Global Payments Inc. (GPN), a payment technology and software solutions provider reported better-than-expected second-quarter results and raised its full-year 2021 guidance. However, shares plunged 11.2% to close at $171.79 on August 2. (See Global Payments stock charts on TipRanks)

The company reported adjusted earnings of $2.04 per share, up 55.7% compared to the prior-year period, and outpaced the Street’s estimate of $1.89 per share.

Adjusted revenue stood at $1.94 billion, up 28% year-over-year, and beat the analysts’ estimate of $1.85 billion.

Jeff Sloan, the company’s CEO, said, “Our differentiated strategies have enabled the compounded rates of growth we realized in the quarter…We continue to balance strategic investments across our businesses, unique relationships with the world’s largest technology companies, ongoing consistency in execution, and efficient return of capital to shareholders.”

For the full year 2021, the company guided for adjusted revenue and adjusted earnings to fall in the range of $7.70 – $7.73 billion and $8.07 – $8.20 per share, respectively.

Consensus estimates for revenue and earnings stand at $7.61 billion and $8.00 per share, respectively.

The company increased its share buyback authorization program to $1.5 billion and is also expanding its European presence with the acquisition of Bankia’s payment businesses in Spain.

PGN also announced a new partnership deal with Amazon Web Services for distribution and cutting-edge technologies at Netspend to boost its digitization, internationalization, and B2B expansion.

Following the results, Mizuho Securities analyst Dan Dolev reiterated a Hold rating on the stock with a price target of $190, implying 10.6% upside potential to current levels.

Dolev believes GPN’s results are underwhelming and said, “Although GPN’s issuer processing business is best-in-class, it also faces emerging disruption from tech entrants with bank consolidation acting as a headwind. In acquiring, we view GPN’s high exposure to Travel & Entertainment (T&E) in its legacy business as a potential hurdle to growth.”

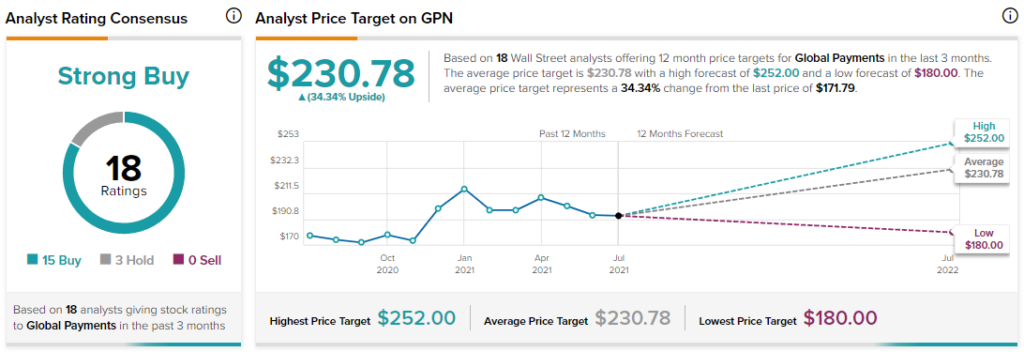

Overall, the stock commands a Strong Buy consensus rating based on 15 Buys and 3 Holds. The average Global Payments price target of $230.78 implies 34.3% upside potential to current levels. Shares have lost 4.1% over the past year.

Related News:

What Do IMAX’s Risk Factors Indicate?

Vista Outdoors Shares Jump on Blowout Q1 Results

Pfizer Delivers Blowout Quarter, Raises Guidance