Shares of FedEx are up almost 5% on Monday after Bernstein upgraded the stock to Buy from Hold on expectations of better-than-expected 1Q results.

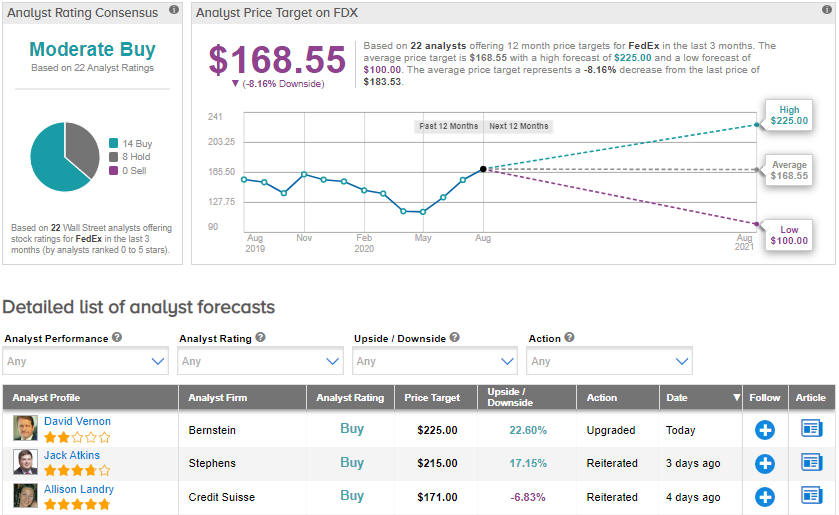

Bernstein analyst David Vernon maintained FedEx’s (FDX) price target of $225 (22.6% upside potential). He expects “the company to deliver results better than consensus expectations on better residential pricing, continued strength in Express and air cargo rates, and an inflection in ground margins.” Vernon added that “E-commerce parcel pricing is expected to remain strong as the pull forward of e-commerce penetration has strained delivery capacity.”

On August 7, Stephens analyst Jack Atkins raised FedEx’s price target to $215 (17.2% upside potential) from $180, and reiterated a Buy rating. He stated that the setup for FedEx “is perhaps the best it has been since mid-2013” and he sees “increasingly positive demand and pricing signals.”

On August 6, the company announced that it will increase the surcharge on international parcel deliveries across certain destinations to mitigate the higher costs resulting from restrictions imposed by countries related to the coronavirus pandemic.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 14 Buys and 8 Holds. In light of the stock’s year-to-date increase of 23%, the average analyst price target of $168.55 now implies downside potential of 8.2%. (See FDX stock analysis on TipRanks).

Related News:

FedEx Gains 7% On Delivery Rate Hikes, Stephens Lifts PT

JMP Securities Lifts Zillow PT On Strong 2Q

Wedbush Lifts Apple’s PT To ‘Street High’