By Kate George

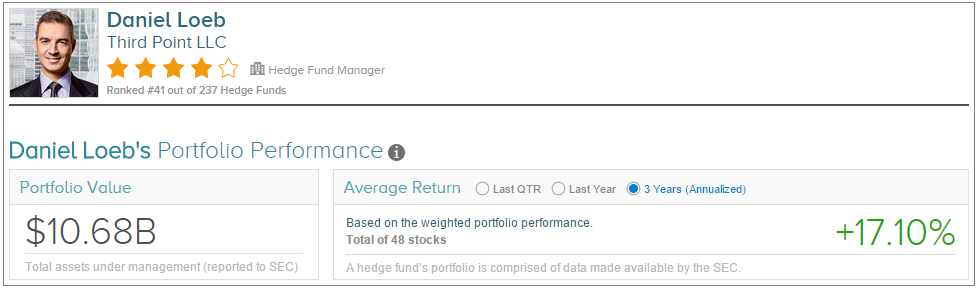

Daniel Loeb is a billionaire hedge fund boss with a portfolio value of $10.68 billion.

Looking at Loeb’s recent investment moves, the hedge fund manager has reduced his holdings in Amgen, Inc. (NASDAQ:AMGN) by 10%, year-to-date. However, at 11.66%, Amgen comprises the largest portion of his portfolio. Since August, Amgen’s stock has dropped 25%, nearly in line with the iShares NASDAQ Biotechnology Index (IBB), which has dropped 25% over the same timeframe. However, based on TipRanks’ statistics, a majority of analysts who have recently rated the stock differ from Loeb. Of the nine analysts, six have rated it as a Buy with an average 12-month price target of $189.50, a 35% potential upside over current levels.

Loeb has added ZIOPHARM Oncology Inc. (NASDAQ:ZIOP), a clinical-stage biopharmaceutical company, to his portfolio. Recently, Ziopharm was in news for a new collaboration with Intexron to develop therapies for the treatment of Graft versus Host Disease. As per TipRanks’ statistics, the average 12-month price target for Ziopharm is $21, a potential upside of 128% over current levels.

Loeb also added FedEx Corporation (NYSE:FDX) to his portfolio. As per the company’s latest earnings release on September 16, the company reported lower-than-expected first quarter earnings of $692 million. The company also lowered its full-year EPS outlook to $10.4-10.9, as opposed to the earlier target of $10.6-11.1. Some of the factors behind this lower outlook are weaker demand in the trucking industry. Loeb’s sentiments for the stock are shared by a majority of the 10 analysts who have recently rated FedEx as per TipRanks’ statistics. Of the 10, eight analysts have rated the stock as a Buy and two have rated it as a Hold. The average 12-month price target is $185.14, a nearly 28% potential upside from current levels.

For the past three years, David Loeb’s hedge fund has given an average annualized return of 17.10%.

As per TipRanks’ statistics, Loeb’s hedge fund, Third Point LLC, is ranked 41st out of 237 hedge funds.