First Horizon Corp. reported better-than-expected 4Q results. Shares of the bank holding company rose 1% in Monday’s pre-market session.

First Horizon’s (FHN) 4Q earnings of $0.46 per share declined 2.1% year-over-year but came in higher than the Street’s estimates of $0.33 per share. Revenues (comprised of net interest income and noninterest income) rose 63.6% year-over-year to $810 million and topped analysts’ expectations of $783.3 million.

The bank’s net interest margin declined 55 basis points from the year-ago period to 2.71%, while provision for credit losses declined 89% year-over-year to $1 million.

The bank’s average loans soared 95% to $59.8 million in the reported quarter. Average deposits spiked 112% and stood at $69.6 million as of the end of the fourth quarter. (See FHN stock analysis on TipRanks)

Following the results, Raymond James analyst Michael Rose maintained a Buy rating on the stock. Rose noted that lower provisions and stronger revenues drove 4Q EPS beat.

“Looking ahead, its initial 2021 outlook calls for: (1) low to mid single-digit decline in net interest income; (2) low-teens decline in fee income; (3) low to mid single digit decline in noninterest expenses; (4) an NCO [net charge-off] ratio of 0.25 – 0.35%; and (5) a CET1 [Common Equity Tier 1] ratio of 9.5% with the optionality to repurchase shares,” the analyst commented.

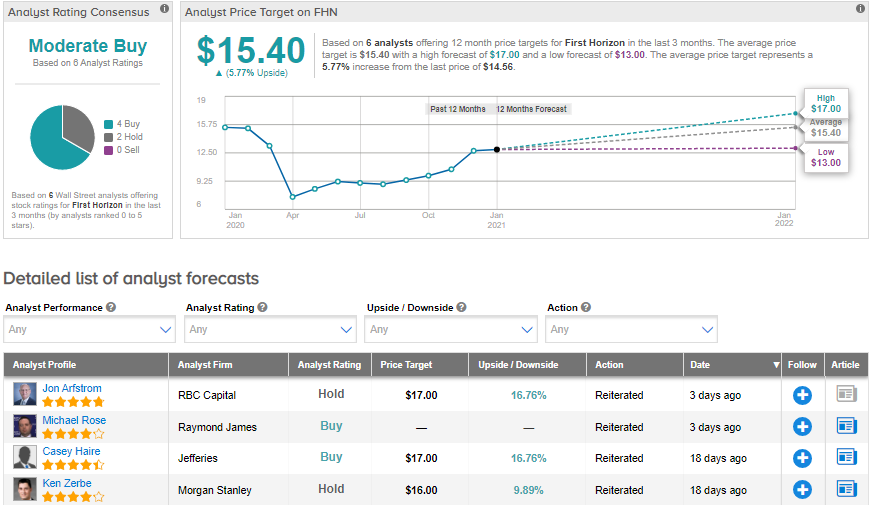

Overall, consensus among analysts is a Moderate Buy based on 4 Buys and 2 Holds. The average analyst price target of $15.40 implies upside potential of about 5.8% to current levels. Shares have declined 9.8% over the past year.

Related News:

Regions Financial’s 4Q Profit Jumps 61%

Huntington Drops 4.6% On 4Q Profit Miss

Union Pacific Slips 5% On Weak 4Q Freight Revenues