Goldman Sachs Group’s (GS) quarterly profit almost halved as the U.S. investment banks set aside almost a $1 billion to cover potential loan losses tied to the coronavirus pandemic.

Net earnings in the first quarter ended March 21, slumped 49% from the year-ago period to $1.21 billion. Diluted earnings per common share (EPS) fell to $3.11 in the first three months of the year from $5.71 in the same period last year 2019. Goldman missed analysts’ estimates expecting a profit of $3.35 per share on average. The investment bank’s stock rose a mere 0.2% to $178.52.

Provision for credit losses increased to $937 million in the quarter, primarily due to significantly higher provisions related to corporate loans as a result of the continued pressure in the energy sector and the impact of the coronavirus pandemic on the broader economic environment.

“Our quarterly profitability was inevitably affected by the economic dislocation,” said Goldman Chief Executive Officer David Solomon. “As public policy measures to stem the pandemic take root, I am firmly convinced that our firm will emerge well-positioned.”

Goldman’s net revenues of $8.74 billion were little changed from the year-ago period due to “significantly” lower net income generated from the investment bank’s asset management business as a result of the downturn in global equity and credit markets. The asset management’s business losses though were offset by the bank’s bond trading business, which had its best quarter in nearly five years. Analysts’ estimates for revenues were around $7.92 billion.

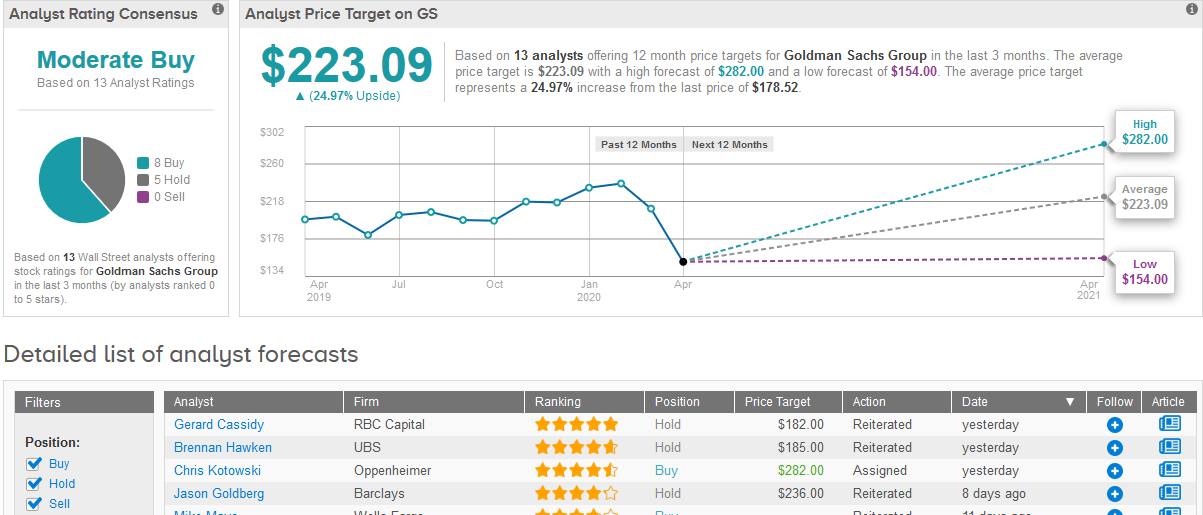

Ahead of the financial resutls, Societe Generale analyst Andrew Lim on Monday raised Goldman’s rating to Buy From Sell. Overall Wall Street analysts assign a Moderate Buy consensus rating to the bank’s stock based on 8 Buys and 6 Holds. The $223.09 average price target sees investors making a potential 25% profit on the shares in the next 12 months. (See Goldman Sachs stock analysis on TipRanks).

Goldman’s Board of Directors approved a dividend of $1.25 per common share to be paid in June.

Related News:

Arcus Surges 50% In After-Hours Trading On Rumored Gilead Stake

Billionaire David Shaw Pulls the Trigger on These 2 Stocks

Time to Pull the Trigger? RBC Offers 2 Stocks to Buy