Inovio Pharmaceuticals (INO) on Tuesday announced “positive” interim clinical data results of INO-4800, its experimental vaccine candidate against the novel coronavirus.

Shares, however dropped 12% to $27.74 in midday U.S. trading, suggesting investors were taking the results with a grain of salt. The value of the stock has this year already ballooned 740%.

Inovio said that the early-stage clinical data demonstrated that INO-4800 resulted in immune responses and was generally safe and well-tolerated in all participants in the first two Phase 1 trial cohorts. In addition, the biotech company announced that INO-4800 has been selected to participate in a non-human primate (NHP) challenge study as part of the U.S. government’s Operation Warp Speed, a national program aiming to provide substantial quantities of safe, effective vaccine for Americans by January 2021.

“We are very encouraged by the positive interim safety and preliminary cellular and humoral immune response results to date as well as the inclusion of INO-4800 in Operation Warp Speed,” Inovio President and CEO Joseph Kim said. “We are also pleased that INO-4800 vaccination abrogated viral replication in the lungs of mice challenged with SARS-CoV-2.”

Furthermore, Inovio added that it has expanded its Phase 1 trial to add older participants in additional cohorts and plans to initiate a Phase 2/3 efficacy trial this summer upon regulatory concurrence.

The Phase 1 clinical trial of INO-4800 initially enrolled 40 healthy adult volunteers in the age of 18 to 50 years at two U.S. sites. About 94% of Phase 1 trial participants demonstrated overall immune responses at week 6 after two doses of INO-4800 in trial with the 40 healthy volunteers in preliminary analyses.

INO-4800 targets the major antigen Spike protein of SARS-CoV-2 virus, which causes Covid-19 disease.

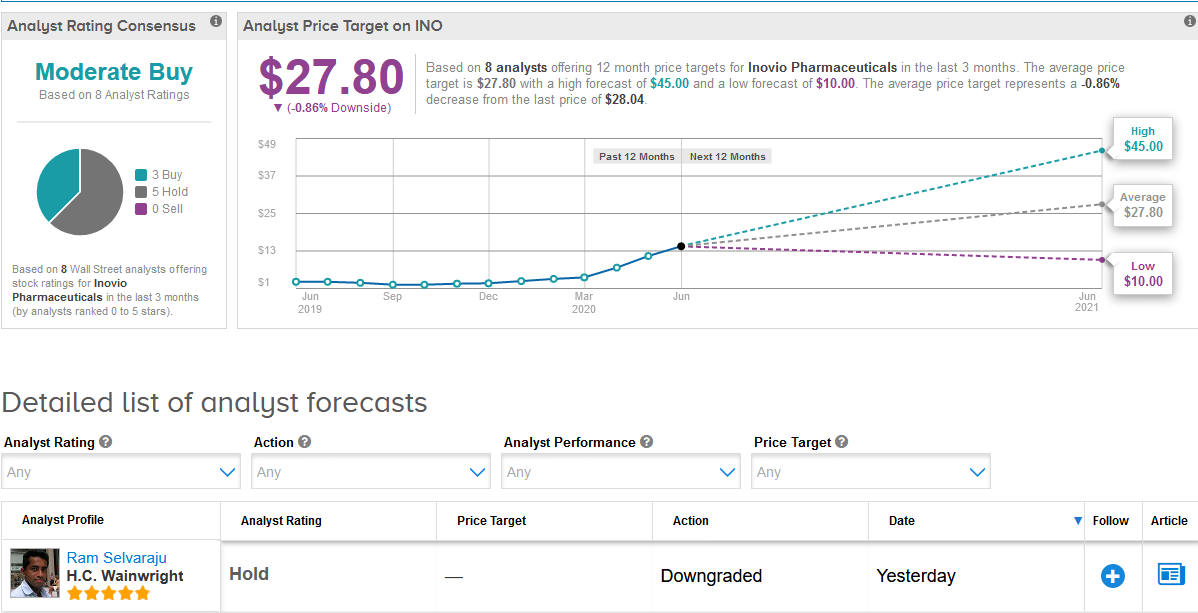

Following Inovio’s stellar rally this year, five-star analyst Ram Selvaraju at H.C. Wainwright on Monday downgraded the stock to Hold from Buy and withdrew his price target.

“We believe the risk/reward ratio for Inovio has increased significantly as many open questions remain, including the strength and duration of neutralizing antibodies and T cell responses that may be generated in human trials and the effective protection the vaccine may demonstrate in animal challenge studies,” Selvaraju said in a note to investors.

The skepticism stems from the fact that there is no approved human vaccine for any type of coronavirus and that no DNA vaccines have been approved yet for human use, he added.

The Street has a cautiously optimistic outlook on Inovio, with a Moderate Buy analyst consensus based on 3 Buy ratings versus 5 Hold ratings. As the share price spiked so fast this year, the $27.80 average analyst price target now indicates shares are more than fully priced. (See Inovio stock analysis on TipRanks).

Related News:

Gilead Sets Pricing for Covid-19 Treatment Remdesivir at $2,340 Per Patient

AstraZeneca Strikes $127 Million Deal With Brazil For Covid-19 Vaccine

Vaxart Explodes 96%- And Rallies After-Hours- On Covid-19 Deal