Real Madrid vs Barcelona, The Beatles vs The Stones – our cultural landscape is filled with intense rivalries which arouse the tribal instincts in us all. Almost everyone has an opinion, and a favorite to go along with it.

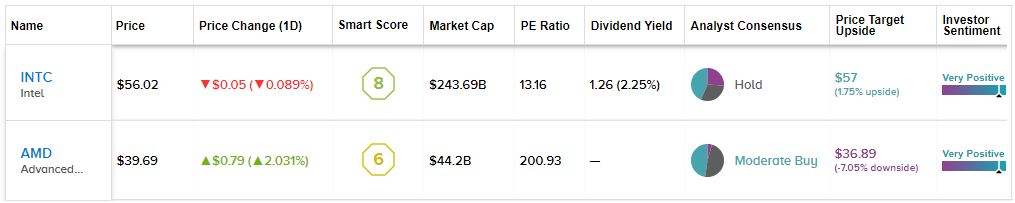

Add to this list then, CPU giants Intel (INTC) and Advanced Micro Devices (AMD). The two are the only major players regularly fighting it out in the CPU market. Although Intel’s market cap is almost 5 times bigger than AMD’s, the latter has been making big strides this year.

Stock Comparison Tool | TipRanks

AMD has taken advantage of Intel’s shortages in the low end of the PC market this year and has eaten away at Intel’s traditional dominance. Add to this the recent reports of AMD processors outselling Intel’s by 5 to 1 in Germany’s large Mindfactory stores, along with a recent survey by the European Hardware Association (EHA) which concluded 60% of tech enthusiasts expressed a preference for AMD desktop processors over its rival, and a trend becomes apparent.

Both companies recently unleashed new products on the market. AMD launched its 7nm Threadripper 3970/3960 series for the high-end desktop market, while not to be outdone, Intel launched its new Cascade Lake-X processor, the 18-core Core i9-10980XE.

5-star Mizuho analyst Vijay Rakesh recently took a look at both and had some key takeaways; in gaming, the Intel units had the upper hand, its processor faster than AMD’s by 15-20%. In a growing industry with an estimated 1.0-1.5B PC gamers globally, Intel is well positioned to benefit. On the other hand, the Threadrippers’ increased cores and faster rendering times make it very attractive to the 70-80 million content creators on YouTube or Instagram.

Pricewise, Intel came out in top, with the analyst noting, “Desktop Intel core i9 is priced at ~$488-$979, decent price/performance versus new AMD 7nm (36core/64Threads) high-end Desktop 3970X at $1399+ or the DT Ryzen 9 generation 3950 at $749–and INTC is also aggressive with Cascade Lake pricing.”

Rakesh concluded, “Even though we believe AMD is ramping a solid, broad, product portfolio with 7nm, INTC, with legacy 14nm, is still price-competitive with good performance, and ramping new 10nm NB/mobile i3/i5/i7. KEY for INTC stock, in our view, would be 1) ramping its 10nm Ice Lake Server and Desktop, and also 2) closing the gap with 10nm PCIe4.0/38cores in 2H20.”

To this end, the top-rated analyst maintained a Buy rating on INTC, along with a $64 price target, which implies about 14% upside from current level. Rakesh, on the other hand, thinks AMD’s surge has run its course for now, and maintained a Neutral rating on the stock, along with a target price of $38. (To watch Rakesh’s track record, click here)

To find other good ideas for tech stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.