Archer Aviation (NASDAD:ACHR) stock has been on a roll over the past month, having gained some 40% since early April. While ACHR remains down by 10% for the year, there has been plenty of positive developments for bulls to latch onto.

The electric air taxi pioneer has teamed up with United Airlines to launch eVTOL services in both the New York and Chicago areas, pledging to offer “a safe, sustainable, low noise, and cost-competitive alternative to ground transportation.”

The company is also working to create a network of air taxis in international markets, including Abu Dhabi and eastern Africa – and has signed deals with the Abu Dhabi Aviation and Ethiopian Airlines.

Still, not everyone is ready to buckle in for the ride. Despite the customer partnerships, investor Guilherme Nunes is concerned that too much is still up in the air.

“Despite potential, Archer faces high risks, including certification delays and cash burn, making it a HOLD until proven delivery in 2025,” the investor opined.

Nunes outlines three different scenarios, which detail optimistic, base, and pessimistic projections for the company. In the rosiest future, ACHR would reach profitability next year, and deliver gross margins of 20%, 45%, and 55% in 2026, 2027, and 2028, respectively. This would translate into gross profits of $1.787 billion by 2028.

However, Nunes reminds investors that delays often occur in established industries, making it safe to assume that this will also be the case for this blue ocean business. This could very well cause Archer Aviation – which “has a history of cash burn and lofty promises” – to raise capital once again in 2026.

Adding to his cautious approach, the investor also notes a troublesome incongruity, as ACHR has already agreed to deliver more than 1,000 eVTOLs prior to receiving FAA production approval.

“This timing mismatch between order intake and delivery could severely impact expected margins,” cautions the investor.

Bottom line? Nunes isn’t ready to go all-in. “If the company delivers on its promises, it could be a great buy,” he admits. “But will they deliver?”

“There are many ‘ifs,’ which raise the investment’s risk level,” Nunes concludes, urging investors to stay cautious. For now, he’s sticking with a Hold (i.e., Neutral) rating on ACHR shares. (To watch Nunes’ track record, click here).

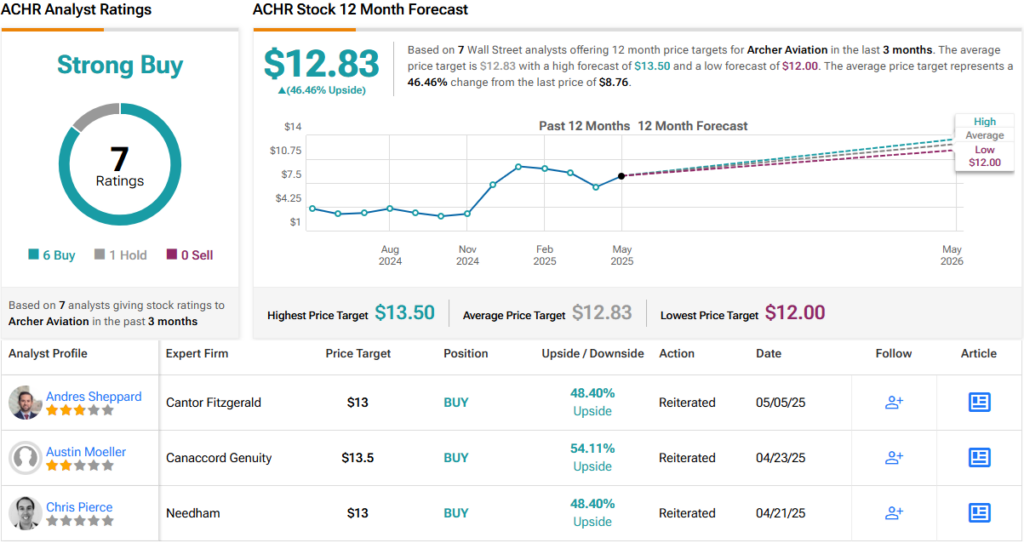

Wall Street, on the other hand, clearly feels that ACHR is well on its way to delivering on its promises. With 6 Buy and 1 Hold recommendations, the stock boasts a Strong Buy consensus rating. Its 12-month average price target of $12.83 implies a potential upside of 46%. (See ACHR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.