General Electric shares are up about 4.7% in morning trading, after its CEO said that he expects to see positive industrial free cash flow (FCF) in the second half of 2020. Shares of the industrial giant closed over 10% higher on Wednesday.

Speaking at a conference, General Electric’s (GE) CEO Larry Culp disclosed that the company is making “good progress” in reducing costs by $2 billion and generating cash savings of $3 billion to cope with the coronavirus pandemic. Culp added that key markets are stabilizing and results are improving gradually. He expects FCF to turn positive in the second half of this year.

The company reported industrial free cash outflow of $2.1 billion in the second quarter as the coronavirus pandemic stalled demand in its aviation business, which is GE’s most profitable and cash-generative business segment. (See GE stock analysis on TipRanks).

JPMorgan analyst Stephen Tusa said “Investors who view General Electric’s guidance yesterday for positive free cash flow in the second half of 2020 as an inflection misunderstand the company’s business.” He added that he has no reason to change his estimates following the CEO’s “vague commentary.”

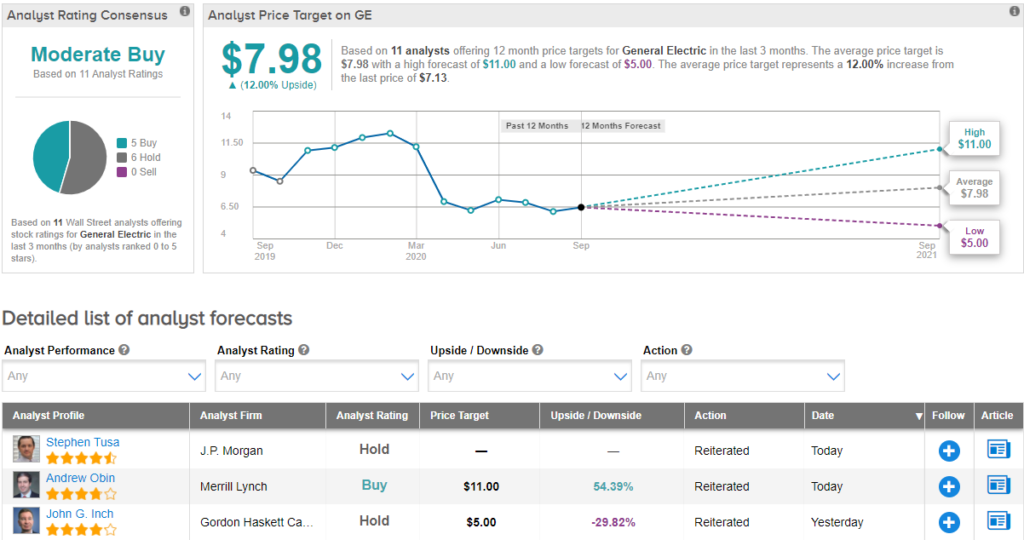

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 5 Buys and 6 Holds. The average price target of $7.98 implies upside potential of about 11.8% to current levels. Shares have declined 37.5% year-to-date.

Related News:

Sony Increasing Production On PlayStation 5 By 50%- Report

Microsoft Unveils Xbox Series S Gaming Console At $299

Adobe Tops 3Q Estimates Spurred By Cloud-Based Software Demand