FedEx, on Monday, announced that it will increase shipping rates by an average of 4.9% for US domestic, export, and import services from effective January 4 next year. Rates for FedEx Ground and FedEx Home Delivery, the categories in which the bulk of e-commerce orders are handled, will also be raised by 4.9%.

In addition, starting Jan. 2021, FedEx (FDX) will levy a 6% late fee on US FedEx Express and FedEx Ground customers who don’t pay their invoices according to agreed payment terms. The company will also make changes in FedEx Express, FedEx Ground, and FedEx Freight surcharge, effective January 18, 2021.

FedEx said, “These rate changes enable FedEx to continue investing in service enhancement, fleet maintenance, technology innovations and other areas to serve customers more effectively and efficiently.” (See FDX stock analysis on TipRanks).

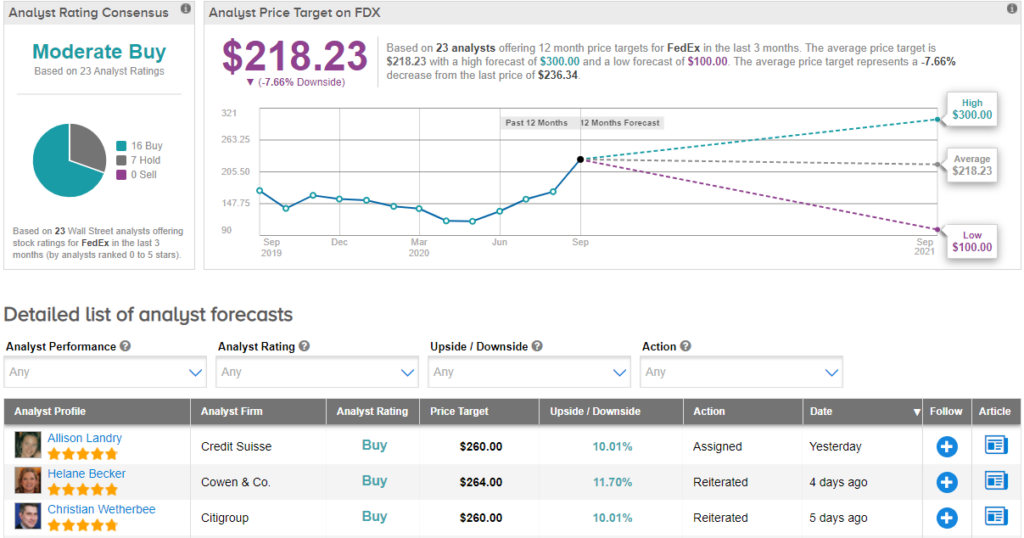

On September 14, Credit Suisse analyst Allison Landry raised the stock’s price target to $260 (10% upside potential) from $171 and reiterated a Buy rating. Landry expects volume growth to sustain for the longer-term. The analyst foresees margin expansion, strong double-digit EPS growth, and improved free cash flow conversion for FedEx.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 16 Buys and 7 Holds. Given the year-to-date share price gain of over 56%, the average price target of $218.23 implies downside potential of about 7.7% to current levels.

Related News:

Cowen Boosts FedEx’s PT By 58% Ahead Of 1Q Results

Verizon To Buy America Movil’s TracFone In $6.25B Deal

Lennar’s 3Q Profit Jumps 33% On Robust Housing Demand