Is it time to rain on the parade? Or is it time to buy into the markets? That’s what investors must decide. And according to Wall Street banking giant Goldman Sachs, they may need to make up their minds quickly.

Goldman starts by pointing out what we all know, that the S&P 500 is up almost 40% from its low point in the last week of March. That’s an amazing rally, but the bank’s analysis team warns that 2H20 may not be quite as upbeat as the first six months. The bank’s team predicts an annualized growth rate of 25% in Q3, down from the 33% forecast earlier.

The rise in corona cases and the reinstatement of social and economic restrictions forced the change in outlook. According to Jan Hatzius, chief economist, “The recent declines are minor compared to the collapse in activity in March and April, but they clearly indicate a break from the steady upward trend since mid-April.”

The bank believes the downward trend will be real, but likely short-lived; even red-state Texas has imposed a mask mandate. It is like that as state and local authorities nationwide, along with more grass-roots initiatives, push for increased precautions, the corona tide will slowly recede.

So, markets may go any which way. And to protect your portfolio, Goldman Sachs’ stock experts have tapped two equities that you should buy – and one that you should avoid. We’ve pulled up the details from the TipRanks database, to find out what lies behind these calls.

Simon Property Group (SPG)

First on the list is a real estate investment trust, Simon Property Group. This company is both the largest shopping mall operator in the US, and the largest retail REIT. In normal times, owning and operating high-end shopping destinations is a lucrative niche; but with the coronavirus and the shutdowns, SPG has faced heavy headwinds in the first half of this year.

Start with Q1. The company reported earnings below expectations, and a 20% drop in profits. The key Funds from Operations metric, which is used by analysts as an indicator of the general health of REITs, was down over 8% year-over-year, to $980.6 million. At the same time, the company started reopening its properties – in line with local policies – in the first half of May, and this week announced a $2 billion issue of senior notes, sold in three tranches due in 2025, 2030, and 2050.

As part of the mixed picture for SPG, the company also slashed its dividend payment by 38%, from $2.10 to $1.30. The new dividend was declared on June 29, and represents an annualized payment per share of $5.20. At that rate, despite the cutback, the yield remains an impressive 7.54%.

The company’s liquidity and dividend got the notice of Goldman Sachs. In the bank’s report on REITS, they recommend buying SPG. Analyst Caitlin Burrows writes, “We believe that the size and strength of SPG’s balance sheet is a positive differentiator for the company. Given its A rating by S&P, we expect SPG to access the unsecured market at attractive pricing in 2020 and further bolster its liquidity position.”

Caitlin puts a $94 price target on SPG, suggesting the stock has a 41.5% upside for the coming year.

Overall, SPG gets a Hold from the analyst consensus – Wall Street is inclined toward caution here, where Goldman Sachs is willing to take a risk. The stock has 13 recent reviews, breaking down to 4 Buys, 8 Holds, and 1 Sell. The shares are selling for $66.69, and the average price target of $80.08 indicates a potential upside of nearly 21% over the next 12 months. (See SPG stock analysis on TipRanks)

Brixmor Property (BRX)

Next on our list, Brixmor Property, is another big name in retail property ownership. Brixmor is decidedly mid-market, where SPG above is high-end; BRX’s top three tenants are TJ Maxx, Kroger, and Dollar Tree. The company has built a strong niche in the mid-market, however, and came into 2020 with a solid position: over 400 shopping centers, with more than 71 million leasable square feet.

The nature of Brixmor’s business helped ensure a steady stream of shoppers, even during the height of the corona crisis. With Kroger as the #2 tenant, the company did not see rental income slip as much as some other REITs. EPS slipped only slightly sequentially, from 47 to 46 cents per share in Q1. On a negative note, management suspended the dividend payment starting in Q1, stating that they would revisit the policy on a quarterly basis going forward.

The company has been taking efforts to shore up liquidity, and in June closed a purchase offer on existing senior notes due in 2022. The sale brought in over $182 million, or 36.5% of the outstanding principal amount on the notes.

Goldman Sachs’ Caitlin Burrows expressed her confidence in the strength of the company’s portfolio, noting “BRX owns a portfolio of Open Air properties across the United States, which we believe will be an advantage in this current retail environment. Strip Centers offer competitive retail supply versus enclosed malls on the basis of pricing and also benefit from higher exposure to essential tenants as well as the concentration of retailer store openings which are among BRX’s top 40 tenants.”

To this end, Caitlin rates BRX a Buy along with an $18 price target. This implies a 37% one-year upside.

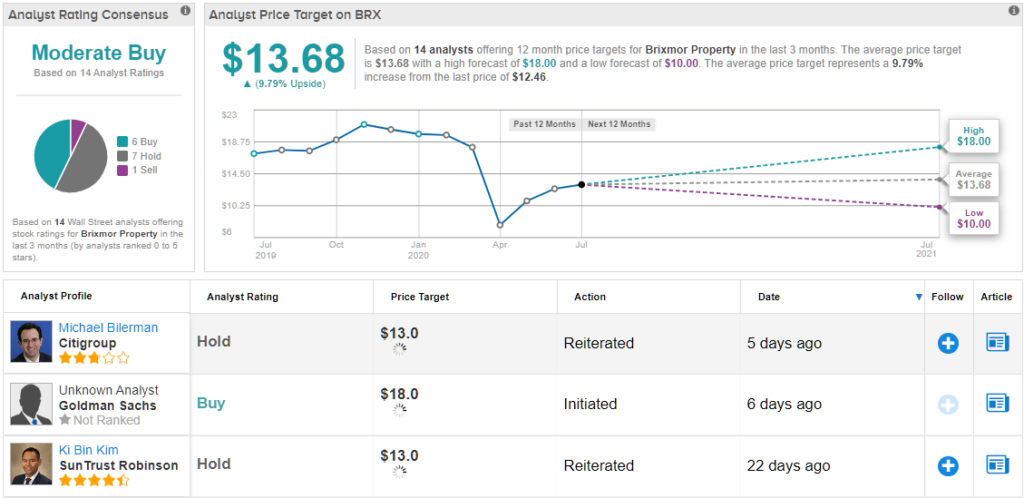

The analyst consensus here is a Moderate Buy, based on 6 Buys, 7 Holds, and 1 Sell set in recent weeks. Shares are selling for $12.46, and the average price target of $13.68 suggests a 10% upside from current levels. (See BRX stock analysis on TipRanks)

Macerich Company (MAC)

Goldman Sachs’ Caitlin Burrows isn’t all bullish on REITs. She is also initiated coverage on Macerich, another retail-oriented real estate trust, with a Sell rating. Macerich is the third largest owner/operator in the US shopping mall sector, and boasts over 50 million square feet of leasable retail space.

After a strong fourth quarter, Macerich saw earnings drop sharply during the corona crisis. Q1 EPS was 81 cents, down over 18% from Q4. Top-line revenues also slipped, by 6%, to $221 million. The stock’s share price has behaved as might be expected – MAC collapsed badly during the Feb-March bear market, and still has not recovered. The stock is down 59% from its February levels.

At the same time, there are some bright spots. Macerich in mid-June announced that all of its retail properties were open for business again, a positive leading indicator for 2H20. And, at the end of May, the company declared its regularly quarterly dividend of 50 cents per share – but there was a twist. The dividend was paid partly in cash – up to 10 cents per share – and the balance in shares of common stock.

That was an important point for Burrows. The analyst laid out her view of MAC as follows: “We believe MAC’s high portfolio quality is overshadowed by its elevated leverage, limited access to debt, and potential dividend risk.”

Looking at details, Burrows noted of the company’s leverage: “MAC’s leverage has been negatively impacted by lower EBITDA over the past few years.” And about the dividend, Burrows acknowledges the current hybrid payment but is not sanguine of the future: “Having reduced the total common stock dividend less than peers, there could be further dividend reductions given the company’s pressured balance sheet and liquidity.”

This is the stock that Goldman says to Sell. In line with that, the bank puts a $6.50 price target, suggesting a downside for the coming year of 21%.

Overall, the Moderate Sell rating on MAC is based on 7 Holds and 3 Sells from the analyst consensus. At $8.25, and with an average price target of $8.22, the stock is not going to move from here, at least according to these analysts. (See MAC stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.