IBM Corp reported a better-than-estimated profit in the first quarter driven by sales of its cloud computing business. However revenue came in slightly below forecast as the company withdrew its 2020 guidance.

In the first three months of the year, net income declined to $1.18 billion, or $1.31 per share, from $1.59 billion, or $1.78 per share, in the year-ago period. Adjusted EPS amounted to $1.84 per share, above the $1.80 per share estimates. Total revenue declined 3.4% to $17.57 billion during the same period, coming slightly below analysts’ estimates of $17.62 billion.

IBM said its key areas of investment will continue to be hybrid cloud and AI as clients modernize their businesses and need to enhance their work-at-home capabilities in today’s COVID-19 environment. Business revenue generated from its cloud business rose 19% to $5.4 billion in the first quarter.

“IBM remains focused on helping our clients adapt to the immediate challenges of the COVID-19 pandemic, while we continue to enable them to shift their mission-critical workloads to hybrid cloud and expand their use of AI to help transform their operations,” said Arvind Krishna, IBM chief executive officer. “Our first-quarter performance in cloud is a reflection of the trust clients place in IBM’s technology and expertise today, and positions us to continue building an enduring hybrid cloud platform for the future.”

Krishna noted that in the past few weeks, the company was experiencing a shift in client priorities towards a preservation of capital, which has impacted its software business disproportionately.

Looking ahead, the company suspended its 2020 annual forecast as the coronavirus pandemic fuels uncertainty across financial markets amid expectations of a recession in the global economy. Against this IBM said it remained committed to its dividend plan.

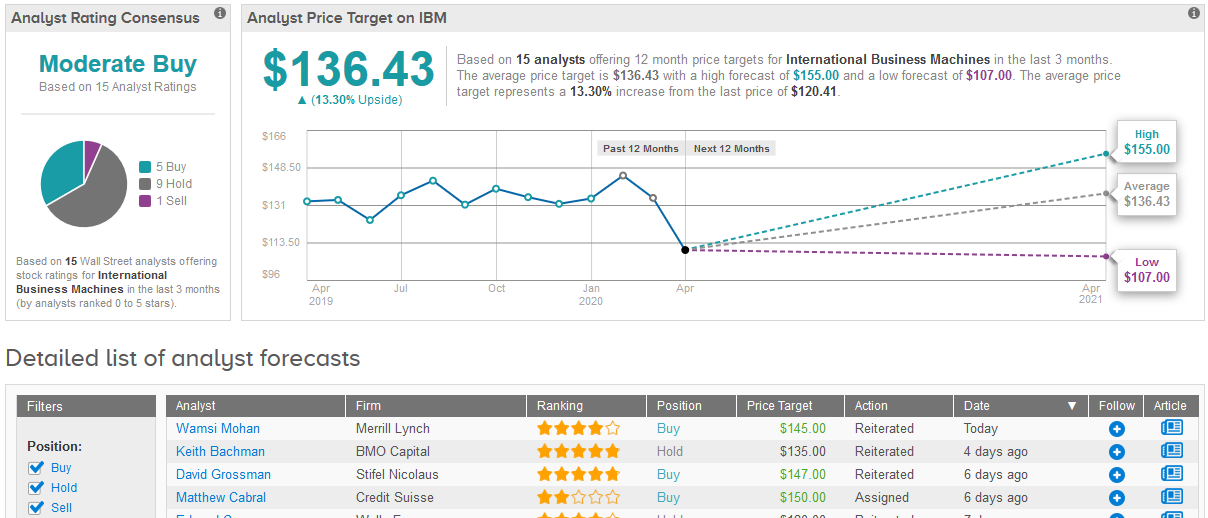

Wall Street analysts are divided on the company’s rating as 9 say Hold the stock, 5 say Buy and 1 says Sell adding up to a Moderate Buy consensus rating. The $136.43 average price target suggests shares have 13% upside potential in the coming 12 months. (See IBM stock analysis on TipRanks).

IBM ended the first quarter with $12 billion in available cash which includes marketable securities. Debt totaled $64.3 billion, which includes global financing debt of $22.3 billion, is down $8.7 billion year-on-year. In addition, the software giant said it had $15 billion of unused credit lines.

Related News:

United Airlines Expects $2.1 Billion Quarterly Loss as Travel Stalls

GE Enters Into $15B Credit Facility, Stock Plunges Over 40% YTD

Cheesecake Factory Gets $200 Million Cash Injection From Roark Capital