Wincanton PLC (GB:WIN) is a UK-based company specializing in supply chain solutions. The company offers businesses essential services such as storage, handling, distribution, transport management, and more.

The company announced its full-year earnings for 2023 last week. The company posted growth of almost 3% in its revenues of £1.46 billion, which was driven by a boost from new customer acquisitions achieved across all four sectors of the group. Well-established customers like Sainsbury’s, Waitrose & Partners, Wickes, Co-op, and Halfords have agreed to renew their contracts with the company.

Despite this, the company’s annual profits before tax fell by 30% to £38.2 million as compared to the previous year. However, excluding the special one-off costs, the company’s pre-tax profits increased by 6% to £62 million, which was also above analysts’ expectations. Headwinds like lower volumes and high inflation costs prevailed during the year, and the company expects them to continue in 2024.

Talking about shareholders’ returns, the company increased its full-year dividend by 10% to 13.2p per share as compared to 12p paid in 2022. This company’s dividend yield stands at 5.14%.

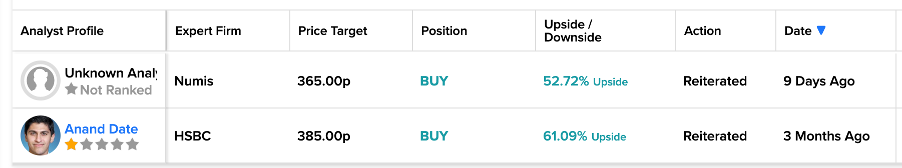

Nine days ago, Numis Securities reiterated their Buy rating on the stock suggesting growth of more than 50% in the share price.

What is the Stock Price Prediction for Wincanton?

WIN stock has a Moderate Buy rating on TipRanks, based on two Buy recommendations. At an average price target of 375p, analysts predict an upside of 54% from the current level.

YTD, the stock has been trading down by 30% after it fell sharply in March on losing a major government contract.