Gilead Sciences disclosed that the results from the Phase 1b trial of its investigational antibody therapy, magrolimab, used for previously untreated acute myeloid leukemia (AML) patients, showed “promising” and “durable” responses.

Gilead (GILD) said that the study of the investigational anti-CD47 monoclonal antibody being studied in AML patients who are ineligible for intensive chemotherapy, including patients with TP53-mutant AML, demonstrated high response rates in combination with azacytidine.

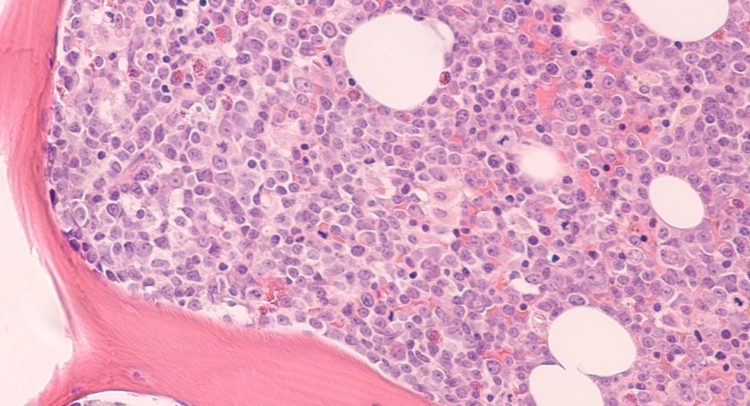

AML is a type of cancer that starts in the bone marrow and can quickly move to the blood and other parts of the body, including the lymph nodes, spleen and central nervous system. Approximately 20,000 Americans are diagnosed with AML each year.

“We continue to be encouraged by the response rates seen in this study and are rapidly advancing the development of magrolimab based on its potential to help address significant unmet medical needs,” said Gilead’s head of oncology Daejin Abidoye.

In the study, 64 patients were treated with magrolimab plus azacitidine, including 47 patients with the TP53 mutation. As of November 2020, 63% of the patients evaluable for efficacy achieved an objective response, 42% achieved a complete remission (CR), and 12% achieved a CR with an incomplete count recovery (CRi). The median duration of response (DOR) was 9.6 months and the median time to response was 1.95 months.

Back in September, Gilead was granted breakthrough therapy designation for magrolimab from the US Food and Drug Administration (FDA) for the treatment of myelodysplastic syndrome (MDS) in newly diagnosed patients.

Morgan Stanley analyst Matthew Harrison last month resumed coverage of the stock with a Hold rating and a $67 price target (8.8% upside potential), arguing that although the company has broadened its pipeline for potential topline growth, there are not enough “major catalysts” until 2021.

In addition, Harrison believes “near-term headwinds” are poised to keep Gilead shares range bound ahead of key Trodelvy and magrolimab data in 2021.

Shares in Gilead have declined about 5.3% year-to-date, with the average analyst price target of $76.59 indicating 24% upside potential lies ahead in the coming 12 months.

The rest of the Street is cautiously optimistic on the stock. The Moderate Buy analyst consensus is based on 10 Buys versus 9 Holds and 2 Sells. (See Gilead stock analysis on TipRanks).

Related News:

BioCryst Pops 19% After FDA Approval Of Orladeyo Therapy; Needham Says Hold

Eli Lilly Inks $812.5M Covid-19 Antibody Supply Deal With US; Street Sees 18% Upside

Merck Cashes In On Moderna Equity Investment As Stock Pops 631% YTD