As a result, Squali reiterated his Buy rating, although as mentioned, the price target gets a haircut – down from $265 to $230. From current levels, the upside potential comes in at 47%. (To watch Squali’s track record, click here)

The major source of Facebook’s revenue is from advertising, so it is bound to feel the weight of coronavirus’ impact. As ad budgets all over the world get severely slashed, there will naturally be less money to spend on Facebook.

That being said, as the world’s leading social media platform, with a 62% market share, the outbreak has benefitted FB in another way. With the rise of social distancing, engagement has increased, with users around the world participating in support groups, sharing info and homemade entertainment in an effort to alleviate the isolation.

Squali also notes that although brand marketers from the hardest hit industries are reducing ad spend, in order to gain visibility, there has been an increase in the number of smaller direct advertisers taking advantage of lower ad prices.

In conclusion, Squali makes a clear positive assessment of Facebook’s prospects. The 5-star analyst said, “The coronavirus is forcing the global economy into a standstill, and with it, FB, as the largest social platform, is seeing the effects of the sharp pullback in advertising demand WW…While visibility into timing for the turnaround remains poor, we believe that FB is one of the platforms likely to emerge strongest out of this crisis given growing user engagement, its effectiveness (must buy) for advertisers and excellent financial position.”

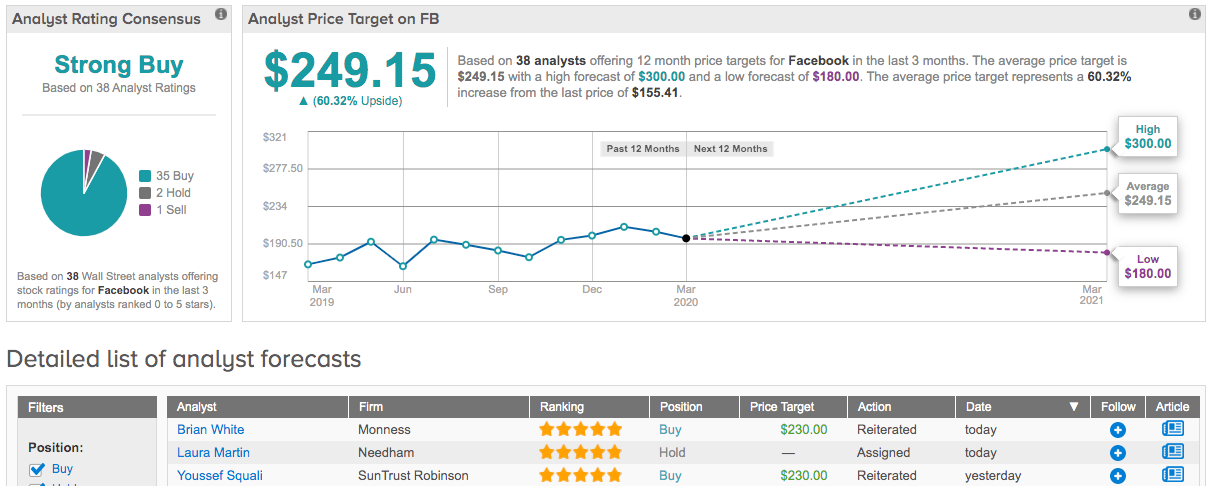

Does Facebook receive the same support from the rest of the Street? Yes, it does. A Sell and 2 Holds pale in significance when confronted with the bulls’ charge of 35 Buy ratings. The Strong Buy consensus rating comes with a $249.15 price target, implying upside potential of 60%. (See Facebook stock analysis on TipRanks)