Ford Motor Co. (F) said it expects to incur a pre-tax loss of about $600 million in the first quarter as the coronavirus outbreak depressed sales and forced the closure of car plants and showrooms.

Ford’s shares fell more than 5% after the automaker said it sees its first-quarter loss before interest and taxes to amount to about $600 million versus a profit of $2.4 billion in the year-ago period.

Revenue is projected to be about $34 billion as first-quarter vehicle sales to dealers declined 21% from a year ago, largely as a result of lower production and demand. In addition, Ford said it anticipates valuation allowance adjustments against deferred-tax assets to amount to about $900 million.

“We continue to opportunistically assess all funding options to further strengthen our balance sheet and increase liquidity to optimize our financial flexibility,” said Ford’s CFO Tim Stone. “We also are identifying additional operating actions to enhance our cash position.”

In March, Ford suspended its $600 million quarterly dividend and antidilutive share repurchase program. Stone added that the company is taking other steps to preserve cash, including lowering operating costs, reducing capital expenditures and deferring executive salaries.

As of April 9, Ford had about $30 billion in cash on its balance sheet, including $15.4 billion in proceeds it borrowed last month against two existing credit lines.

Only Ford’s joint ventures in China, where coronavirus risks are moderating, are currently producing and selling vehicles to dealers. Looking ahead, the automaker is seeking to start a phased restart of its manufacturing plants and supply network beginning in the second quarter, with enhanced safety standards in place to protect workers. Any decisions on resumptions will be made in cooperation with local unions, suppliers, dealers and other stakeholders, the company said.

“However, we believe we have sufficient cash today to get us through at least the end of the third quarter with no incremental vehicle production and wholesales or financing actions,” said Stone.

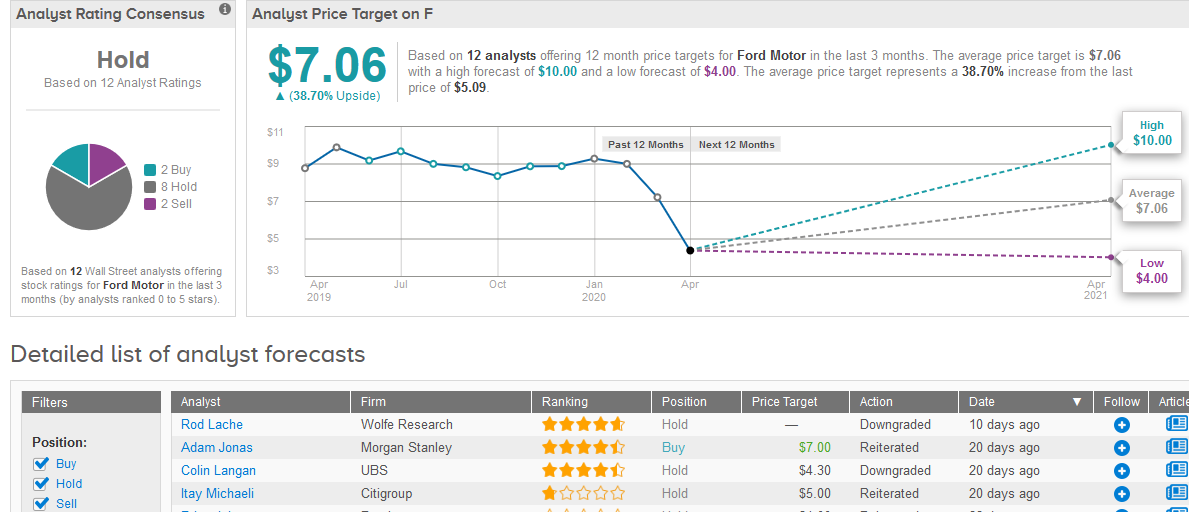

Earlier this month, five-star analyst Rod Lache at Wolfe Research cut Ford’s rating to Hold from Buy. Overall, the analyst community has a Hold consensus rating on the stock based on 8 Holds, 2 Buys and 2 Sells. The $7.06 average price target implies 39% upside potential in the coming year. (See Ford’s stock analysis on TipRanks)

Related News:

Florida’s Disney World Reaches Accord to Furlough 43,000 Workers

Tesla Scored Record China Sales In March, Says Industry Association

Make the Most of Insider Activity with the TipRanks Insiders Tab