Investment bank Goldman Sachs ($GS) says U.S. hedge funds are buying Chinese stocks at a record pace after the government in Beijing announced a slew of economic stimulus measures.

American hedge funds have bought a record amount of beaten down Chinese equities over the last week, according to Goldman Sachs. The unprecedented buying comes after China’s government announced stimulus measures that include mortgage rate cuts to support the housing sector, the reduction of bank capital requirements to boost lending, and money to help companies’ buyback their own stock.

Well-known hedge funds that are piling into China include Appaloosa Management, whose president, David Tepper, said on CNBC that he’s buying “everything” related to China. Man Group ($GB:EMG), the world’s largest publicly traded hedge fund with nearly $180 billion of assets under management, is also buying substantial amounts of Chinese stocks.

Surging Markets in China

BlackRock ($BLK), the world’s largest asset manager with $10 trillion under management, recently upgraded Chinese stocks to an Overweight rating. Michael Burry, the famed investor who called the subprime mortgage crisis of 2008, has been buying Chinese stocks for months through his hedge fund, Scion Asset Management.

Regulatory filings in June of this year showed that Chinese e-commerce giant Alibaba ($BABA) was Burry’s top holding. He also held big stakes in Chinese search engine Baidu ($BIDU) and ecommerce platform JD.com ($JD).

The frenzied buying on the part of U.S. hedge funds and investors sent Hong Kong’s main stock exchange to a 20-month high on October 1, bringing its gains to 31% in less than three weeks. Hong Kong’s Hang Seng exchange is having its best performance since 1973. At the same time, mainland China’s CSI 300 index has risen 26.7% since mid-September.

Is Goldman Sachs Stock a Buy?

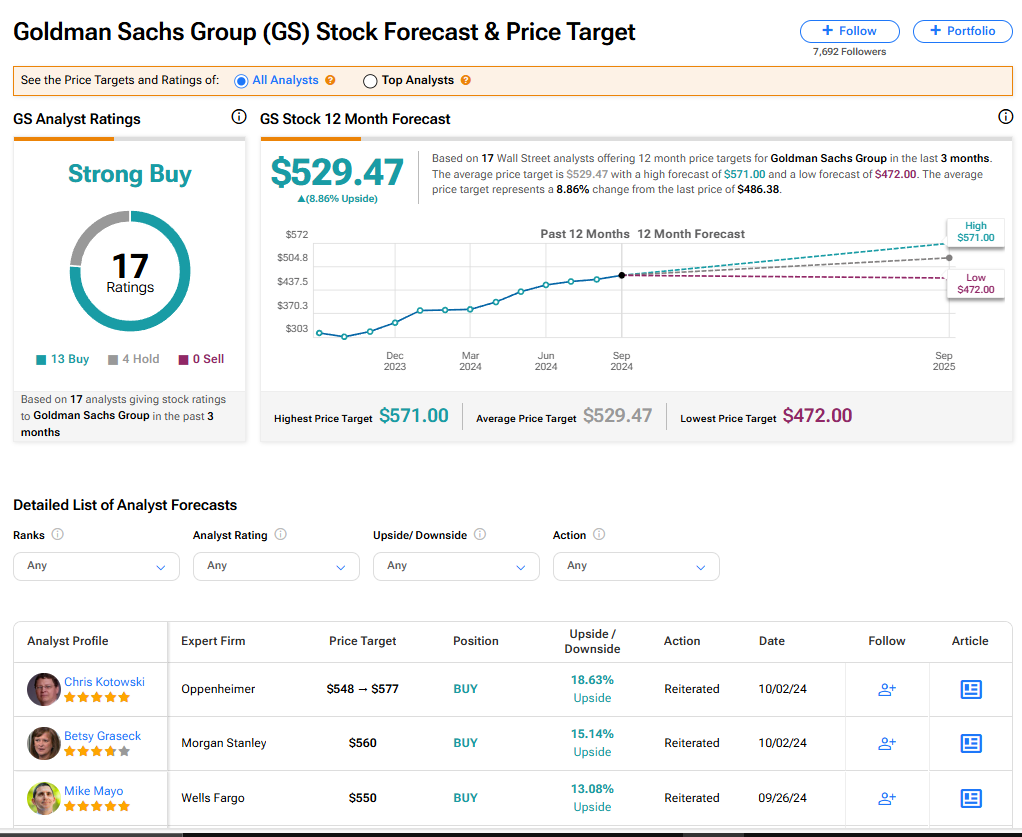

Goldman Sachs’ stock has a consensus Strong Buy rating among 17 Wall Street analysts. That rating is based on 13 Buy and four Hold recommendations issued in the last three months. There are no Sell ratings on the stock. The average GS price target of $529.47 implies 8.86% upside from where the stock currently trades.