When insiders are buying the company’s stock, there is pretty much only one way to look at it. They have some valuable insights that make them bullish on the share prices. Insider trading could be of great help to investors if they get the information on time and can use it to their advantage.

In this context, TipRanks Daily Insider Transactions is one such tool that displays recent insider trading activities of various companies in specific markets. This tool includes date-wise buying and selling of shares by insiders, along with other details.

Let’s have a look at these companies from the German market and discuss their recent insider transactions.

Deutsche Telekom AG (DE:DTE)

Deutsche Telekom is a leading telecommunications company in Europe, providing fixed, mobile, internet, and IPTV products and services.

The company’s shareholders are happy as the stock is in good shape and has given a return of 20% in the last year. For long-term investors holding the stock for more than three years, the returns are much more stable at 43%.

The company posted high growth numbers in its third-quarter results for 2022. Adjusted net profit increased by more than 80% year on year to €2.4 billion, owing to higher customer growth and new rate plans. This has motivated the company to increase its full-year guidance numbers for the third time in 2022.

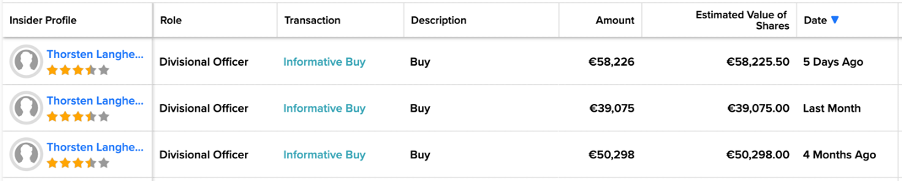

As per TipRanks, corporate insiders have bought €97.3k worth of shares in the last three months. The most recent transaction was by the company’s divisional officer, Thorsten Langheim, who bought 47,500 shares at a price of €1.23 per share, worth €58.2k.

This insider confidence signal is positive for the company.

Prior to this, Langheim also bought some shares of the company in November and in August 2022. His track record shows a success rate of 60% on his transactions, with an average return of 8.34%.

Deutsche Telekom Stock Forecast

According to TipRanks’ analyst consensus, Deutsche Telekom stock has a Strong Buy rating, based on 12 Buy recommendations.

The average target price for DTE is €25.42, which represents a 35% change in the price from the current level.

Bayer AG (DE:BAYN)

Based in Germany, Bayer AG is a well-known name in the pharmaceutical and biotechnology space.

The company’s stock returns are not as impressive as those of Deutsche Telekom, but it has still managed to give a return of 6.82% in the last year. Analysts see this as a long-term buying opportunity with various high-potential drugs in the pipeline.

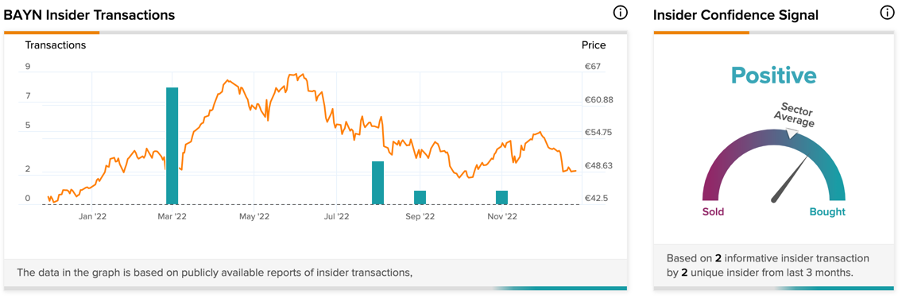

Compared to Deutsche Telekom, Bayer has had more insider transactions in the last few months. The corporate insider has bought €1.1 million worth of shares, indicating big confidence in the company’s fundamentals.

Peeking into more details, the company’s chairman and chief executive, Werner Baumann, bought 20,000 shares at €50.04 per share in November 2022. This transaction was for €1 million. Prior to this, he purchased 30,000 shares in August 2022 for €54.45 per share, worth €1.63 million.

These two transactions represented the largest insider purchases in the company’s history. This clearly suggests his confidence in the share prices, as he has spent a major amount buying them.

The following is a snapshot of recent insider trading in the company’s shares.

Is Bayer a Good Stock to Buy?

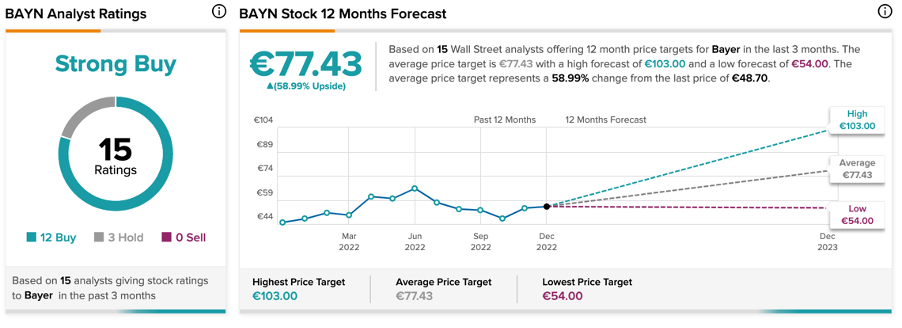

According to TipRanks’ analyst consensus, Bayer stock has a Strong Buy rating, based on 12 Buy and three Hold recommendations.

The average target price is €77.43, which has an upside potential of 59% on the current price level.

Final Thoughts

Investors should take a cue when insiders are buying the company’s stock. These people are way ahead of analysts and other experts in knowing the performance of the company.

The TipRanks’ Insider Transactions tool makes these data readily available for investors, specific to each company. Also, classifying the transaction as an informative or non-informative buy gives powerful insight to investors as they choose their stocks.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.