Alphabet’s (NASDAQ:GOOGL) unit, Google, will reportedly allow promotions for certain pharmaceuticals containing cannabidiol (CBD). Beginning January 20, 2023, Google will show ads for certain topical, hemp-derived products.

Advertisements of these products have long been restricted on several digital platforms, despite the passage of the 2018 Farm Bill, which legalized them in the U.S. Even now, Google’s authorization of these ads will be limited to products with tetrahydrocannabinol content of less than 0.3%.

Furthermore, the eligible ads will be shown only to users above the age of 18 in California, Colorado, and Puerto Rico. Also, these ads will not be reflected as masthead YouTube banners.

It is worth mentioning that the tech giant reported a 3.2% sequential drop in revenue from the advertising business in its third-quarter results. The decline was due to lower advertisement spending on YouTube and the Google Network as lower engagement levels were witnessed in gaming.

Is GOOGL a Good Buy?

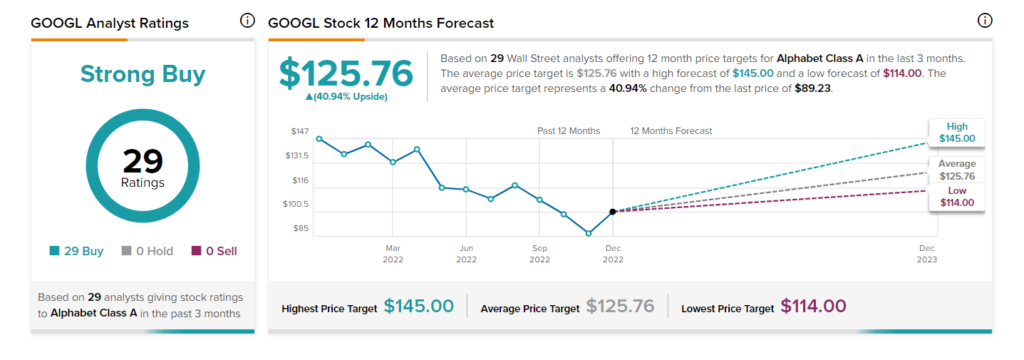

Alphabet stock has a Strong Buy consensus rating based on 29 unanimous Buys. The average stock price target of $125.76 suggests about 40.9% upside potential from current levels. Shares have declined 38.5% year-to-date.

GOOGL is one of Wall Street’s favorite picks. Moreover, as per TipRanks’ Smart Score rating, GOOGL stock has a Smart Score of 10, implying that the company is highly likely to outperform market expectations.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.