Gilead Sciences Inc.’s (GILD) shares fell 5% after a leaked draft report indicated that its experimental antiviral drug remdesivir failed to show clinical improvement in coronavirus patients.

News source STAT reported that a summary of the study results from a long-awaited clinical trial conducted in China was mistakenly posted to the website of the World Health Organization.

“A draft document was provided to WHO and inadvertently posted on the website and taken down as soon as the mistake was noticed,” said WHO spokesperson Tarik Jasarevic. “The manuscript is undergoing peer review and we are waiting for a final version before WHO comments.”

According to the leaked summary study of hospitalized adult patients with severe COVID-19 “remdesivir was not associated with clinical or virological benefits”. The study was stopped prematurely because of difficulty in enrolling patients in China, at a time where the number of Covid-19 cases was declining.

In response to the leaked study, Gilead spokesperson Amy Flood said that the company believes “the post included inappropriate characterization of the study.” Because the study was stopped early because it had too few patients, she said, it cannot “enable statistically meaningful conclusions.” However, she said, “trends in the data suggest a potential benefit for remdesivir, particularly among patients treated early in disease.”

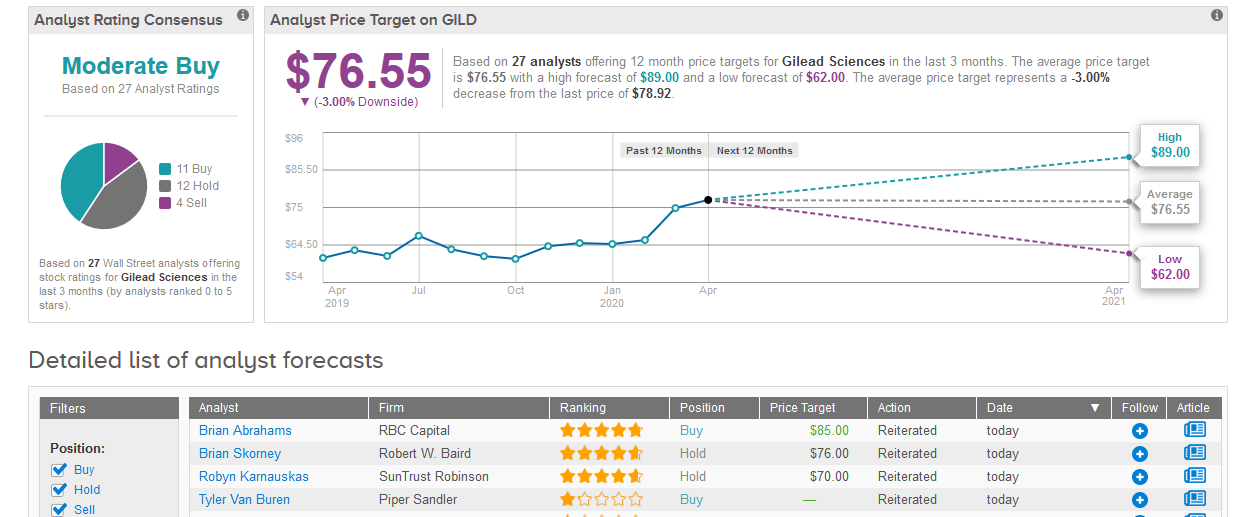

Five-star analyst Brian Skorney at Robert W. Baird said that the results of the leaked study “should be very sobering” suggesting that if remdesivir as an antiviral, can’t even get an antiviral result, the odds are not high that there will be any role for COVID-19 treatment, even in earlier stage patients. Skorney who has a Hold rating on the stock with a $76 price target goes further to contend that the market is overestimating the role of the drug in the pandemic.

TipRanks data shows that out of the 27 analysts covering the stock in the past three months, 11 are bullish with a Buy rating on Gilead stock, 12 are sidelined with a Hold rating and 4 are bearish with a Sell rating, adding up to a Moderate Buy consensus rating. The 12-month average price target of $76.55 implies 3% downside potential in the shares.

Gilead boasts a 10 score from TipRanks Smart Score. That’s thanks to a combination of bullish datapoints, including a very positive sentiment from investors, increased hedge fund activity, bullish news sentiment and even bullish opinions from the financial blogging community. (See Gilead stock analysis on TipRanks)

Related News:

Expedia Shares Fly on $3.2 Billion Capital-Raising Plan

Kimberly-Clark Sales Jump to $5 Billion Boosted by Tissue Sales

Lam Research’s Solid Customer Demand Sparks Multiple Buy Ratings