As the battle against COVID-19 wages on, investors are seeking refuge. Nations around the world are taking drastic measures to flatten the curve, but these efforts are expected to hit the economy hard.

Amid the ongoing public health crisis, even the most seasoned Wall Street observers have been spooked. Three months after the virus began its rapid spread, so much remains unknown about COVID-19 and the amount of time that social distancing will be necessary. As a result, investors are turning to less risky plays, but even safer investments like Treasury bonds have been put through the wringer.

With this causing recession fears to mount, investment firm Goldman Sachs notes that some companies have what it takes to outperform in the long run, namely those with strong balance sheets.

Bearing this in mind, we used TipRanks database to get all the details on two of the firm’s stock picks with plenty of cash on hand. On top of Goldman Sachs’ vote of confidence, both have received enough bullish calls from other analysts to earn a “Strong Buy” consensus rating.

That being said, Goldman Sachs reminds investors not all names are poised to weather the storm and emerge as a long-term winner. So, we took advantage of the same tool to learn more about one ticker that has fallen out of favor with not only the firm, but also the rest of the Street. Let’s dive in.

Bunge Limited (BG)

Bunge operates in the agricultural sector, providing grains and oilseeds to food processors as well as crop transportation services. While it hasn’t managed to escape the broader market sell-off, Goldman Sachs sees a turnaround on the horizon.

Adding BG to the firm’s Americas Conviction List (CL), analyst Adam Samuelson points to its strength in the Brazilian market. Corn and soybean sales have already exceeded year-ago and long-term averages for both the 2019 and 2020 harvests. According to Samuelson, this implies that first quarter Agribusiness earnings are slated for a boost. In addition, crush margins are still healthy, and spot margins in Brazil, Argentina and China have improved during the quarter thanks to strong soybean availability. The COVID-19 outbreak also isn’t expected to have a material impact on Q1 operations or margins.

With the company placing a significant focus on reorienting its operations and risk management as well as improving ROIC, Samuelson believes there is “scope for material further asset sales, a resumption in buybacks and other operational levers to achieve its 9%+ ROIC target.” Expounding on this, he stated, “We view BG as a unique self-help story with a meaningful catalyst path ahead including scope for above-consensus Q1 results and the opportunity for management to further outline its internal transformation plan at the investor day.”

Add this to a 6.3% dividend yield and it becomes clear why Samuelson noted, “…we believe longer term investors will be rewarded as the pathway to medium-term earnings and returns improvement crystallizes over the next several months.”

To this end, the analyst reiterated his Buy recommendation and $69 price target. Should the target be met, shares could be in for a 117% twelve-month gain. (To watch Samuelson’s track record, click here)

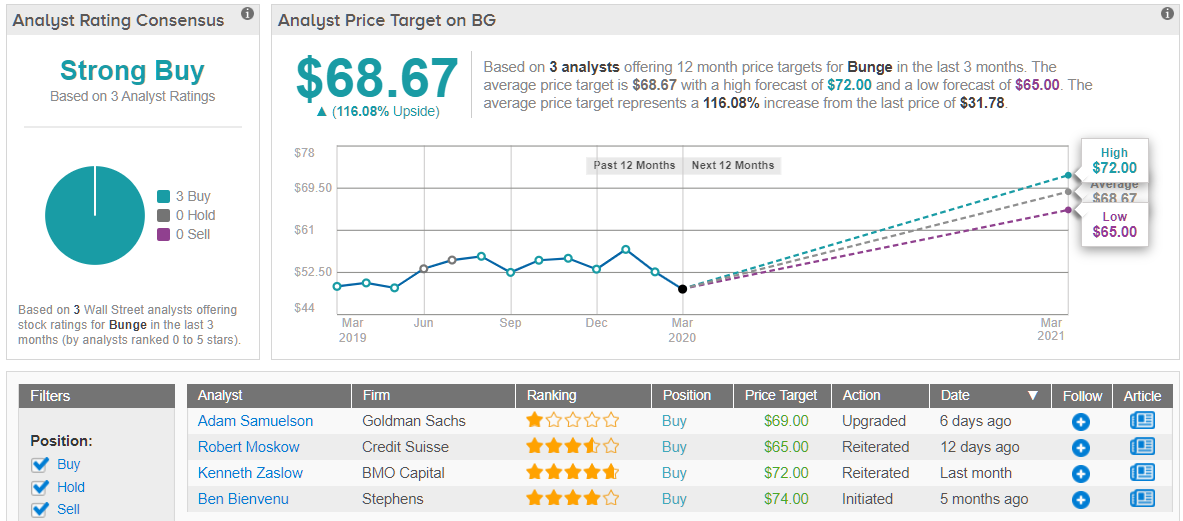

What does the rest of the Street have to say? As it turns out, other analysts are on the same page. 3 Buys compared to no Holds or Sells issued in the last three months add up to a Strong Buy consensus rating. Not to mention the $68.67 average price target suggests 116% upside potential. (See Bunge stock analysis on TipRanks)

SkyWest (SKYW)

At first glance, airlines might not look like the most compelling opportunities right now. Like the rest of the industry, increasing restrictions on travel have weighed down SkyWest. However, Goldman Sachs believes that the company is ready to fly past its peers in the long-term.

Weighing in on SKYW for Goldman, analyst Catherine O’Brien acknowledges that the travel industry has been dealt a major blow, and while the company does face less revenue risk, shares have been on the decline since the World Health Organization started tracking the number of infections.

Explaining the decline, O’Brien stated, “We believe this is due in part to its higher-than-industry leverage position. However, we believe the company’s leverage is somewhat misunderstood, as the majority of its debt is aligned with its capacity purchase agreements (i.e., it has contracted revenue to cover its interest payments). Furthermore, our illustrative stress test analysis implies the potential for upside from current share price levels.”

It’s also important to mention that most of the airline company’s debt is tied to its Embraer E175 fleet. However, should SKYW fail to secure new capacity purchase agreements for this fleet, “there are essentially no interest coverage considerations” because it will own the aircraft once maturity is reached.

Additionally, O’Brien points out that during the quarter, SKYW won several flying contracts. “We have seen several major airlines consolidate their regional partners, with SkyWest winning additional contracts through this process. If the company secured additional contracts in the future, this would drive incremental organic earnings growth,” she said.

Based on all of the above, O’Brien upgraded her rating from Neutral to Buy. Even though the Goldman Sachs analyst reduced the price target from $73 to $58, this still leaves room for potential upside growth of 187%. (To watch O’Brien’s track record, click here)

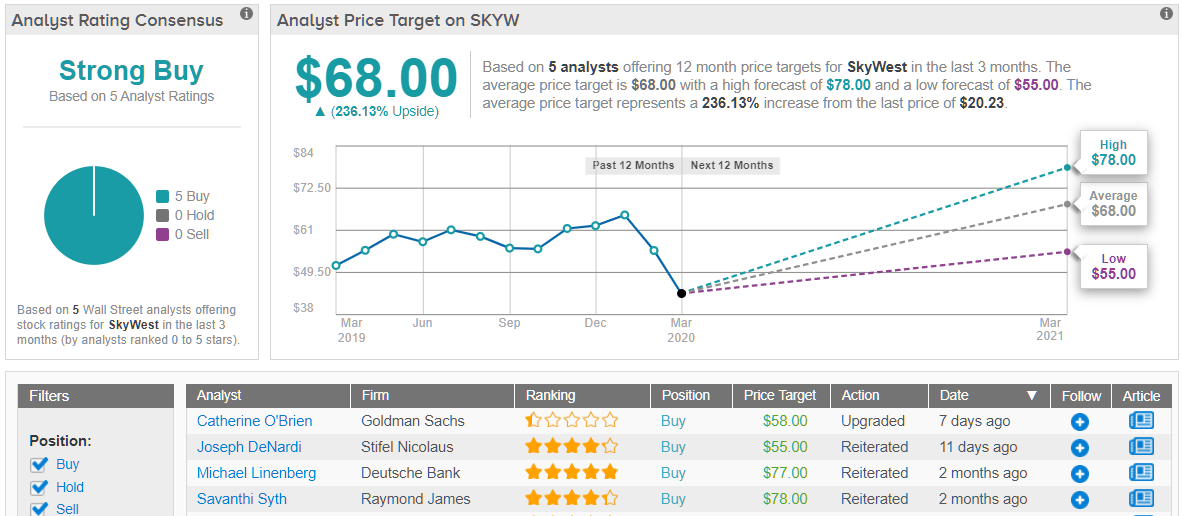

With 100% Street support, or 5 Buy ratings to be exact, the message is clear: SKYW is a Strong Buy. At $68, the average price target is more aggressive than O’Brien’s, and puts the upside potential at 236%. (See SkyWest stock analysis on TipRanks)

American Airlines (AAL)

While Goldman Sachs is bullish on SkyWest’s long-term growth prospects, the same can’t be said for its peer American Airlines. In the last month alone, shares have slid 63%, with the firm not expecting the narrative to change anytime soon.

Analyst Catherine O’Brien, who also covers SKYW, restated that the airline industry as a whole has been negatively impacted by COVID-19. However, the current climate has made her less optimistic about AAL’s standing specifically.

“Our Buy rating was predicated on a unique opportunity at American to concentrate growth out of its most profitable hubs through 2021, and detailed analysis on the company’s debt which gave us greater confidence that it could weather the challenges as the most levered name in our airlines coverage universe. Although American has started to execute on its hub connectivity plan starting with DFW in 2019, and there is still room to run with this initiative, we believe progress has likely slowed due to heightened uncertainty surrounding COVID-19,” O’Brien commented.

It should also be noted that AAL’s leverage could create problems for the company. “…although we do not expect American to run into liquidity challenges based on our current forecasts, we believe that the company’s leverage position will likely contribute to higher volatility in the stock price in the near-term. While we admit that this volatility could drive an upside surprise in the future, we do not think the risk/reward profile warrants a Buy rating,” O’Brien explained.

Taking all of this into consideration, O’Brien decided to watch from the sidelines and dropped the rating down from Buy to Neutral. The price target was also cut from $34 to $15, indicating 45% upside potential.

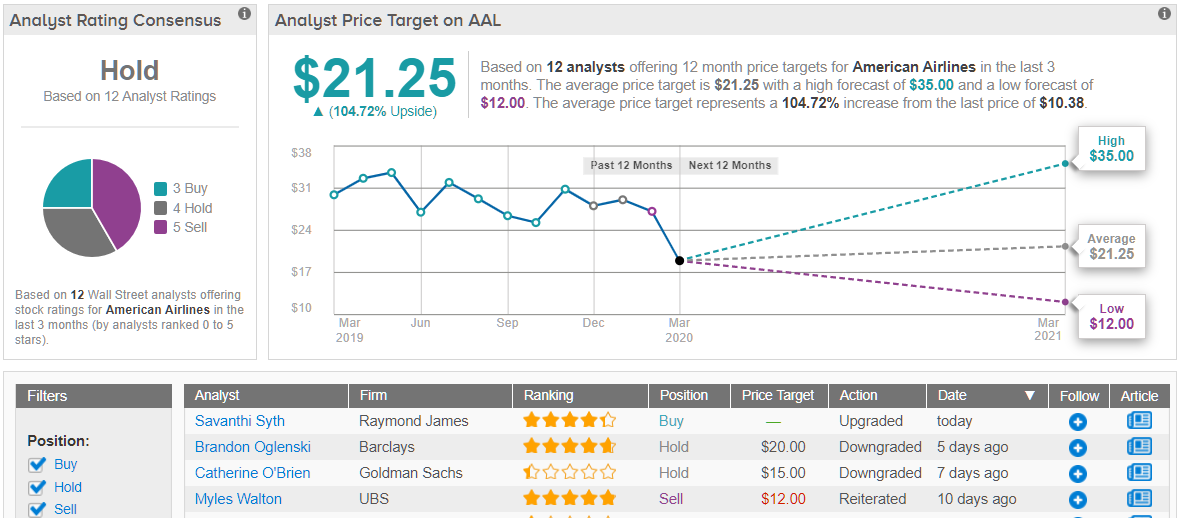

Looking at the consensus breakdown, the bears have it. Based on 3 Buys, 4 Holds and 5 Sells received in the last three months, the word on the Street is that AAL is a Hold. Having said that, its $21.25 average price target implies that shares could soar 105% in the next twelve months. (See American Airlines stock analysis on TipRanks)