Hasbro Entertainment (NASDAQ:HAS), the maker of a wide range of toys and games, is taking a beating in today’s trading session so far. Hasbro took a double downgrade at Bank of America (NYSE: BAC) Securities, and the news behind it brought serious doubts to the company’s outlook. Analyst Jason Haas CFA previously had Hasbro at a Buy but dropped it down to “underperform” after its latest results. Haas stated that BoA took a “deep dive” into the company and noted a serious issue potentially afoot with its “Magic: The Gathering” line.

Haas noted that Hasbro—based on word from collectors, dealers, game stores, and distributors—has been overproducing Magic cards in a bid to derive profit. Reasonable enough, but Haas noted that the move may be “destroying the long-term value of the brand.” Thus, Haas issued the double downgrade.

Haas is likely right about Hasbro’s play to milk value from its properties. However, I’m not quite as pessimistic about the overall impact. I’m neutral on Hasbro right now. Though Hasbro likely is killing its golden goose, that’s not the only one Hasbro’s got on hand.

Is HAS Stock a Buy, According to Wall Street?

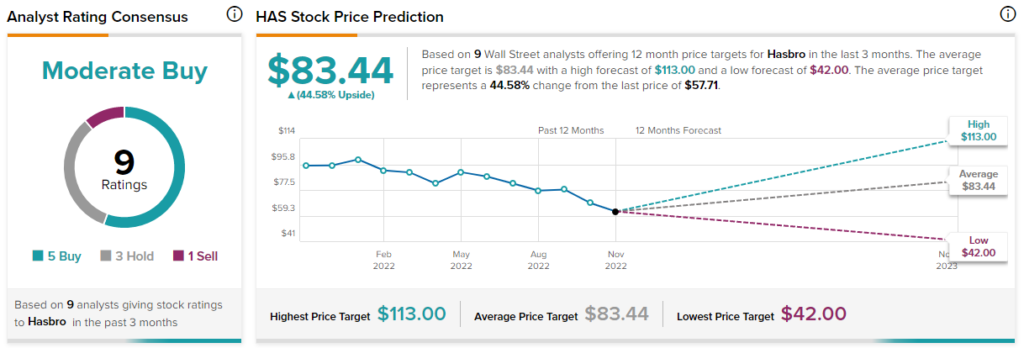

Turning to Wall Street, Hasbro has a Moderate Buy consensus rating. That’s based on five Buys, three Holds, and one Sell assigned in the past three months. The average Hasbro price target of $83.44 implies 44.6% upside potential. Analyst price targets range from a low of $42 per share to a high of $113 per share.

Meanwhile, Hasbro has a ‘Perfect 10’ Smart Score on TipRanks. Having achieved the absolute high point of the scale, Hasbro is considered all but certain to do better than the broader market.

That’s not a viewpoint that’s universally supported, however. Insider trading at Hasbro has been tepid at best, with only one insider transaction taking place from May 2022 to October 2022. Retail investors with portfolios on TipRanks are neutral overall.

Hasbro’s other financial numbers aren’t exactly spurring confidence, either. Its ready cash on hand has been in decline for the last three quarters, going from $1.02 billion in March 2022 to $545.5 million in September 2022.

On the plus side, assets are up slightly at $9.63 billion against June 2022’s $9.5 billion. Net debt has been on the rise for the last three quarters, however, going from $2.98 billion in March 2022 to $3.46 billion in September 2022.

A Lot Less Magic in an Overprinted Gathering

Magic: The Gathering has been around for quite some time now – long enough that I can personally remember a brisk secondhand market for the cards. Players routinely bought secondhand cards to enhance their decks with all the cards that made their strategies most effective.

Various changes over the years made that secondhand market somewhat less than effective, though. Reprints and various banned cards made it harder and harder to trade in the older material. Magic: The Gathering itself now has several levels of play, ranging from Standard to Modern to Vintage, each with its own rule sets.

So yes, it is entirely possible that Hasbro is overplaying its hand. Churning out new versions, printing vast quantities, and making surprisingly few truly rare cards could be a problem for the company later on.

How much of a problem that is, however, is the real question.

Even assuming the worst, that’s barely the start of Hasbro’s line of intellectual property. As of November 9, 2022, Hasbro owns 818 separate trademarks. Some listings are a bit redundant or repeated outright, but the list is there, and those trademarks have their own projects underway.

March 2023, for example, will see the new Dicelings toy line released. It’s set to coordinate with the release of the Dungeons & Dragons: Honor Among Thieves movie. A new line of vintage-styled retro Star Wars figures is in the works.

Granted, Magic: The Gathering is a big part of Hasbro’s bottom line. It generates about 15% of Hasbro’s revenue and better than a third of its EBITDA figures, reports note. Losses there, therefore, will be particularly strongly felt. Some of Hasbro’s trademarks are weaker than others, too. Don’t look for “Pax, My Poopin’ Pup” to save Magic’s losses.

Conclusion: One Dead, Several Hundred to Go

Of course, most Hasbro investors would prefer to see Hasbro not burn entire trademarks to the ground to try and squeeze every penny out of them. If Hasbro did ultimately choke the life out of Magic: The Gathering, that would be terrible news but likely survivable.

Hasbro may be killing the magic, but there are plenty of other properties ready to potentially take its place. That’s why I’m neutral on Hasbro. It remains to be seen just how bad a loss Hasbro is courting by overprinting Magic cards.