Haleon PLC (GB:HLN) made its debut on the stock market in 2022 after being spun off from GlaxoSmithKline (GB:GSK). Since then, it has become the world’s leading consumer healthcare company. Haleon has some well-known brands like Sensodyne, Centrum, Otrivin, Eno, etc. in its portfolio.

Since its launch, Haleon’s stock has delivered a return of 17%. The stock picked up some momentum and has gained more than 30% in the last six months.

Let’s delve into more details.

The Bullish Case

To begin with, the company possesses a strong brand, which is advantageous in terms of competition and brand loyalty. Moreover, the company has the benefit of sourcing 80% of its products locally, which helps manage costs and ultimately profits.

In March, the company announced its full-year earnings for 2022. The total organic sales grew by 9%, above the guidance range of 8-8.5%. The higher sales were led by the army of its power brands, which showed a growth of 10% and accounted for nearly 70% of the group’s overall growth.

The company also posted a growth rate of 6% in its operating profits for the year. This was driven by its operating leverage and pricing power advantage, which offset the higher inflation costs.

For 2023, the company is targeting sales growth of 4–6%, margin improvement, debt reduction, and higher investments in its brands.

Experts Opinion

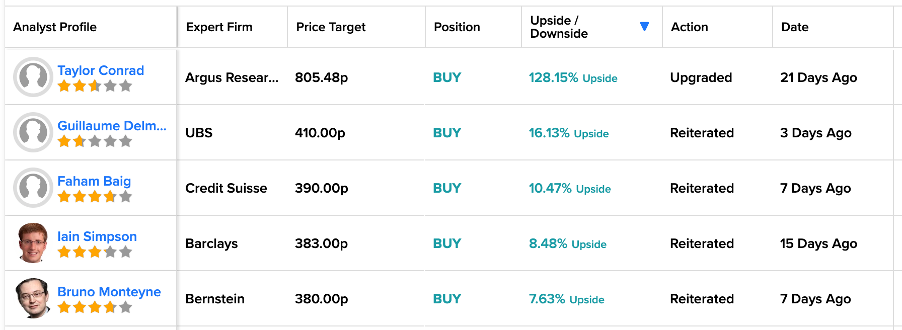

The stock has gained acceptance from the likes of UBS, Credit Suisse, Barclays, and more.

21 days ago, analyst Taylor Conrad from Argus Research upgraded his rating from Hold to Buy on the stock. His price target of 805.48p implies more than 120% of huge upside in the share price. Conrad believes “Haleon, supported by its market-leading brand names, will benefit from tailwinds like the growing popularity of preventive medicine, and the increasing shift from prescription to over-the-counter medications.”

Barclays’ analyst Iain Simpson recently commented that the company’s sales targets are “achievable,” but it could struggle to hit higher margins.

He is bullish on the Q1 2023 results for the company and said, “It will be another piece of evidence to convince long-only investors of Haleon’s structural growth potential.” Barclays predicted annual sales growth to be around 5.5% in 2023.

What is the Future of Haleon Stock?

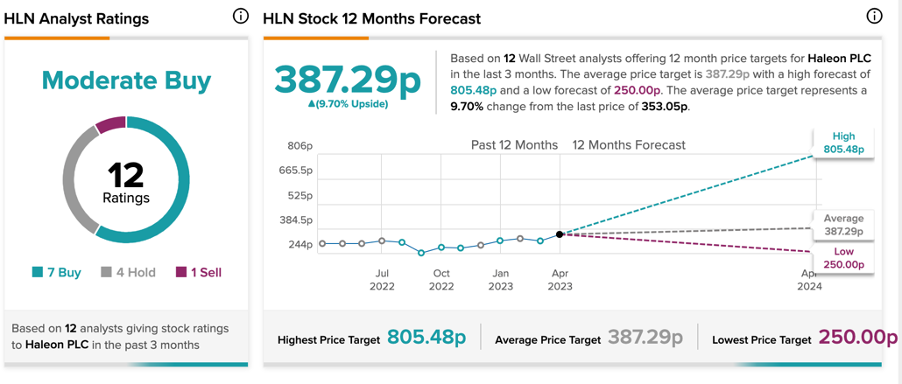

According to TipRanks, HLN stock has a Moderate Buy rating based on seven Buy, four Hold, and one Sell recommendations.

The average target price of 387.3p is almost 10% higher than the current price level.

Concluding Remarks

Haleon appears to be a top-tier player in the consumer healthcare segment. Despite its strong brand image and defensive characteristics, it is currently undervalued compared to its expanded group of peers.

Given its stable position and undervaluation, Haleon could be a valuable addition to your investment portfolio.