By Jordan Faigen

The Kentucky Derby kicks of today, ending a week full of horse racing with the final “Run for the Roses” and starting the first leg of the U.S. Triple Crown.

Churchill Downs In The News

This will be the 140th Spring Meet of the Kentucky Derby at the world-renowned Churchill Downs Inc. (CHDN) Racetrack. The Kentucky Derby, also known as the “Most Exciting Two Minutes In Sports”, will be watched by more people than the Super Bowl as horses compete to win a chance at earning the coveted Triple Crown. Not only is Churchill Downs gearing up for a major event, but the company was also just granted a one-year conditional license to operate its Fair Ground racetrack in New Orleans by the Louisiana Racing Commission. And not too long from now, the company plans to enter into online gaming. CEO Bob Evans stated that Churchill Downs plans to be a “significant player” in online gaming, and now he just has to decide where he will deploy his plans.

An Analyst Perspective

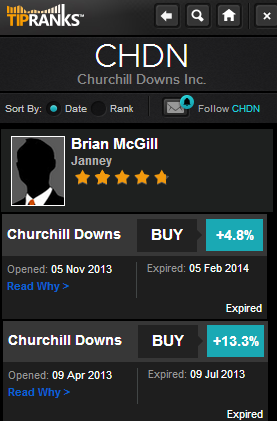

Janney Capital Markets analyst, Brian McGill, has a strong history recommending entertainment stocks, including Churchill Downs. Brian recently recommended BUY Churchill Downs and raised his price target from $102.00 to $103.00. Brian has a 100% success rate recommending Churchill Downs and has earned a +5.9% average return over S&P-500 on the stock. These stats have helped him earn an overall standing as number 101 out of 3038 analysts, with a +5.7% average return over S&P-500 and a 64% success rate recommending stocks.

Brian McGill’s Past Churchill Down Recommendations

In this week’s Flashback Friday, let’s take a look at Brian’s previous Churchill Down’s recommendations to see how he came out on top.

In November of last year, Brian reiterated his BUY Churchill Downs rating and raised his fair value target to $96.00 from $91.00. It appeared that Churchill Down’s competitors experienced a negative impact on revenue due to fewer race days at Calder and Arlington. However, Churchill Downs managed to increase revenue 61% year-over-year due to “the addition of Riverwalk and Oxford. Excluding these properties, revenue would have been mostly flat with the prior year period.” Brian believed this was a strong positive sign, based on the fact that everyone was having a hard time.

Brian also noted that, “The online business displayed solid revenue growth and less spending at Luckity drove better than expected margins.” Brian pointed out that investments in two new projects, Oaks and Derby, would “generate adequate return”, not to mention potential gaming expansion in Kentucky and Illinois could bring “$15 to shares”. This recommendation earned Brian +4.8% over S&P-500.

Earlier that same year, Brian initiated coverage of Churchill Downs in April with a BUY rating and an $84.00 price target. At the time, Brian said he was confident that the company would “make acquisitions of gaming that will allow growth going forward”. Illinois was planning to pass a gaming expansion bill that Brian said would, “serve[] as a major catalyst for the shares that we do not think is priced into the stock at this point.” Brian also pointed out that “the company has used this growing annuity to diversify into casino gaming by purchasing several regional gaming properties over the past several years and the company will continue this strategy into the future.” Brian ended up earning +13.3% over S&P-500.

The race is this weekend so, gamblers get your bets ready and investors choose your stocks wisely. Will you be a Kentucky Derby winner?

Jordan Faigen covers financial markets and the latest stock market news. Jordan can be reached at Jordan@tipranks.com