Tesla’s ($TSLA) CEO Elon Musk‘s social media platform, X, had its valuation marked up by 32.4% in October, according to an exclusive report from Axios. This represents the largest monthly increase recorded by Fidelity, which helped Musk acquire the company in 2022. However, despite this markup, Fidelity still values X at nearly 72% less than its original $44 billion purchase price, reflecting the ongoing challenges faced by the platform.

Why Has Fidelity Marked Up X’s Valuation?

Fidelity’s history with X has been a rollercoaster. The financial services company began marking down X’s shares just a month after Musk assumed control of the platform, signaling early doubts about the company’s financial prospects. However, the report noted that as a shareholder, Fidelity lacks direct access to X’s financial performance and does not disclose how it evaluates privately held companies.

One possible explanation for Fidelity’s recent valuation hike could lie with xAI, Musk’s separate venture developing a large language model (LLM) using data from X. Notably, Fidelity participated in xAI’s $6 billion Series B funding round, initially holding its shares at cost before marking them up by 70% in October.

Additionally, there are reports that X Holdings may hold a significant equity stake in xAI. If these reports are accurate, it would provide further context for Fidelity’s decision to raise X’s valuation.

What stands out is the timing. Fidelity marked up its valuation of X before the U.S. elections or any potential involvement by Musk in a future Trump administration became relevant considerations.

What Is the Target Price for TSLA?

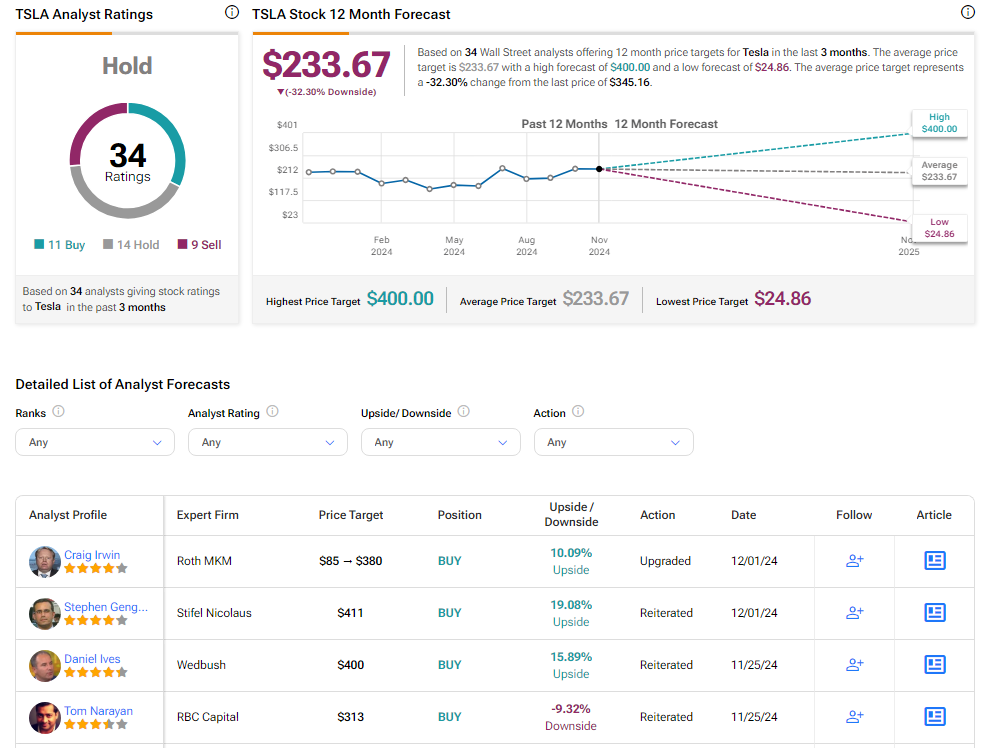

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on 11 Buys, 14 Holds, and nine Sells. Over the past year, TSLA has increased by more than 40%, and the average TSLA price target of $233.67 implies a downside potential of 32.3% from current levels.