General Motors (NYSE: GM) sells cars and trucks that are built to last. However, GM stock wasn’t as durable as General Motors’ vehicles in 2022. Nevertheless, I am bullish on General Motors stock as the company managed to race to the number-one spot in terms of U.S. auto sales despite a slew of macroeconomic challenges.

General Motors is among Detroit’s most established and well-known automakers. Yet, the company had to deal with the same issues that other American car companies did in 2022: inflation, fears of a recession, and high interest rates that made it more difficult to afford auto payments.

Along with those factors, inventory shortages caused an 8% year-over-year decline in U.S. automobile sales last year. Yet, despite the challenges, General Motors steered into the fast lane and overtook its competitors. Besides, General Motors is forging ahead with electric vehicle (EV) initiatives that should impress environmentalists and investors alike.

GM Stock is Grossly Undervalued

Before we address General Motors’ amazing achievement, first, it’s important to relay some vital stats. For one thing, General Motors has a super-low 5.9x P/E ratio, which indicates a bargain that’s ripe for the picking right now.

Furthermore, General Motors pays a 0.53% annual dividend yield, which is a nice little bonus for patient investors. Also, if you like earnings plays, check this out: General Motors’ next quarterly earnings release is scheduled for January 31. So, be sure to mark your calendar for that event. With only one exception, the company beat every one of Wall Street’s quarterly EPS forecasts since late 2020.

Despite that impressive feat, GM stock is still much closer to its 52-week low ($30.33) than its 52-week high ($63.91). It’s not very often that you’ll find such a prime bargain in an iconic American automaker.

It’s Official: General Motors was 2022’s #1 U.S. Car Seller

This is more than just an interesting piece of trivia that you can tell your friends at parties. It’s a truly astonishing feat, as General Motors managed to beat all of its competitors and reclaim the top spot in terms of 2022 U.S. automobile sales.

That’s right: General Motors took that title from Japanese automaker Toyota Motor (NYSE:TM) by selling the most vehicles in the U.S. last year. It’s a major point of pride for General Motors, which held the top spot since 1931 but relinquished it to Toyota at the end of 2021.

It’s also worth noting that General Motors posted 41% growth in fourth-quarter 2022 U.S. new vehicle sales. That’s a whole lot better than Toyota’s 13% growth in that area, so clearly, General Motors is thriving despite the aforementioned macro-level challenges.

GM Stock is an EV Investment That Shouldn’t be Ignored

Despite General Motors’ notable U.S. sales milestone and ultra-cheap share price, EV aficionados might need more information before jumping into the trade. As it turns out, General Motors offers investors several reasons to put GM stock on their watch lists.

For one thing, General Motors expects the company’s North American EV portfolio to be profitable in 2025, which really isn’t too far away. Already, General Motors is scaling its EV capacity in North America to over one million units annually.

Moreover, General Motors just launched its Dealer Community Charging Program. To kick off this program, General Motors oversaw the installation “of the first community charging stations in Wisconsin and Michigan,” according to a press release. This is significant, as a major automaker shouldn’t just deliver EVs without also promoting the availability of EV infrastructure.

Additionally, General Motors joined vehicle electrification specialist BrightDrop, along with Canadian Prime Minister Justin Trudeau and Ontario Premier Doug Ford, to open “Canada’s first full-scale electric-vehicle manufacturing plant.” This shows that General Motors has EV industry ambitions that cross country lines, along with support from high-ranking government officials in Canada.

Is GM Stock a Buy, According to Analysts?

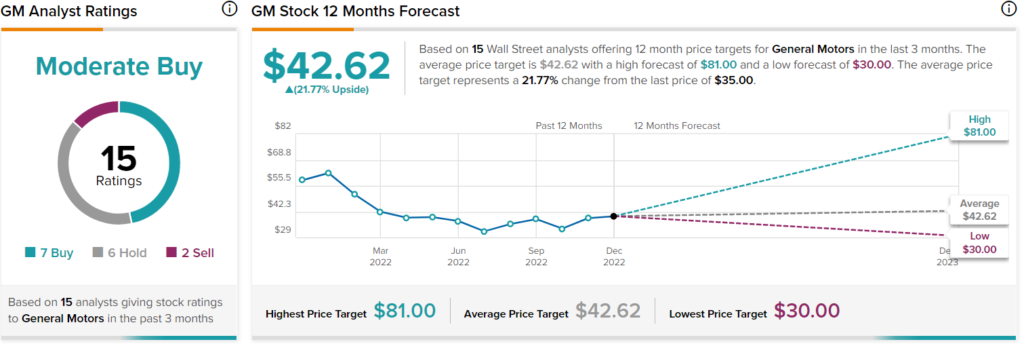

Turning to Wall Street, GM is a Moderate Buy based on seven Buys, six Holds, and two Sell ratings. The average General Motors price target is $42.62, implying 21.8% upside potential.

Conclusion: Should You Consider General Motors Stock?

After a bruising year for businesses and automakers, in particular, General Motors wrapped up 2022 by reclaiming a crucial title and growing its domestic vehicle sales. Despite all this, GM stock is cheaper than it ought to be.

That’s not a problem, but only a reason to consider picking up some General Motors shares and holding them for the long term. Meanwhile, EV investors have multiple reasons to take a position in GM stock, as this old carmaker is making waves in the modern alternative-energy movement.