Global stock markets have been on a rollercoaster ride since the COVID-19 pandemic shook the world. After closing at a record high on February 19, 2020, the U.S. stock market crashed due to the instability caused by an unprecedented pandemic. But, the stock market staged an unexpected comeback very soon and a bull market started on hopes of recovery and government stimulus.

Tech stocks enjoyed a strong rally in 2020 as certain businesses, like e-commerce and cloud computing, gained immensely from pandemic-led tailwinds. In contrast, tech stocks were battered in 2022 amid high interest rates and fears of a looming recession.

Let’s take a look at the stocks of six tech giants and see where they stand compared to their pre-COVID highs (we’ll consider stock prices until February 19, 2020, for pre-COVID highs).

Amazon (AMZN)

Amazon (NASDAQ:AMZN) stock has plunged from its pre-COVID high of $109.30. The stock closed at $89.87 on January 10, 2023, reflecting nearly 46% decline over the past year. It fell out of the trillion-dollar market cap club in November. Amazon shares skyrocketed in 2020 as consumers extensively depended on e-commerce retailers for various goods. However, as the economy reopened gradually, consumers started returning to physical stores, which led to a slowdown in Amazon’s revenue growth. Amazon stock rose just above 2% in 2021, lagging its FAANG peers.

While the company’s Amazon Web Services cloud computing division has been resilient and helped in offsetting the weakness in retail business this year, investors are concerned about the deceleration in AWS and the overall revenue growth.

Is Amazon a Buy, Hold, or Sell?

Wall Street remains bullish about Amazon’s long-term growth prospects based on its dominance in the e-commerce and cloud computing markets. The Street’s Strong Buy consensus rating is based on 36 Buys and three Holds. The average AMZN stock price target of $137.50 implies 53% upside potential.

Apple (AAPL)

Apple (NASDAQ:AAPL) stock, which closed at $130.73 on January 10, 2023, has appreciated compared to its pre-COVID high of $81.96. Shares rose about 35% in 2021, following an 82% rally in 2020. Work, play, and learn-from-home trends drove solid demand for Apple’s Mac and iPads during the pandemic. However, iPhone sales declined in Fiscal 2020 (ended September 26, 2020) in anticipation of newer models.

Despite supply chain issues, Apple’s iPhone sales bounced back strongly in Fiscal 2021. The company’s sales grew over 33% in Fiscal 2021, with strength across all product categories and Apple’s Services business. With fading pandemic tailwinds, persistent supply chain bottlenecks, and the impact of macro pressures on consumer spending, Apple’s sales growth slowed down to 7.8% in Fiscal 2022 (ended September 24, 2022).

What is the Target Price for Apple Stock?

While Apple stock has fallen nearly 25% over the past year, Wall Street continues to be bullish about one of the world’s most innovative companies. The Strong Buy consensus rating for Apple is backed by 22 Buys and five Holds. At $174.71, the average AAPL stock price target implies 33.6% upside potential.

Meta Platforms (META)

Meta Platforms (NASDAQ:META, formerly Facebook) stock has fallen significantly from its pre-COVID high of $224.20 to $132.99 on January 10, 2023. The leading social media platform benefited from high ad spending during the pandemic as businesses rushed to reach a growing online customer base.

However, a slowdown in ad spending following the economic reopening, growing competition from TikTok, and the shift to lower monetization products like Reels have weighed on Meta’s revenue in 2022. Furthermore, Apple’s iOS privacy changes have impacted Meta’s ability to target ads and have cost it billions of dollars. Investors are also concerned about the huge investments made by the company in its Metaverse projects.

Is Meta a Buy, Sell, or Hold?

Wall Street is cautiously optimistic about Meta Platforms, with a Moderate Buy consensus rating based on 29 Buys, eight Holds, and three Sells. At $148.08, the average Meta stock price target suggests upside potential of 11.4%. META stock has fallen more than 60% in the past 52 weeks.

Microsoft (MSFT)

Trading at $228.85 as of writing, Microsoft (NASDAQ:MSFT) stock has advanced when compared to its pre-COVID high of $190.70. Nonetheless, the stock has declined over 27% in the past year.

Microsoft has a diversified business model and is well known for its widely used Office 365 software, Windows operating system, hardware offerings, and Azure cloud computing platform. The company gained from rapid digitization and accelerated shift to the cloud triggered by work-from-home mandates during the pandemic.

With the waning of COVID-led favorable trends, MSFT’s revenue growth has slowed down due to a deceleration in Azure growth and lower Windows revenue owing to weakness in the personal computers (PC) market.

Is Microsoft Stock a Buy?

Despite near-term headwinds, Wall Street is positive about Microsoft’s multiple revenue streams and solid fundamentals. The Strong Buy consensus rating for Microsoft stock is backed by 26 Buys and three Holds. The average MSFT stock price target of $286.13 implies 25% upside potential.

Alphabet (GOOGL) (GOOG)

Shares of Google parent Alphabet (NASDAQ:GOOGL) (GOOG) are trading above their pre-COVID high of $76.54 (for GOOGL). Alphabet’s overall revenue grew 41% in 2021 compared to 13% rise in 2020, driven by strength in ad spending during the pandemic. However, high inflation and macro pressures led to a pullback in ad spending this year and impacted revenue from YouTube and Google’s search ads.

Is Alphabet Stock a Buy, Sell, or Hold?

Wall Street is highly bullish about Alphabet based on 32 unanimous Buys. Analysts are confident that the company’s dominant position in the digital ads space will support long-term growth. Additionally, the rapid growth in Google Cloud revenue is worth paying attention though the business is not profitable yet.

At $125.94, the average GOOGL stock price target implies 42.4% upside potential. GOOGL stock has tumbled 37% over the past year.

Tesla (TSLA)

We finally discuss electric vehicle (EV) maker Tesla (NASDAQ:TSLA), which is often considered a tech stock by several investors and Tesla bulls. Supply chain and production disruptions triggered by the COVID-19 resurgence in China and macro pressures have dragged down Tesla stock this year. Also, Tesla CEO Elon Musk’s Twitter acquisition and the subsequent distraction have shaken investor confidence.

Tesla was one of the worst-performing stocks of 2022. It has plunged over 66% in the past 52 weeks to $118.85, as of January 10, 2023. Nevertheless, it’s worth noting that the EV leader’s stock is still trading at a better level than the pre-COVID high of $64.60.

What is the Average Price Target for Tesla?

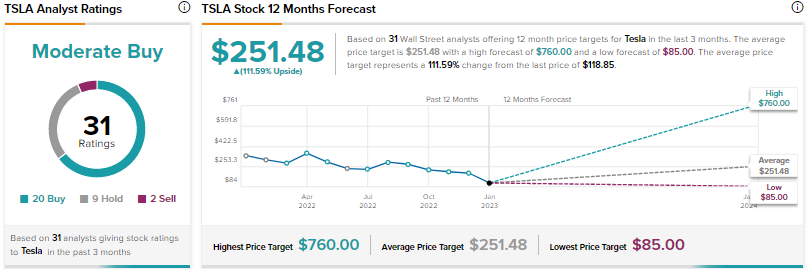

Despite ongoing economic pressures, several analysts are still optimistic about Tesla’s strong prospects in the lucrative EV market. The consensus Moderate Buy rating for TSLA stock is based on 20 Buys, nine Holds, and two Sells. The average TSLA stock price prediction of $251.48 indicates nearly 111.6% upside potential.

Conclusion

Among the six stocks discussed above, Amazon and Meta Platforms are trading below their pre-COVID highs. Wall Street analysts are looking beyond the near-term macro pressures and are highly optimistic about Amazon, Apple, Microsoft, and Alphabet. Meanwhile, they are cautiously optimistic about Tesla and Meta Platforms.