Once again, the world is gripped by uncertainty. Fear of an international outbreak of coronavirus, on top of recent worrisome developments between the US and Iran, have spooked investors, sending all three major indexes down over the last week.

However, no matter the global outlook, one thing remains certain; investors are still in the game, on the lookout for the best opportunities the market presents. As it happens, if you know where to look, a world teetering precariously on the edge often presents specific investment opportunities.

With this in mind, we pulled up two of Goldman Sachs’ recent stock picks which the renowned investment bank thinks can soar in the coming months. Using TipRanks’ Stock Comparison tool, we were able to read the fine print on what 2020 has in store for the two tickers. Let’s take a closer look.

Denali Therapeutics Inc. (DNLI)

Denali Therapeutics has started off 2020 with a bang. The neurodegenerative disease-focused biotech is up by 34 % year-to-date. The reason for the surge? The company, which is developing a broad portfolio of candidates engineered to cross the blood-brain barrier (BBB) for neurodegenerative diseases, released an update on the pipeline’s progress. The market, in return, liked what it saw.

Among the good news was the data in a Phase 1b trial of LRRK2 inhibitor DNL201, the company’s candidate for the treatment of Parkinson’s disease. The results exhibited “high levels of target and pathway engagement and improvement of lysosomal biomarkers.” Additionally, a Phase 1b study of fellow Parkinson candidate and LRRK2 inhibitor, DNL151, exhibited “high levels of target and pathway engagement and modulation of lysosomal biomarkers in healthy volunteers.” Both drugs met biomarker goals and were generally well tolerated.

Goldman Sachs’ Salveen Richter thinks the safety profile of DNL201 and DNL151 should “ease investor concern regarding potential LRRK2 mediated peripheral/pulmonary toxicities.”

The 5-star analyst further added, “While we are cognizant drug development in neurodegenerative diseases has historically been challenging, we believe DNLI’s biomarker-driven approach to establish target/pathway engagement and patient phenotyping (selecting the appropriate patients) will lead to an increased likelihood of clinical success.”

Richter thinks the key driver for DNLI in 2020, though, is Denali’s blood brain barrier (BBB) Transport Vehicle (TV) platform. The analyst expects biomarker proof-of-concept results from Phase 1/2 DNL310 in Hunter syndrome by late-2020. Based on pre-clinical data, Richter is confident in the outcome.

The analyst said, “We are optimistic that DNL310 will effectively transport the missing IDS protein across the BBB, at therapeutically relevant doses, and demonstrate a reduction (over 50% is the bar) in CSF glycosaminoglycans (GAG) from baseline.”

What does it all mean, then? It means Richter upgraded her rating on Denali from Neutral to Buy. The upgrade comes with a bump of the price target, too, up from $20 to $37. The new figure indicates possible upside of a rousing 58%. (To watch Richter’s track record, click here)

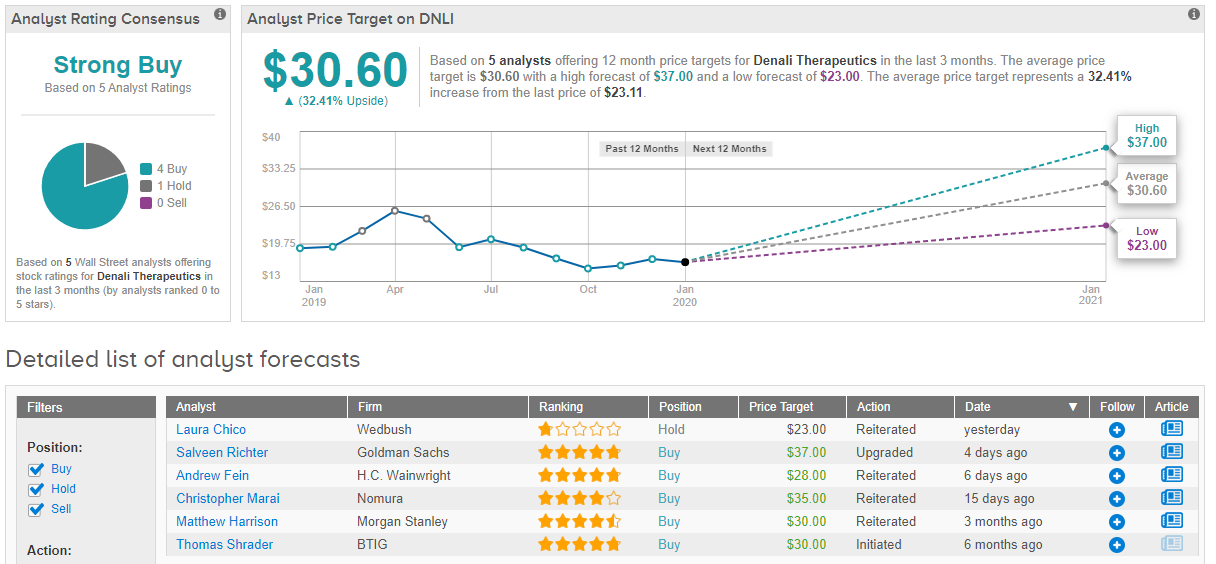

The Street is also enthusiastic. 4 Buy ratings and 1 Hold add up to a Strong Buy consensus rating. With an average price target of $30.60, analysts expect Denali to add 34% to its share price over the coming 12 months. (See Denali stock analysis on TipRanks)

Sibanye Gold (SBGL)

Even people with a distinct lack of interest in the movements of financial markets know that in times of uncertainty, investors often turn to the safe haven of gold. The current global climate, then, is good news for gold and other precious metals companies such as Sibanye-Stillwater. The company is South Africa’s largest individual producer of the precious commodity. It’s also one of the world’s ten largest gold producers, and the third largest producer of palladium and platinum. Sibanye’s diversification has been a sound strategy, as the company is not reliant on the sharp movements of just one commodity’s price.

Sibanye stock soared dramatically in 2019, rising by over 250% throughout the year; the surge was driven by commodity pricing, the consummation of a protracted acquisition and resolution of a long strike at one of its mining assets. The company boasts a considerably improved balance sheet, too. Sibanye’s net debt was reduced to $1.5 billion by the end of last year’s second quarter, the lowest it has been since Sibanye acquired Stillwater in mid-2017.

According to Goldman Sachs’ Eugene King, there are several tailwinds which could see 2019’s market performance extend into 2020. The analyst cites strong PGM (platinum group metals) drivers, continued deleveraging, shareholder returns and a compelling valuation even after the recent rally in PGMs, as catalysts. King forecasts “an above-peer 2020E FCF yield of 20% all offered at a 23% discount to peer 2020E EV/EBITDA valuations.”

The analyst said, “While the rally in the broad space has been significant, drivers for Palladium and Rhodium remain purely fundamental with no short-term reversal in sight… We believe spot prices are unlikely to pull back meaningfully, enabling continued deleveraging by SGL… With the majority of its operations in SA, SGL stands to gain from a weaker rand. While power stability issues (Eskom) are a risk to earnings, this would likely be offset by a reactive move in PGM prices.”

All the above reasons led King to keep his Buy rating on Sibanye. The analyst’s price target comes in at $14 and implies upside potential of 36%. (To watch King’s track record, click here)

Adding to the good news, SBGL earns a Smart Score of an 8 out of 10 from TipRanks. The metric uses 8 key factors to help determine the strength of an investment opportunity. (See Sibanye stock analysis on TipRanks)