With the S&P 500 at record highs, investors are facing an unusual problem: too many places to put their money. A strong jobs report and good news on the US-China trade front have helped to boost the markets; as noted by investment bank Goldman Sachs, in the last week of October over $6.1 billion went back into global stock funds.

But where is the smart money going? Goldman economist Silvia Ardagna favors US stocks, but he is careful to hedge his recommendation: “The de-escalation of trade tensions between the U.S. and China has triggered the question whether investors have been too negative and there could be some positive surprises.” He adds that the ongoing US-China trade talks, and the good feelings they have engendered, have his wealthy clients eager to get their money working again.

And with that background, we can better understand some of the surprising recommendations that have come from Goldman’s financial research team in recent days.

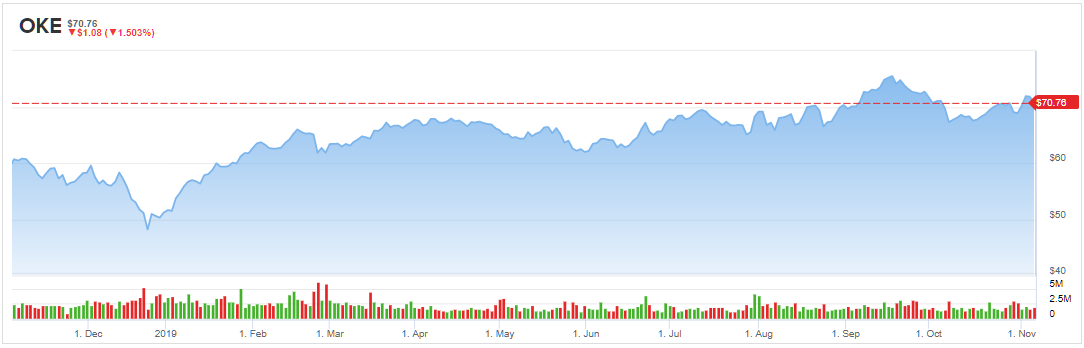

Oneok (OKE)

Based in Tulsa, Oklahoma, Oneok is a $12 billion dollar-a-year midstream pipeline company for the natural gas industry in the American West. The company provides midstream services – gathering, processing, storing, transporting, and marketing – for natural gas producers in the Mid-Continent, Permian, and Rocky Mountain production regions. Oneok netted $305.5 million in income in 2018.

In its last quarterly report, released on October 30, OKE showed EPS in-line with the estimates, at 74 cents. Revenues, however, missed the forecast by 4.2%, coming in at $2.26 billion against the expected $2.36 billion. The revenue miss was impacted by a combination of expenses due to expanded operations and higher operating costs. While cash flow was down roughly 12% year-over-year, cash on hand was up. Oneok had an impressive $673.3 million in cash and cash equivalents available at the end of September, compared to just $12 million nine months earlier.

Goldman analyst Michael Lapides notes the company’s mixed results, but also points out that ‘expanded operations’ specifically means two major pipeline projects expected to come on-line next year. Lapides writes, “OKE is in the late stages of a significant capex cycle, with two large-scale pipeline projects expected to ramp up over the next 6-9 months per management, driving stronger returns, and deleveraging… Given OKE’s asset integration and our wet gas production estimates, we believe there is good visibility to volume growth for these two pipeline projects…”

In line with his outlook, Lapides upgrades OKE to a Buy rating, and sets an $81 price target, suggesting an upside of 16% to the stock. (To watch Lapides’ track record, click here)

OKE is not widely covered by the Street’s analyst corps; among those who do cover the stock, however, the consensus is a Moderate Buy. OKE shows an average price target of $79.33, implying room for about 13% upside from the current trading value of $69.77. (See Oneok’s stock analysis on TipRanks)

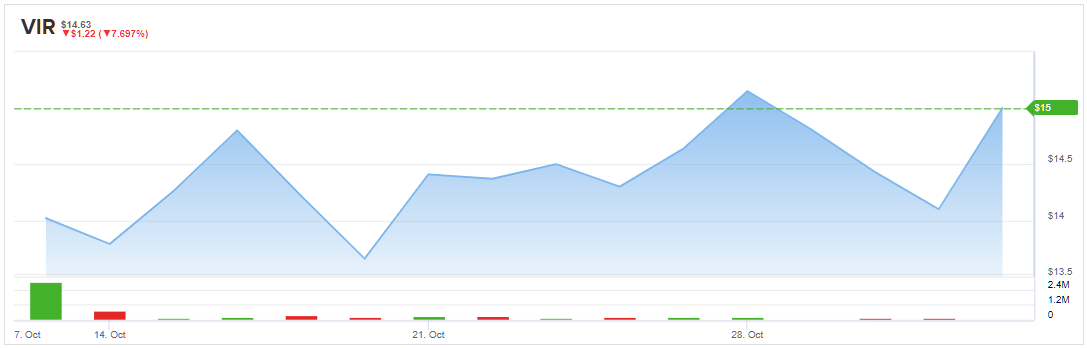

Vir Biotechnology (VIR)

This biotech research company, founded in 2016 as a clinical-stage immunology company focusing on the eradication of infectious diseases, had its IPO last month. Since then, it is up 12% in the markets; in its first few weeks of trading, volumes have been modest, and the stock has been volatile.

Vir is backed by the Gates Foundation, and has two main projects past the pre-clinical testing phase. A hepatitis B treatment, in collaboration with Alnylam, is in Phase 2 testing, while an Influenza A treatment is in Phase 1 testing. Three more drugs, for TB, HIV, and another for Hep-B, are in the pre-clinical phase. The Gates Foundation is supporting the TB and HIV research. For a small biotech, Vir has a varied pipeline with strong potential.

As a new company, Vir hasn’t got a long public record to lean on. That hasn’t stopped Goldman Sachs analyst Paul Choi from initiating coverage of the stock with a Buy rating and an aggressive price target of $37, which implies an impressive upside potential of 133%. (To see Choi’s track record, click here)

In his initiation report, Choi says, “While we acknowledge that much of the pipeline is early stage, we see significant upside to the stock driven primarily by upcoming Phase 2 HBV and influenza data in 2020, which we think could increase investor confidence in VIR’s platform approach to infectious diseases…” Choi acknowledges that this company is in its early stages, and that the clinical research, while promising, has only just begun. He adds, “…we acknowledge that VIR is several years away from the commercial launch of any of its clinical candidates. We therefore anticipate focus will remain on clinical data over the near-term…”

How does Choi’s bullish bet weigh in against the Street? It appears the analyst is not the only one enthusiastic on this biotech company’s prospects, with TipRanks analytics demonstrating VIR as a Strong Buy. Out of 4 analysts polled by TipRanks in the last 3 months, all 4 are bullish. With a return potential of nearly 100%, the stock’s consensus target price stands at $29. (See Vir’s stock analysis on TipRanks)

Tal Education Group (TAL)

And now we get to a Chinese company. TAL, based in Beijing, describes itself as “a leading education and technology enterprise.” The company’s core focus is on improving science and technology education through integration of internet-based tech in the classroom. TAL has had success in China’s tier-1 cities, and is in process of shifting its priorities to the so-called tier-2 cities.

TAL trades on the NYSE, where it has shown a 61% year-to-date gain, nearly triple the S&P gain of 22%. In the company’s most recent quarterly release, for Q2 fiscal 2020, it showed a drop in EPS to 2 cents per share, despite a 33% year-over-year gain in revenues to $936 million. The jump in revenue was attributed to a 54% increase in enrolled students from the year-ago quarter. TAL also boosted Q3 guidance by 41%, to $826 million. Shares spiked after the earnings release, gaining 13%.

In a recent report, Goldman’s Christine Cho revisited her firm’s earlier review of TAL and upgraded the rating from Neutral to Buy. Cho wrote, “TAL’s learning center (LC) expansion beyond the top 5 cities has become a key focus in its capacity expansion in recent years. In fact, TAL entered 14/13 new cities in FY19/FY1H20, reaching a footprint of 69 cities as of FY1H20, and learning centers in non-top 5 cities have grown to 52% of the total LC base… We strongly view effective penetration into lower-tier cities as key to long term growth…” Cho’s $50 price target on TAL suggests room for a 15% upside. (To watch Cho’s track record, click here)

The online education company now looks like a very compelling investing opportunity, as TipRanks analytics showcasing TAL as a Strong Buy. (See Tal Education’s stock analysis on TipRanks)