General Motors (GM) on Monday suspended its quarterly cash dividend and share buyback plan in an effort to conserve its cash position as the coronavirus-related global lockdowns hurt car sales.

In addition, the Detroit-based automaker announced that it had extended a three-year revolving credit agreement for $3.6 billion to April 2022.

“We continue to enhance our liquidity to help navigate the uncertainties in the global market created by this pandemic,” said General Motors Chief Financial Officer, Dhivya Suryadevara. “Fortifying our cash position and strengthening our balance sheet will position the company to create value for all our stakeholders through this cycle.”

General Motors said it remained committed to its capital allocation plan, which is focused on reinvesting in the business at pre-tax returns equal to or greater than 20%; maintaining a strong investment-grade balance sheet; and returning capital to shareholders after the first two objectives have been met.

The dividend suspension did not come as a surprise to some analysts.

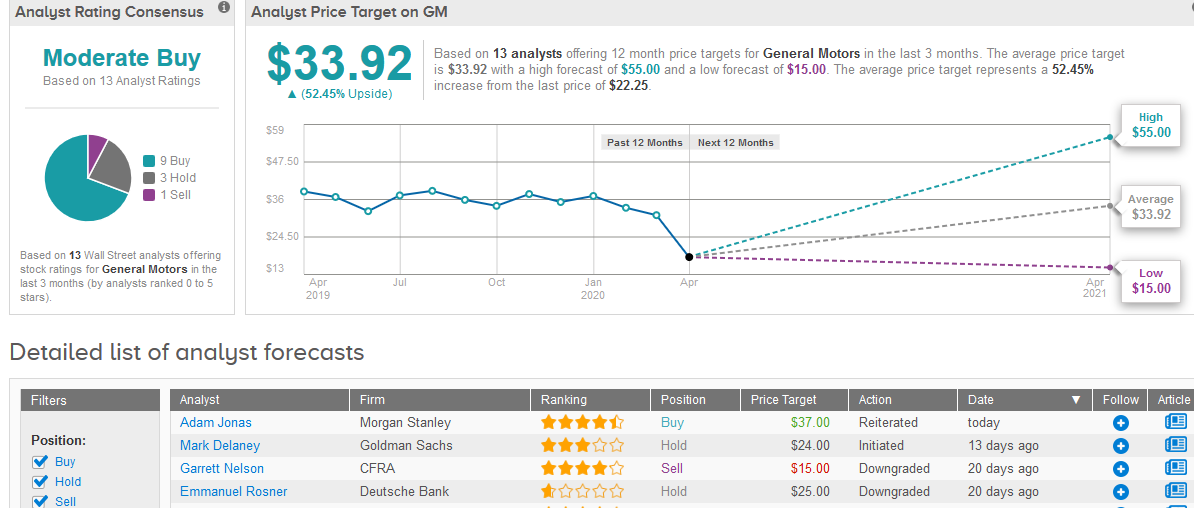

Adam Jonas, analyst at Morgan Stanley, who had already expected that General Motors would withdraw its dividend from the second quarter does not see a dividend reinstatement within his forecast horizon of 2022.

Jonas, who has a Buy rating on the stock with a $37 price target, views Monday’s announcement as part of a broader turn in fundamentals and newsflow that supports General Motors as his top pick among U.S. automakers.

Overall, Wall Street analysts are cautiously optimistic about General Motors’ stock with 9 Buys, 3 Holds and 1 Sell adding up to a Moderate Buy consensus rating based. With shares currently priced at $22.31, investors could gain 52% in the next 12 months should the $33.92 average price target be met. (See GM stock analysis on TipRanks).

Related News:

Ford Recalls Workers As Gears Up For Factory Restart

Adidas Forecasts 40% Sales Slide in Second Quarter Hit By Coronavirus Store Closures

Check Point Software Profit Beats Estimates Boosted By Remote Work Push