Fitch Ratings cut General Motors (GM) to BBB-, or one notch above junk status, from BBB previously, amid expectations that the vehicle maker’s credit profile and sales will stay weak for a prolonged period during the economic downturn fueled by the coronavirus pandemic.

The ratings agency expects “the macro environment to remain weak through the rest of 2020 and much of 2021, which will likely keep sales volumes well below the 2019 level into much of 2022.”

Car production came to a halt in March because of the fast spread of the coronavirus outbreak. The U.S. automaker plans to reopen most of its North American plants on May 18. GM has implemented cost-cutting steps in response to the COVID-19 outbreak, including withdrawing its dividend and share buybacks, reducing marketing budgets, and lowering some workers’ salaries.

In addition, Fitch said that GM’s dividends will likely remain suspended through 2020 or until the company repays most of its revolver borrowings. The Detroit-based carmaker had over $34 billion in automotive cash and marketable securities as of March 31, after drawing $15.9 billion on its revolving credit facilities.

At the same time, Fitch kept a stable outlook for the automaker as it believes that the company will be able to maintain an investment-grade credit profile once the worst of the pandemic has passed. The rating outlook is based on the assumption that GM’s North American operations will restart in the latter half of the month.

“Th company will burn a substantial amount of cash in 2020 as a result of pandemic-related plant shutdowns, but the level of cash burn will be mitigated by the company’s smaller global footprint, with its lack of European operations a particular benefit in the current environment,” Fitch said. “The company should start generating cash once production restarts.”

GM shares, which plunged 70% this year, were up 1.9% at $22.30 in pre-market trading in the U.S.

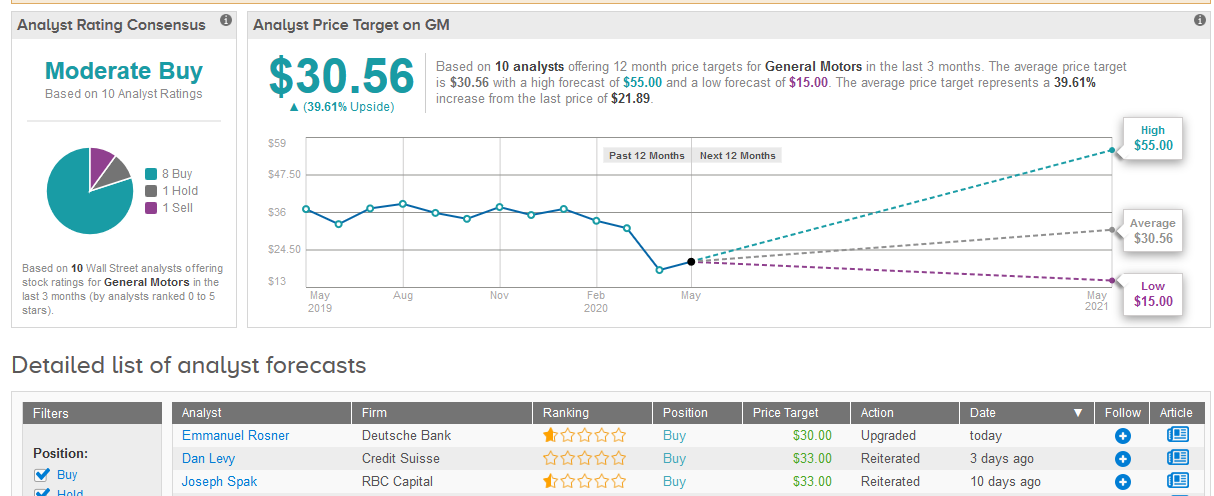

Credit Suisse analyst Dan Levy this week reiterated his Buy rating on GM stock with a $33 price target.

“We believe the silver lining to the current disruption is that GM can validate it does in fact have a healthier business model today than it did in the past,” said Levy.

The remainder of Wall Street analysts are cautiously optimistic about GM’s stock. The Moderate Buy consensus rating is divided into 8 Buys, 1 Hold and 1 Sell. The $30.56 average price target suggests 40% upside potential in the shares over the coming year. (See GM stock analysis on TipRanks).

Related News:

Costco April Store Sales Drop as Shoppers Are Stranded at Home

General Motors Seeks Further $2B Loan – Report

Square Dips as Quarterly Loss Almost Triples Due to Virus Pandemic