The S&P 500 closed at an all time high on Monday evening — then closed at an even higher high on Wednesday — 3,046.77. Goldman Sachs believes this rally could keep going well into 2020.

A recent report from Goldman Sachs predicts that 2020 will see corporations spend nearly a half-trillion dollars on stock buybacks, mergers, and acquisitions next year. Add in buying by U.S. individual investors and foreign investors, and that buying could be pushed well beyond the $500 billion-mark, says Goldman Sachs analyst David Kostin, as investors seek to profit from “positive equity market returns,” buoyed by “rising interest rates, and stabilizing US and World GDP growth.”

But where do you look to find those profits specifically?

Using the Stock Screener at TipRanks to seek out highly rated stocks in the ever-growing healthcare sector, for which Goldman Sachs analysts expect to see double, near double, or more than double returns in the next 12 months, we’ve come up with three candidates for you today.

Arvinas Holding (ARVN)

Based in New Haven, Connecticut, cancer-fighter Arvinas is researching therapies to degrade cancer-causing proteins in diseases such as prostate cancer and breast cancer.

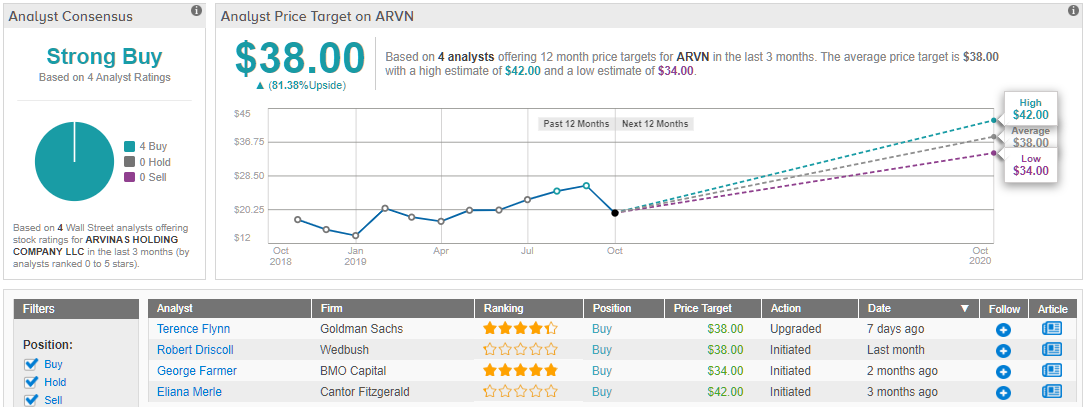

Goldman Sachs analyst Terence Flynn upgraded Arvinas to “buy” with a $38 price target after reviewing the result of Phase 1 clinical trials of the company’s ARV-110 (for prostate cancer) and ARV-471 (for breast cancer) drugs. (To watch Flynn’s track record, click here)

As the label “Phase 1” suggests, Flynn admits that “trials are still in the early stages,” but initial safety data looks good, opening a path to proceed to evaluating “first clinical efficacy data.” Flynn increases his probability of success for both ARV-110 and ARV-471 to 25% (vs. 20% prior) given the initial safety/PK data presented, which in his view “provide some incremental de-risking of the drugs.”

If all goes well, Flynn foresees “blockbuster potential” for both drugs, with potential peak sales of $2.9 billion and $4.7 billion, respectively — a big improvement over the $15 million in revenue Arvinas has booked over the last 12 months.

Street sentiment on this one is good as well, with three analysts initiating coverage of Arvinas over the last three months — in addition to Goldman’s upgrade. And like Goldman, all three of these other analysts rate the stock a “buy,” which qualifies the stock for “strong buy” sentiment in our book. A consensus target price of $38 (in line with Goldman’s own target price) implies 81% upside for the shares over the next 12 months. (See Arvinas stock analysis on TipRanks)

Livongo Health (LVGO)

Next up: taking a different path to healthcare, Livongo Health is a Mountain View, California, software company seeking to harness data to improve patient outcomes in the fields of hypertension treatment, diabetes care, and weight management.

This one attracted the attention of Goldman Sachs analyst Robert Jones, after Livongo was awarded a contract “to provide the Livongo for Diabetes solution to eligible members covered by the Federal Employees Health Benefits program under one health plan covering 5.3mn lives.” Beginning on January 1, 2020, and for at least nine to 12 months thereafter, Livongo will work to reduce diabetes in the federal workforce — and receive between $20 million and $25 million for its services in 2020, and perhaps $30 million to $35 million in 2021 if all goes well.

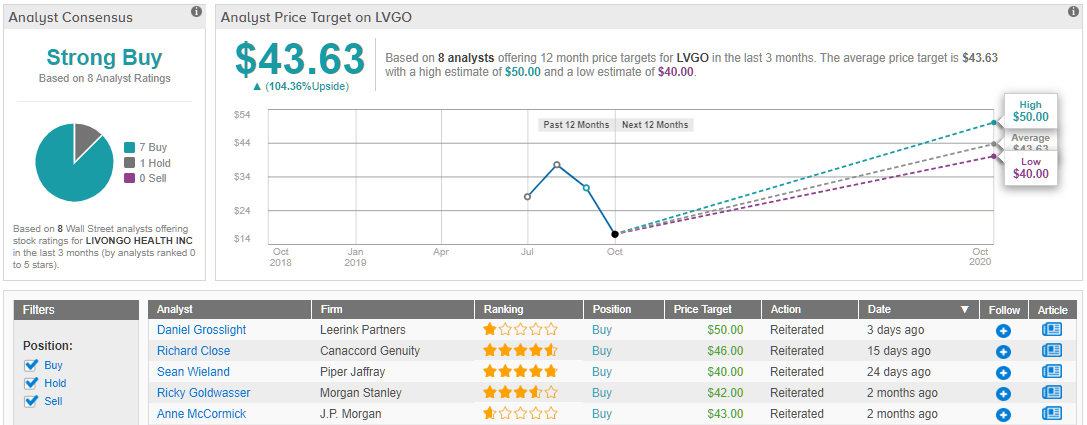

This single contract, therefore, holds the potential to grow Livongo’s $113 million in trailing revenues by 22% next year — and push Livongo stock up as high as $43 a share, in Jones’ estimation, over the next 12 months.

The rest of Wall Street is even more optimistic. More than half a dozen analysts have chimed in over the past couple of months, most with buy ratings, and with an average price target of $43.63. If they’re right, that means Livongo stock could more than double over the next 12 months. (See Livongo stock analysis on TipRanks)

Myovant Sciences (MYOV)

Returning to the pharmaceutical field now, but shifting our gaze to the UK, London-based Myovant Sciences is a clinical-stage biopharmaceutical company working to develop drugs for use in women’s health, with backing from Japan’s Sumitomo Dainippon Pharma, which took a 46% stake in the company last quarter and is helping to move Myovant towards commercial production.

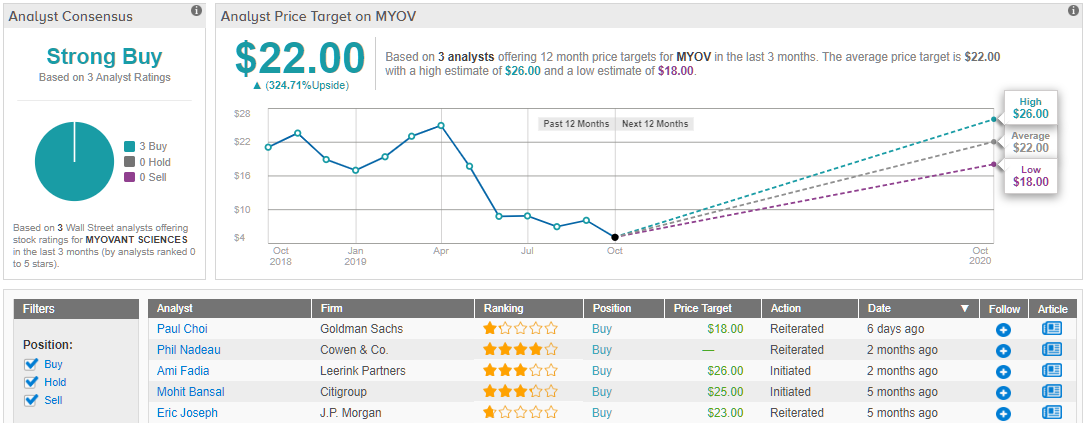

Goldman Sachs analyst Paul Choi isn’t looking for earnings to be much of a catalyst for the stock (because there are none). But sales revenue is anticipated to begin rolling in next year, and could quadruple to more than $153 million by 2021. Furthermore, Choi recommends the stock in anticipation of the companies signing a “definitive agreement” of their partnership, assigning Myovant stock a “buy” rating and an $18 price target. (To watch Choi’s track record, click here)

Wall Street as a whole is similarly bullish, with three “buy” ratings filed in the last two months (including Goldman’s), making the stock a “Strong Buy” according to TipRanks. With Street analysts positing an average $22 average price target, Myovant shows the most profit potential of all on today’s list — 325% to be exact. (See Myovant stock analysis on TipRanks)