You know there was some bad news with a company’s quarterly update when the stock tanks after the results are announced. That’s what happened Monday with Hexo (HEXO). The cannabis player shares fell 27% after the announcement of its fiscal second-quarter results, and one analyst thinks it has farther to fall.

Jefferies analyst Owen Bennett reiterated a Sell rating on Hexo shares along with a $0.70 price target, indicating further downside to the tune of 16%. (To watch Bennett’s track record, click here)

Considering the company announced net revenue of C$17 million, which translates to a 17% rise from the previous quarter and a 27% year-over-year increase, what has prompted the negative sentiment?

Well, first of all, Hexo reported the worst net loss in its history — C$298.2 million.

And that dire figure leads to the following fact: Hexo’s cash position is hanging precariously in the balance; The company ended the quarter with C$81.4 million. HEXO admitted that in order to fund operations in the current fiscal year it will need to raise additional capital. A difficult task in such times.

Bennett opined, “Focus today though will likely rest on the cash situation, with the disclosure that further raises will be necessary despite raising almost C$130m during the quarter. The fact is that cash burn remains too high, with -C$85m of operating cash flow in the quarter relative to a cash balance of C$80m. As we have previously highlighted, attempting to raise cash in the current environment is not something that is likely to be done on favourable terms, as highlighted by Tilray’s latest financing.”

Does the rest of the Street predict a rosier year ahead for Hexo?

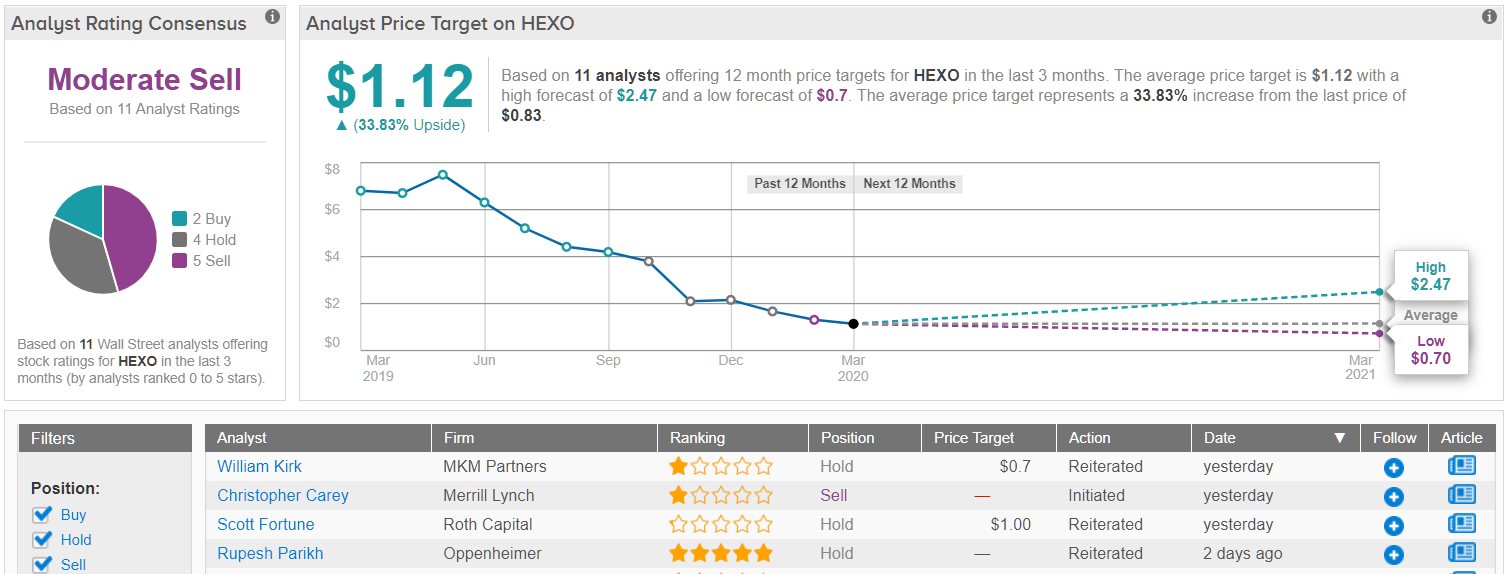

Looking at the consensus breakdown, the bears have it. Based on 2 Buys, 4 Holds and 5 Sell ratings received in the last three months, the word on the Street is that Hexo is a Sell. Having said that, its $1.12 average price target implies that shares could soar 34% in the next twelve months. (See Hexo stock analysis on TipRanks)

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.