With a short history of less than 6 months on the public market, Nikola (NKLA) stock is already an old hand at the volatility game. There have already been many ups and downs, although the electric truck maker’s latest move was a decisively negative one; Shares cratered by 27% on Monday following the announcement that Nikola and General Motors’ proposed partnership was significantly scaled back.

Whereas previously talks had centered on GM taking $2 billion’s worth of Nikola stock in return to throwing its considerable weight behind the development of Nikola’s pickup truck, the Badger, the partnership now amounts to not much more than a supply deal. The two companies signed a MoU (memorandum of understanding) in which Nikola will buy GM’s Hydrotec fuel cells for its FCEV trucks on a cost-plus basis.

It all seems a far cry from early September when the prospective parentship appeared almost a done deal. Since then, however, Nikola’s founder Trevor Milton resigned amidst allegations of fraud and now Nikola has completely abandoned the Badger initiative to focus on the development of its Class 7 and Class 8 semi-trucks.

Deutsche Bank analyst Emmanuel Rosner views the development as “particularly negative for Nikola stock,” while the revised agreement “makes it clear that after months of additional due diligence, GM is not willing to any risk on Nikola.”

“By no longer accepting NKLA equity as payment, but instead demanding capital expenditures upfront and regular payments for fuel-cell deliveries, GM essentially no longer wants to be tied to Nikola´s longer term outlook,” the analyst further said.

The timing of the announcement coincides with another event which could put NKLA stock under additional near-term pressure. Today, December 1, marks the lock up expiry date when Nikola insiders are eligible to sell 161 million shares previously kept out of circulation. Of these, 92.2 million belong to Milton.

Looking beyond the near-term implications, Rosner believes “Nikola’s eventual success (or lack thereof) will depend on its ability to build the right partnerships and develop right economics for its hydrogen trucks and network.”

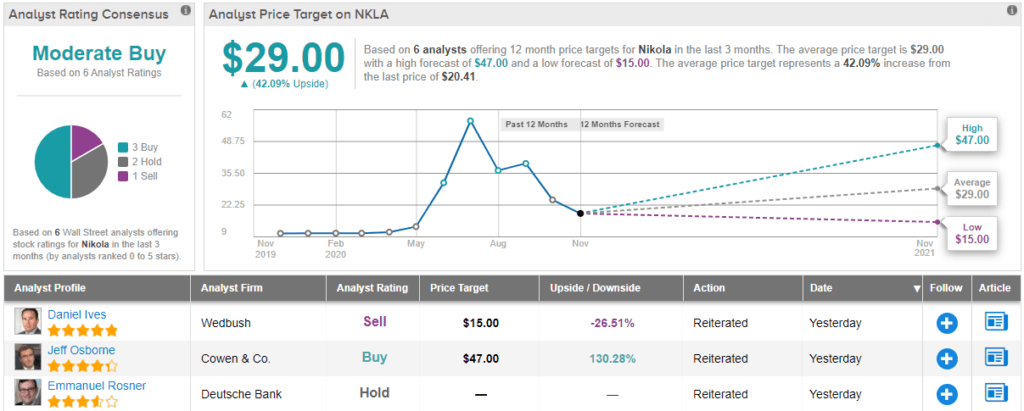

For now, due to “large technical selling pressure and execution risk,” Rosner stays on the sidelines with a Hold rating. The analyst has no fixed price target in mind. (To watch Rosner’s track record, click here)

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 3 Buys, 2 Holds and 1 Sell add up to a Moderate Buy consensus. In addition, the $29 average price target indicates 42% upside potential from current levels. (See NKLA stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.