The combination of good news and bad news makes the markets an intriguing mix of risk and reward. Weighing in on current market conditions, Goldman Sachs strategist Alessio Rizzi sees reason to buy in now – but for the long term.

“While we believe that recent developments support the recent risk-on move, the more constructive pricing of growth and risks lowers the bar for disappointments,” says Rizzi.

Rizzi is not the only Goldman expert who sees opportunities now. The firm’s analysts have been noting a number of bullish stock moves — companies that are well-positioned to make gains in coming months, even in a bear market.

We’ve used the TipRanks database to pull up the details on three stocks that Goldman sees as particularly compelling – in fact, so compelling that the firm has upgraded each of them to a Buy rating.

Science Applications International (SAIC)

The first stock on our list, Science Applications, is a consulting firm in Washington DC’s Northern Virginia Suburbs. The beltway consultants generally are heavily dependent on government contracts, and SAIC is no exception. The company provides engineering, scientific, and technology expertise to governmental service agencies.

If there is one certainty in the modern world, it’s that government will always grow. That said, there is always a market for government consulting. SAIC uses that basic truth to generate solid returns from contracts with the Washington establishment. In Q4 2019, the most recent reported, the company showed $1.58 per share against a forecast of $1.32, based on $1.54 billion in quarterly revenue. The EPS number was up 35% yoy, while the quarterly top line showed 29% growth.

Covering this stock for Goldman Sachs, Gavin Parsons writes of SAIC, “We expect SAIC organic revenue growth to accelerate to 4.5% this year from (1.4%) last year… We believe the market views this as a show-me story and as growth improves sequentially throughout FY21 the stock should re-rate.” The analyst added, “SAIC currently trades at a 12.2% free cash flow yield on our CY21 estimate, compared to peers at 8.4%. There has been a discount as SAIC grew more slowly, but we expect this to close as organic growth accelerates.”

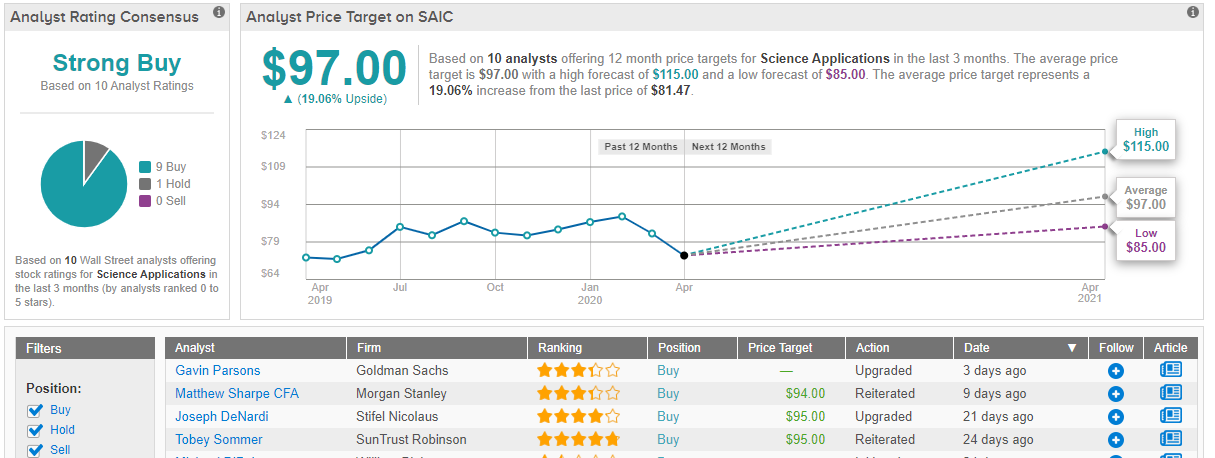

In line with his view that the stock will appreciate going forward, Parsons has upgraded his stance from Neutral to Buy. His price target on the stock, which he raised from $85 to $97, implies an upside of 19% for the coming year. (To watch Parsons’ track record, click here)

Science Applications has a Strong Buy rating from the analyst consensus, with 10 recent reviews of which no fewer than 9 were to Buy. The only hold-out rated the stock a Hold. Shares are selling for a discounted price of $81.55, and the average price target matches Parsons’, at $97. (See SAIC stock analysis on TipRanks)

ADTRAN, Inc. (ADTN)

Alabama-based ADTRAN works in the telecom sector, providing equipment and other products for networking and internetworking applications. The company has a market cap of $465 million, and in addition to the US, has offices in Berlin, Munich, and Hyderabad.

Networking is a service in high demand – especially during this current time of heavy social distancing policies. ADTRAN’s stock performance reflects that demand: the company saw a dip when the bottom dropped out of the market, but is actually trading higher now than it was when the bear began.

The first quarter numbers also show the company’s strength. For Q1, ADTRAN reported GAAP EPS of 2 cents per share, an off-the-charts improvement form the 22-cent loss in the year-ago quarter. The earnings gain was powered by stronger revenues, which came in at $143.8 million, up 19% yoy and beating the forecast by 2%. International sales were the strongest growth segment for the company in Q1.

With a quarter like that, it should be no surprise that ADTRAN maintains its dividend. The 9-cent per share payment exceeds current earnings – but the company has a 16-year history of keeping up the payments. And with a yield of 3.7%, the stock brings a far stronger return than Treasury bonds, and nearly double the return of the average dividend among S&P-listed companies.

Goldman Sachs analyst Rod Hall has bumped his stance on ADTRAN shares from Neutral to Buy. Hall backed his rating based on heavy use of networking tech during COVID-19 pandemic, and the growing trend toward increasing networking.

“We see the company as one of the beneficiaries of increased broadband spending amid COVID-19 related shutdowns. We believe that broadband build-out activity has continued during the shutdown due to strong bandwidth demand created by increasing usage of cloud based collaboration tools and OTT services. We expect broadband investments to continue due to increasing competition from 5G FWA and potential for new federal broadband programs,” the analyst noted.

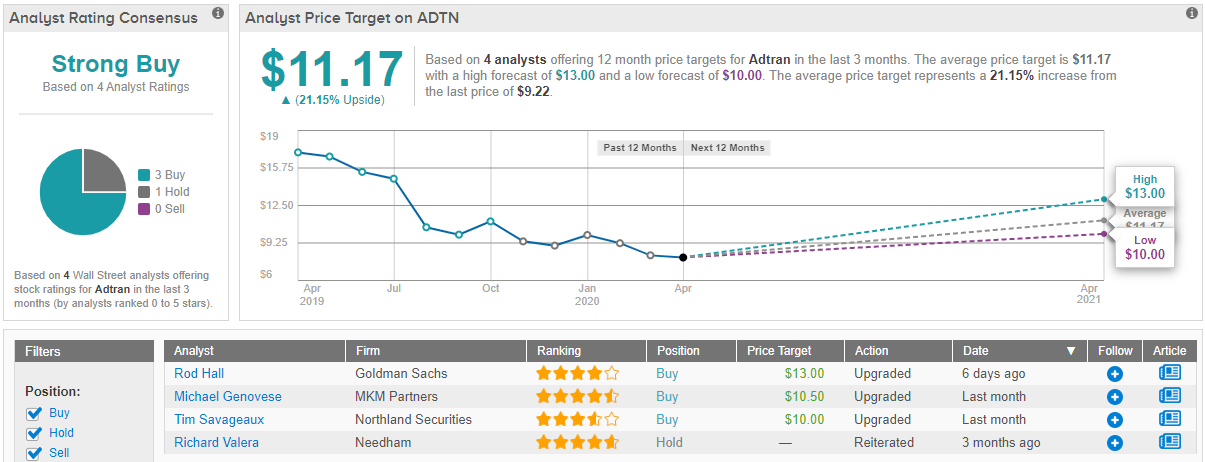

Hall’s Buy rating is supported by his $13 price target, which implies a robust growth potential of 41% for the stock. (To watch Hall’s track record, click here)

ADTRAN is another company that gets a Strong Buy consensus rating from Wall Street’s analysts. With 4 recent reviews on record in the TipRanks database, 3 are Buys and 1 is a Hold; clearly Rod Hall’s upbeat view of the company’s prospects is the norm. Shares are affordable, selling for just $9.22, while the average price target of $11.17 suggests room for a one-year upside potential of 21%. (See ADTRAN stock analysis on TipRanks)

Allison Transmission (ALSN)

Last on our list is $3.9 billion mover in the automotive industry. Allison is the world’s largest manufacturer of automatic transmissions for the commercial vehicle segment, and a major builder of propulsion systems for electric-hybrid vehicles. The company’s powertrain products are used by more than 300 car makers worldwide, for busses, trucks, construction vehicles and equipment, and military vehicles. Allison is headquartered in Indiana, remains an important Rust Belt manufacturer.

Even in today’s climate of lockdowns and stay-at-home orders, supply chains and other vital infrastructure needs to keep moving. The market for commercial duty vehicles is still solid, and Allison’s customer base is not going away.

The Q4 earnings, the most recent reported, reflect the company’s strong position. EPS was 85 cents and revenue came in at $617 million, both well over the forecasts. The earnings support a reliable dividend, which was paid out in March. That payment, of 17 cents, represented a 13% increase from the previous quarter. The annualized payment, at 68 cents, gives a yield of 2%, in line with the broader market average. The key point in this dividend is not its size, but its reliability: Allison has made sure to keep up the payments for the last 8 years, making the dividend attractive to return-minded investors.

Jerry Revich, one of Goldman Sachs’ 5-star analysts, opined, “We upgrade ALSN to Buy as we believe (i) truck production is set to bottom over the next six months, (ii) ALSN’s low fixed cost structure positions the company to deliver cash flow at the trough, and (iii) ALSN’s competitive position will allow continued pricing ahead of material costs in the next cycle.”

“We forecast ALSN’s margins to return to levels last reached in the 2009 financial crisis. ALSN benefits from strong pricing advantage over its low fixed cost structure which gives it ample room to transition through while generating significant cash flow. We expect margins to improve starting 2021E along with resumption of growth in truck production levels,” the analyst concluded.

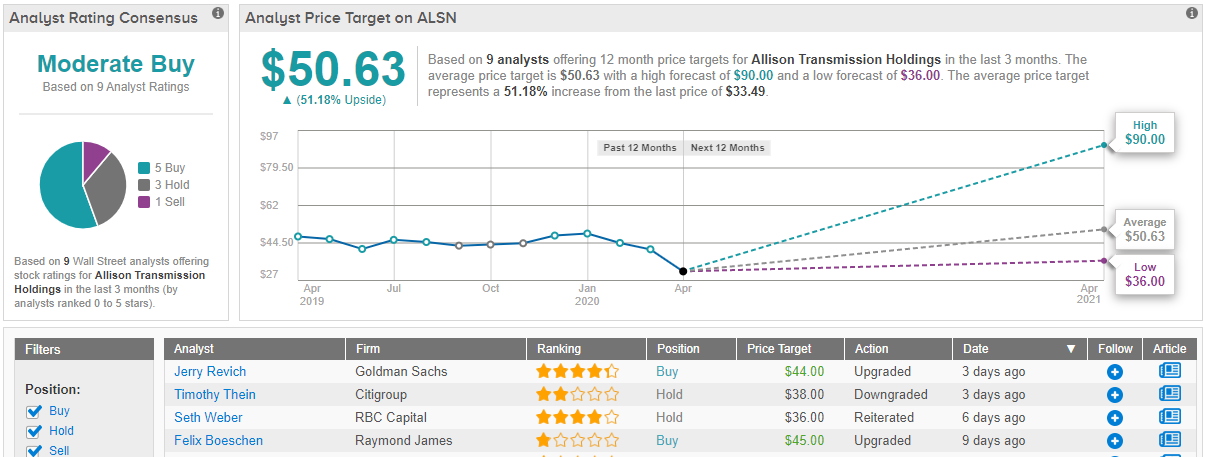

Revich includes a $44 price target with his Buy rating, showing his confidence in a 31% upside for the transmission maker. (To watch Revich’s track record, click here)

Allison Transmission has 9 recent analyst reviews, with a split of 5 Buy ratings, 3 Holds, and 1 Sell giving the stock a Moderate Buy consensus rating. The company does show the highest one-year upside potential of the stocks on this list – with a share price of $33.49, the average price target of $50.63 indicates a strong 51% possible growth. (See Allison stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.