IBM delivered impressive 1Q 2021 results driven by strong client adoption of its hybrid cloud platform. Increased software sales and consulting enabled the company to post revenue growth, fueling suggestions that it would be able to meet its full-year revenue and adjusted free cash flow targets.

Revenue in the quarter was up 1% to $17.7 billion as cloud revenue increased 21% to $6.5 billion. Cloud revenue for the last 12 months increased 19% to $26.3 billion. Red Hat revenue increased 17% year-over-year. IBM (IBM) also delivered non-GAAP earnings per share of $1.77.

The company generated $4.9 billion in net cash from operating activities. Free cash flow totaled $1.5 billion, including $0.6 billion of cash impacts from structural actions initiated in Q4.

“With strong cash generation and disciplined financial management, we increased investments in our hybrid cloud and AI capabilities, while significantly deleveraging in the quarter and supporting our commitment to a secure and growing dividend,” said IBM’s COO and Senior Vice President, James Kavanaugh.

IBM shares are up 10.4% year to date after a 6.7% slide in 2020. (See IBM stock analysis on TipRanks).

Following the first-quarter report, BMO Capital’s research analyst Keith Bachman reiterated that management is taking the proper steps but faces significant challenges. The analyst said, “Moreover, we remain skeptical that IBM can grow revenues in CY22, and project revs to be about flat y/y.”

The analyst has since reiterated a Hold rating on the stock with a $150 price target implying 7.5% upside potential.

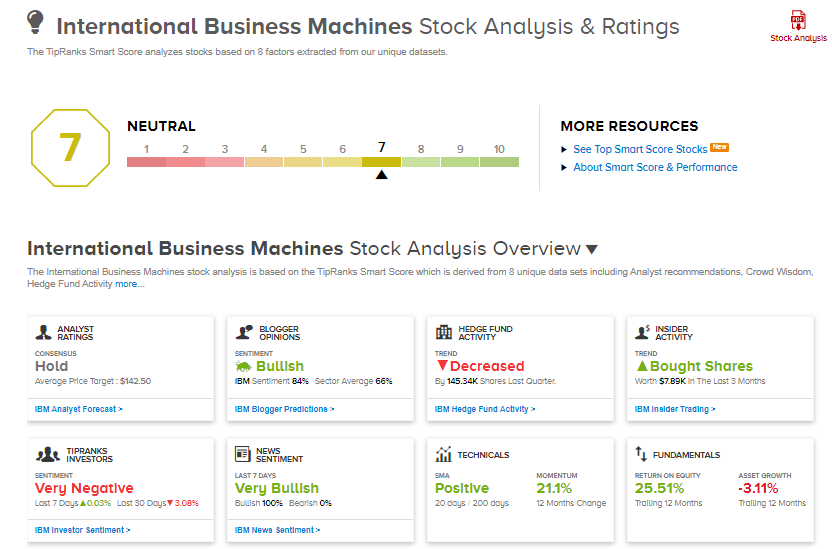

Consensus among analysts is a Hold based on 2 Buys, 3 Holds and 1 Sell. The average analyst price target of $142.50 implies 2% upside potential to current levels.

IBM scores a 7 out of 10 on TipRanks’ Smart Score rating system implying that the stock is expected to perform in line with market expectations.

Related News

Abbott Starts Shipping Over-The-Counter COVID-19 Self-Test

PayPal’s Venmo Adds Support For Bitcoin, Ethereum, Bitcoin Cash and Litecoin

Amgen Completes The Acquisition Of Five Prime Therapeutics