GameStop (NYSE:GME) is slated to release its third quarter Fiscal 2022 results on December 7, after the market closes. Based in Texas, GameStop is a retailer of video games, consumer electronics, and gaming merchandise.

Currently, the Street expects GameStop to post a loss of $0.28 per share in Q3, compared with a loss of $0.35 per share reported in the prior-year period. Meanwhile, revenue is expected to remain constant from the year-ago quarter at $1.3 billion.

The meme stock’s quarterly performance might have been impacted by lower demand for its devices and services. According to the market research company, NPD Group, video game sales declined 5% year-over-year in Q3. Also, accessory spending plunged 12%, indicating a weak quarter for the video game industry as a whole.

Nonetheless, the company had announced plans to focus on cost-cutting initiatives, which may have supported the bottom line to some extent in the upcoming quarter.

According to Wedbush analyst Michael Pachter, GameStop continues to face some short-term headwinds, which include “ongoing hardware constraints, the impact of employee turnover, a sluggish start for its non-fungible token (“NFT”) marketplace, and cash burn.” He expects Q3 revenue to grow modestly year-over-year.

Ahead of GameStop’s Q3 earnings release, Pachter maintained a Sell rating on GME stock and a price target of $6 per share.

Is GME Stock a Buy or Sell?

Overall, GameStop has a Moderate Sell consensus rating based on one Hold and one Sell. The average GME stock price target of $16 implies 37.4% downside potential. The stock has tumbled nearly 33.1% year-to-date.

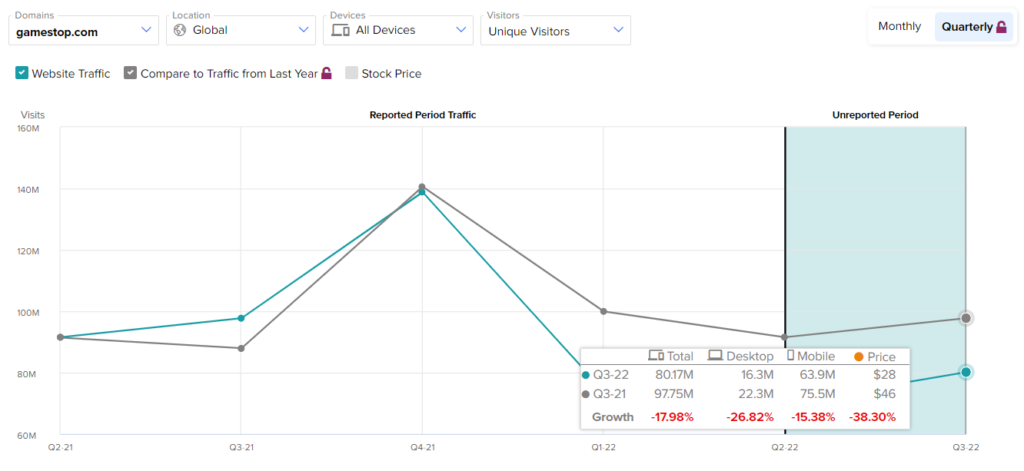

Website Data Reflects a Weak Q3

It’s worth mentioning that the TipRanks website traffic tool hints at a disappointing picture for the quarter. As per the tool, Q3 total estimated visits to gamestop.com fell 17.98% compared to the same period of last year.