By Sarah Roden

Healthcare analysts are optimistic on both ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) and Celgene Corporation (NASDAQ:CELG) as ACADIA’s primary commercialized product received positive coverage and Celgene works to expand the indication for Revlimid. Let’s take a closer look:

ACADIA Pharmaceuticals Inc.

Nuplazid, Acadia’s FDA-approved drug to treat psychosis associated with Parkinson’s, received positive coverage during a webinar hosted by the Michael J. Fox Foundation for Parkinson’s Research.

Following the discussion, Charles Duncan of Piper Jaffray reiterated an Overweight rating on the biotech company with a $44 price target, marking a 30% potential upside from where shares last closed.

The webinar entitled Treating Hallucinations and Delusions Associated with Parkinson’s Disease discussed the pros and cons of Nuplazid. Several experts on the drug and a family member of a PDP patient participated in the discussion. Duncan described the reaction of Dr. Cummings, one of the investigators for the Nuplazid trial, noting he “hailed NUPLAZID as a ‘breakthrough’ for patients and encouraged listeners to discuss PDP symptoms with their doctors, although suggested NUPLAZID only be used for highly disruptive patients at this point in time.”

Overall, the analyst was encouraged by this “foundation-sponsored event” and “high engagement from listeners. Duncan concludes, “Patient recognition and symptom reporting will help drive NUPLAZID adoption.”

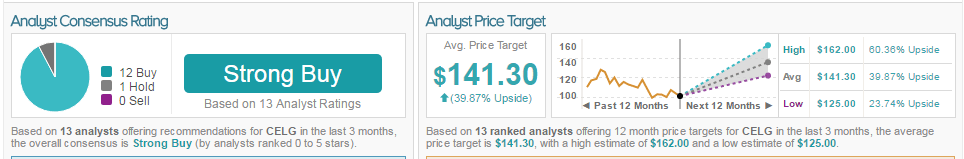

Charles Duncan has a 35% success rate recommending stocks with an average loss of (9.8%) per recommendation, according to TipRanks. Out of the 9 analysts who rated the company in the past 3 months, 89% of analysts are bullish on Acadia while 11% are neutral. The average 12-month price target for the company is $48.86, marking a 43.5% potential upside from where shares last closed.

Celgene Corporation

Following a meeting with Celgene management, William Blair’s healthcare analyst John Sonnier remains bullish on the company thanks to Revlimid, the company’s FDA-approved drug to treat multiple myeloma.

Revlimid is now being tested in five different trials to treat non-Hogkim lymphoma (NHL), which Sonnier believes is “underappreciated by the Street.” The analyst expects that three of these five trials “will likely read out during 2016-2017 and start contributing materially to Celgene’s top line by 2020.” While management believes this new NHL indication could contribute $1 billion to $1.5 billion in revenue by 2020, Sonnier views these estimates as conservative.

Putting Revlimid aside, Sonnier notes that “Celgene has the broadest pipeline in the biotech industry,” with “increased investor interest in the autoimmune pipeline.” Specifically, he points to GED-0301 in testing for Crohn’s disease.

Due to Revlimid’s potential to treat NHL and Celgene’s robust pipeline, Sonnier reiterates an Outperform rating on the company though does not provide a price target.

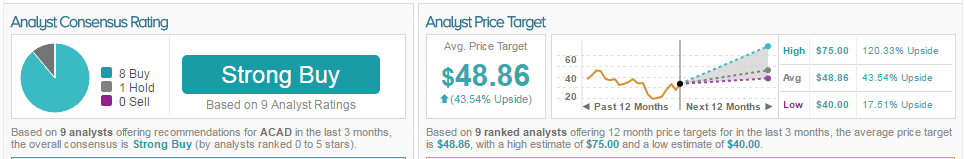

According to TipRanks, 92% of analysts covering Celgene are bullish on the stock, while 8% are neutral. The average 12-month price target between these analysts is $141.30, marking a 39% potential upside from where shares last closed.