Investment bank Goldman Sachs has been looking at the oil industry and finding the stocks to buy. The picture is looking good as we enter 2020, but there’s still background to understand.

Falling prices and a slowing rate of production increases have put pressure on the US oil sector in 2019. The coming year is looking good, however, as Q1 is generally seasonally strong for US oil companies. Exploration and production budgets are renewed with the new year, and toward the end of the quarter, as the weather improves, fracking activity and rig counts begin to recover.

Perhaps anticipating a rising quarter, the oil sector has gained some 10% in the past month. Headwinds remain, however, in the form of OPEC cuts and slowing American production as companies try to leverage lower production to maintain prices. Outside of OPEC and the US, however, Goldman’s analysts expect that producers will continue to boost output.

The banking giant sees several important stock plays in the segment for investors to consider in coming months. One is a straight Buy; the others are upgrades and deserve a closer look. Running each stock through the Stock Screener tool at TipRanks, we’ve confirmed that Goldman Sachs is in the majority on Wall Street in recommending these equities. Here’s what you need to know about them.

Schlumberger Limited (SLB)

With 100,000 employees, operations in 120 countries, and a market cap of $55 billion, Schlumberger is a major player in the oilfield services industry. The company offers the array of services that drilling companies need to conduct operations, with a heavy emphasis on drilling systems and well completions, as well as production services to get oil out of the ground. SLB saw more than $32 billion in revenue for 2018, and is on track to show another good year in 2019.

The third quarter results for the company were positive, with a 43-cent EPS and revenues of $8.54 billion. Both of those results came in over the estimates – industry analysts had predicted EPS of 40 cents and revenues of $8.50 billion.

The strong quarter and solid earnings prop up an even stronger dividend. SLB pays out 50 cents per quarter, and has steadily since 2015. The quarterly payment is higher than the EPS, but the company’s share growth and upside can support that, at least temporarily (more below). For investors, the best part is the yield – at 5.02%, the dividend is more than double the average of S&P listed companies.

Goldman Sachs’ Angie Sedita included SLB in her reviews of oil industry companies. She sees it as a buying proposition, and reiterated her Buy rating on the shares. She set out a case reflecting “1) leadership in the international markets… 2) self-help story of driving margin gains both in North America and Internationally… 3) competitive moat through its technology leadership… 4) global size and scale, more than double the size of the next closest competitor… 5) new CEO’s strategy of a capital light asset model… 6) potential for long-term margin upside from SLB’s digital offerings… 7) solid free cash flow generation (7% FCF yield on 2020E) and an attractive dividend yield (~5.0%).”

Overall, Sedita paints a solid picture of Schlumberger, befitting a company with a long history in the industry (it was founded in 1926) and a leading presence among its peers. She puts a $55 price target on the stock, suggesting a 36% upside potential. (To watch Sedita’s track record, click here)

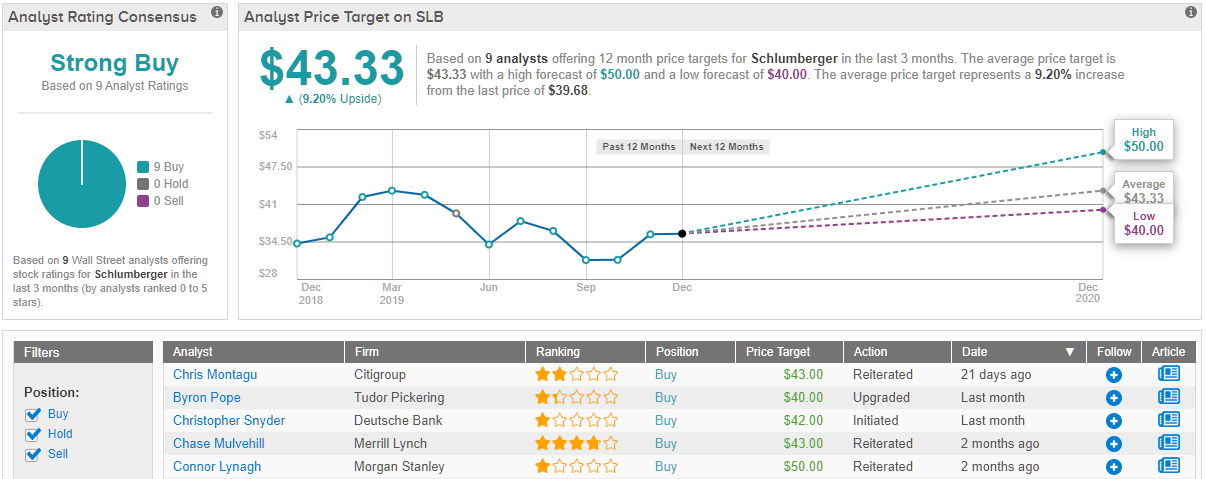

The rest of Wall Street echoes Sedita’s bullish play, as TipRanks analytics exhibit SLB as a Strong Buy. With 9 Buys backing that rating, the consensus is unanimous. SLB shares sell for $39.71, and the average price target, of $43.33, indicates room for a modest, but likely reliable, 9% upside. (See Schlumberger’s stock analysis at TipRanks)

NexTier Oilfield Solutions (NEX)

The oil industry isn’t just all about extraction. The drilling companies need support services, everything from pipelines and storage facilities to waste disposal and recycling. The fracking revolution, which has revitalized the American oil fields, brings with it a need for a variety of specialized services. Water and water mixtures, chemical disposal, pumps, tubing, tanker trucks – it’s a long list, and NexTier has evolved to fill the niche.

That niche is sustainable clear from the company’s third quarter earnings. NEX beat the forecast by 100%, reporting 8 cents per share – double the 4 cents predicted. This came after an even higher beat in Q2, when the company reported 6 cents EPS against a predicted loss of 5 cents. In revenue, NEX brought in $443.95 million for Q3, in line with the forecasts.

The upbeat Q3 numbers came in as NexTier was forming. The company inherited the past performance of Keane Group after Keane merged with C&J Energy Services. The name change to NexTier was part of that amalgamation. The merger of equals was formed to take advantage of cost efficiencies available through the combination.

Keeping in mind the company’s solid industry niche, Goldman Sachs upgraded NEX from Neutral to Buy. Analyst Angie Sedita wrote, “NEX is a top-tier player within the bifurcated pressure pumping segment. NEX has strong field execution, top tier profitability per fleet, and a high level of dedicated agreements with larger E&P operators.” She backed her Buy rating with a $9 price target that indicates a robust 34% upside potential. (To watch Sedita’s track record, click here)

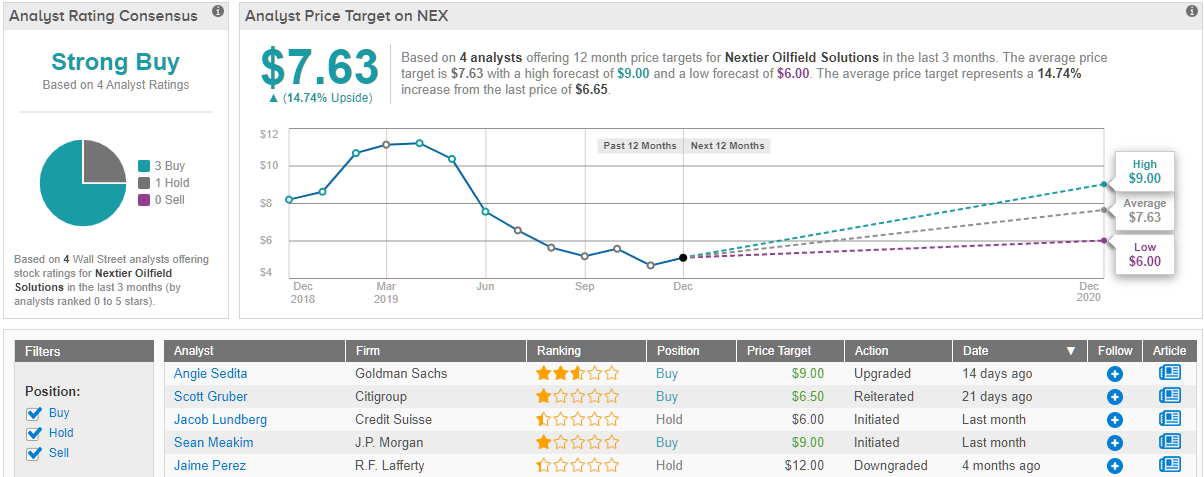

Overall, NEX shares are a bargain in the oil industry. At just $6.69, the share price is an easy point of entry, and the stock has a Strong Buy consensus rating based on 3 Buys and 1 Hold. The average price target, $7.63, suggests room for 15% upside growth in the next 12 months. (See NexTier’s stock analysis at TipRanks)

Oceaneering International (OII)

The next one may not seem like an oil sector stock, but the connection is there. Oceaneering is a sea-floor exploration technology company, offering engineering and tech services including undersea remote operated vehicles; deepwater diving, inspection, and testing systems; seafloor surveying and mapping, and project management. The company serves government customers, as well as aerospace and marine engineering and construction firms, but a large part of its business is with the oil and gas industry – specifically, of course, the off-shore components of the industry.

The oil industry’s difficulties in Q3 pushed Oceaneering into net losses each quarter. The most recent, Q3, showed a loss of 30 cents per share, not only a net loss, but also a loss deeper than expected. Revenues came in at $498 million, down 4% year-over-year, but also 5.5% below the forecast. OII’s Asset Integrity and Advanced Technologies units led the losses.

On a positive note, OII ended Q3 with cash on hand of $340.3 million. The company had kept capital expenditures low, at just $58 million, and carries long-term debt of just under $800 million. Overall, the company’s cash and capital picture is sustainable.

Goldman’s Sedita analyzed OII’s position, and saw fit to upgrade the stock and bump up the price target. In her comments, Sedita justified her Buy rating: “We are increasing our 2020/2021 EBITDA estimates by ~7%/~10% on slightly higher margin assumptions, our view of a steadily improving offshore market environment and OII’s market leading position in ROVs…” Her $20 price target suggests room for 34% upside growth.

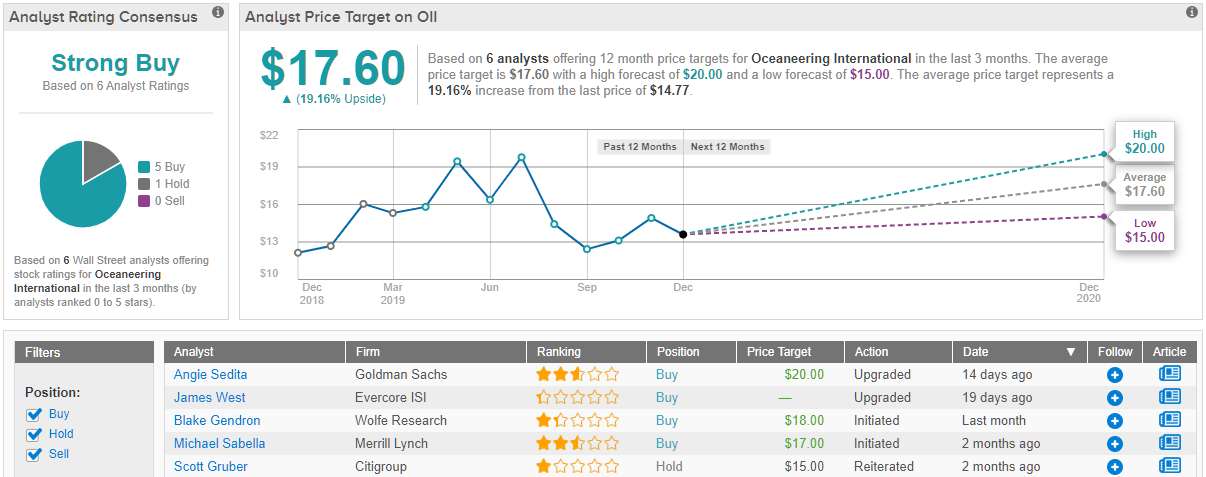

OII shares have 6 recent reviews backing its Strong Buy consensus ratings. Those reviews include 5 Buys and 1 Hold. Shares are priced at $14.90, and the average target of $17.60 implies a strong upside of 19%. (See Oceaneering’s stock analysis at TipRanks)