Shares of Groupon Inc. (GRPN) jumped 16% in the extended trading hours of August 5, before settling down around $31.5 on Friday. The price action followed the company’s upbeat Q2 results, driven by the highest local billings witnessed globally in any quarter since the beginning of the COVID-19 pandemic.

Groupon is a U.S.-based global ecommerce marketplace connecting subscribers with local merchants by offering activities, travel, goods and services. Shares of Groupon have jumped 116% over the past year.

Markedly, adjusted earnings of $0.33 per share significantly beat analysts’ expectations of a loss of $0.03 per share. The company reported an adjusted loss of $0.93 per share in the prior-year period. (See Groupon stock charts on TipRanks)

Revenues did decline 33% year-over-year to $266 million, but exceeded consensus estimates of $242.47 million. The decrease reflected a decline in Product revenues to $60 million, compared to $283 million a year ago.

Groupon’s interim CEO Aaron Cooper commented, “From an operational perspective, we made strong progress, successfully removing Deal restrictions on more than 70% of our inventory in North America.

“We are steadily scaling our initiatives to expand inventory and modernize our marketplace, and believe we are executing the right strategy to transform Groupon into a destination for local experiences and build a foundation for growth.”

Looking ahead, the company updated its full-year 2021 guidance. The company forecasts adjusted EBITDA in the range of $115 to $125 million. Revenues are forecasts to be in the range of $950–$990 million, versus the consensus estimate of $998.1 million.

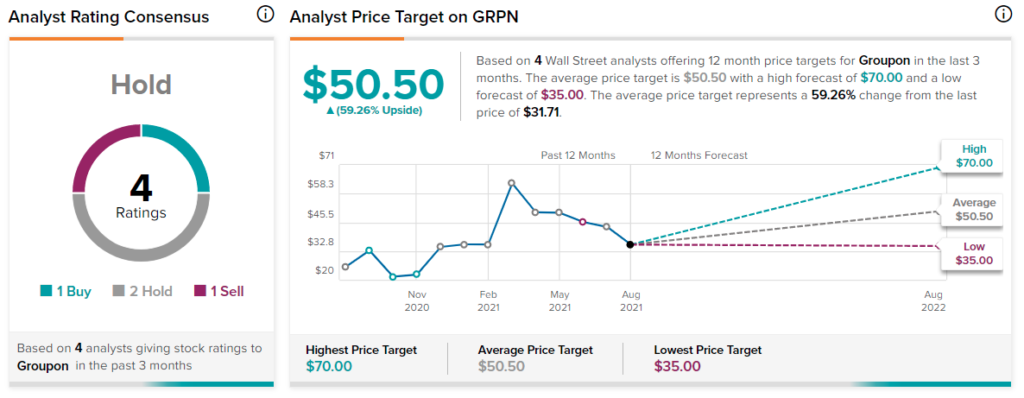

Barclays analyst Trevor Young recently assumed coverage of Groupon with a Sell rating and a target price of $35 (10.6% upside potential).

Overall, the stock has a Hold consensus rating based on one Buy, two Holds, and one Sell. The average Groupon price target of $50.50 implies 59.6% upside potential from current levels.

Related News:

Etsy Q2: Slowdown in New Buyers; Shares Crash 13.8%

Fastly Still Feeling Effects from June Outage

Papa John’s Posts Upbeat Q2 Results