Alphabet’s ($GOOGL) Google has agreed to pay $1.375 billion to the state of Texas to settle claims of violating residents’ data privacy rights. Texas Attorney General Ken Paxton announced the deal, calling it a major victory for consumer privacy and a warning to Big Tech that it “is not above the law.”

This deal highlights the rising legal pressure on tech companies over how they collect and use personal data. It comes shortly after a similar $1.4 billion settlement that Paxton secured from Meta ($META) in July 2024 for using biometric data without user consent. Taken together, these recent cases show that states are now taking stronger action to hold Big Tech responsible for data privacy violations.

Google Accused of Secretive Data Practices

The lawsuit against Google, filed in 2022, alleged that the company collected sensitive user data without consent—ranging from location history and incognito-mode searches to biometric identifiers like voice and facial data. These alleged actions violated Texas consumer protection laws.

While Google did not admit to any wrongdoing, the company said the settlement resolves outdated claims and that it has already made relevant policy changes. A spokesperson noted, “We are pleased to put them behind us and will continue to build strong privacy controls into our services.”

Regulatory Risks Still Linger for GOOGL

This settlement adds to Google’s growing list of legal challenges. In late 2023, the company agreed to pay $700 million in a separate case involving antitrust concerns around its Android app store. Meanwhile, several lawsuits still loom, covering issues from advertising practices to alleged market dominance.

According to TipRanks’ Risk Analysis tool, legal and regulatory risks make up 17.9% of Google’s total risk exposure, above the industry average of 16.6%. As legal pressure mounts, investors remain cautious about the long-term impact of ongoing litigation on Alphabet’s performance.

Is Google a Buy, Sell, or Hold?

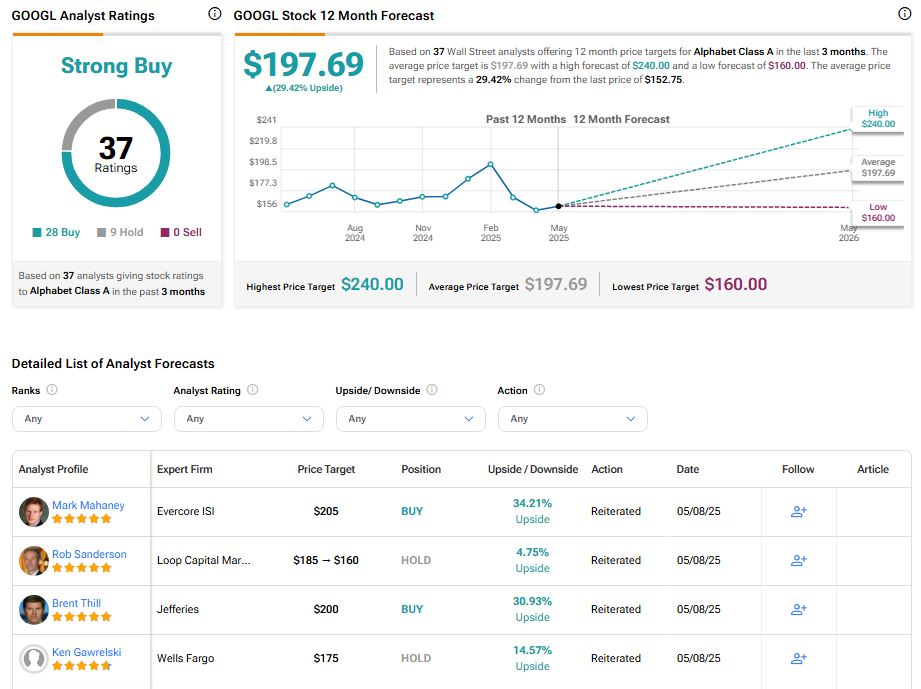

Alphabet is one of the magnificent seven stocks and has lost over 19% year-to-date. On TipRanks, Wall Street analysts remain bullish on Alphabet stock. With 28 Buy and nine Hold recommendations, GOOGL stock has a Strong Buy consensus rating. The average Google price target of $197.69 implies a 29.42% upside potential.