Shares of the cloud-based software solutions provider Intapp (NASDAQ:INTA) have more than doubled in the past six months. Meanwhile, it closed over 18% higher on Tuesday. The spike in INTA stock is supported by its strong Q2 performance and upbeat outlook for Fiscal 2023. While INTA’s financials impress, analysts’ average price target shows limited upside due to the recent rally in its price.

Intapp delivered adjusted earnings of $0.03 per share in Q2 that fared better than the Street’s projection. Wall Street expected INTA to post a loss of $0.03 per share. What stands out is the steady demand for its solutions. Its SaaS and support revenue increased 31% year-over-year in Q2. Meanwhile, the cloud ARR (Annual Recurring Revenue) increased by 42%. Overall, its total revenues increased by 31%.

Given the ongoing momentum in its business, INTA raised its full-year guidance. It expects to deliver total revenues in the range of $340.5 to $344.5 million, up from its previous forecast of $332 to $336 million.

Furthermore, INTA expects to post adjusted EPS in the range of $0.02 to $0.06. Earlier, the company projected a loss per share of $0.03 to $0.07.

Oppenheimer analyst Brian Schwartz is bullish about INTA stock. On Q2 performance, the analyst said that the “results and higher guidance lend good support to INTA as our top 2023 verticals pick. We see good countercyclical demand among Intapp’s end markets and find competition fears overblown.”

However, he pointed out that the company’s outlook suggests a slowdown in growth and operating margins.

What’s the Prediction for INTA Stock?

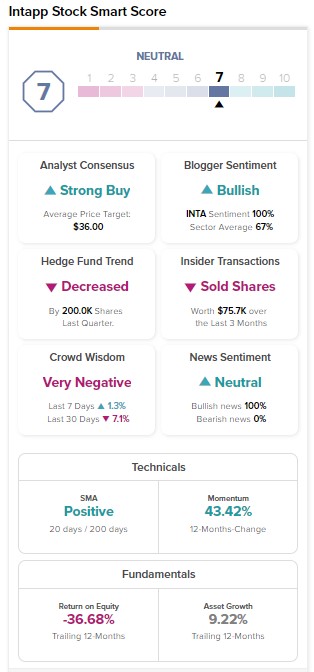

INTA stock has a Strong Buy consensus rating on TipRanks, reflecting eight unanimous Buy recommendations. However, analysts’ average price target of $36 implies a limited upside potential of 7.43%.

Further, hedge funds have capitalized on the rally in INTA stock and lowered their exposure. Hedge funds sold 200K shares last quarter. Intapp has a Neutral Smart Score of seven.

Bottom Line

The surge in INTA stock reflects that positives are already priced in. Meanwhile, the expected slowdown in growth rate due to macro headwinds and a Neutral Smart Score on TipRanks implies that the upside may remain limited in the near term.