By Shira Gonen

McDonald’s Corporation (NYSE:MCD) is arguably one of the biggest turn around strategies of 2015. In the past year, the fast food giant has taken several initiatives to revamp its image amid several challenges and scandals it faced in the past few years. The company suffered sluggish sales the past 6 quarters due to European macro-economic challenges and a general shift from fast food restaurants to casual dining chains like Chipotle. In January of 2015, the company was involved in a racial discrimination lawsuit regarding one of its restaurants in Virginia. Back in 2014, it was discovered that the company’s main supplier in China sold expired meat to some of its Chinese locations. Other problems included the company’s too expansive menu and lack of effective marketing.

The company needed a change, and fast, if it wanted to offset its continuing lackluster sales and poor performance. On January 28, 2015, the company announced its chief brand officer Steve Easterbrook would serve as CEO, replacing retiring Donald Thompson. Easterbrook took several initiatives to turn the company around this year, promising a more “modern, progressive burger company.” As a result of these initiatives, the company posted better than expected sales in its third quarter earnings, the first in 6 quarters. Similarly, the stock price jumped 27% year to date with the company increasing its dividend.

In the past year, the company decided to offer its breakfast menu items all day, officially in U.S. locations starting October 6, 2015. Early data suggests this was the right move, as the NDP Group reported an increase in average ticket prices during lunch due to customers adding breakfast items to their orders. Analyst David Palmer of RBC capital was particularly bullish regarding this endeavor, reiterating his Outperform rating and raising his price target from $110 to $120 on October 23, 2015. He stated, “While All-Day Breakfast and value initiatives appear to be the catalysts needed to jump-start McDonald’s US trends, we suspect brand upgrades are coming in 2016 that could build upon the chain’s momentum.”

Other ways the company reinvented itself this year was by offering an improved menu, focusing on tastier food and improved service with “speed, friendliness and accuracy” to regain lost customers. In its California locations, the company offered burgers with more customizable options. The company also focused on better quality ingredients to change its industrial agriculture image and decided to roll out cage-free eggs in all of its U.S. and Canadian locations in the next 10 years. The company also plans on switching from margarine to butter and using better quality chicken.

The company displayed its shift to a more modern brand in its international locations as well. In Hong Kong, its restaurant offers new ingredients such as couscous and crayfish, customizable salads, and non-traditional menu items such as Belgian waffles. They also offer table service after 6 p.m and a theater-style kitchen. The company also has concept locations in Australia, focusing more on salads and items not traditionally found in its other stores.

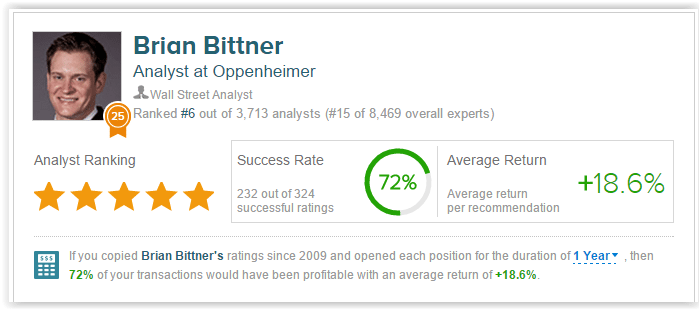

Analyst Brian Bittner of Oppenheimer weighed in on the company, reflecting on its turnaround strategy and new CEO following the company’s investor day. He stated, “The Investor Day showcased a refocused management team’s strategy to turn around the business and enhance shareholder value.” He continued, “MCD is taking many steps to improve operations and enhance shareholder value with a very competent CEO leading the charge.” On November 11, 2015, Bittner reiterated his Perform rating on the company without a price target. Overall, analyst Brian Bittner is ranked #6 out of 3,713 analysts on TipRanks. He has an average success rate of 72% recommending stocks with an average return of 18.6% per recommendation.

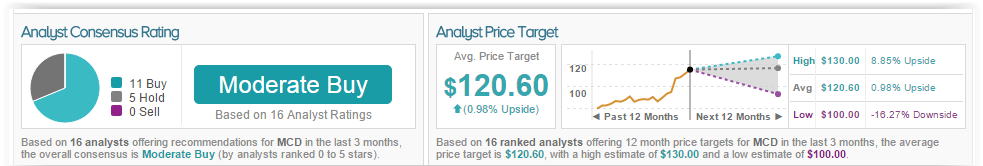

According to TipRanks’ statistics, out of the 16 analysts who have rated MCD in the last 3 months, 11 gave a Buy rating while 5 remain on the sidelines. The average 12-month price target for the stock is $120.60, marking a 1% increase from where shares last closed.