While consumers generally love Fitbit (FIT) products, this hasn’t necessarily converted to sales. And this is making investors nervous.

One of the biggest challenge (and opportunity) the company is facing is marketing its watches as medical devices. While many people use these watches to track health-related activity, they cannot be prescribed widespread by doctors until the company gets federal approval on at least a few features. This puts them in contrast with the Apple Watch, which has FDA clearance on select features, making it more medical device than any Fitbit product. And while the market is small, with only a handful of players, some believe Apple’s dominance will reign and ultimately wipe FIT out.

Deutsche Bank analyst Jeffrey Rand is not as dire as some, but he remains sidelined on Fitbit stock with a Hold rating and $5 price target, which implies about 33% upside from current levels.

While Fitbit hasn’t taken off as a medical device in the US, Rand points to Singapore for optimism. According to the company, Rand says, the recent deal with the Singapore Health Promotion Board is “a validation point that wearable devices can have a positive impact on the health of a large population,” and will pave the way to “opportunities with other governments/insurance companies to provide devices for a large population of people.”

Should the company be able to reach a large population of people like it hopes, Rand believes it has at least one advantage over Apple — it’s ability to work across Android. He says this “remains a key competitive advantage for the company,” as large partnerships with governments or insurance providers means a massive user base — and one that may not always be Apple users.

Rand takes a step back and evaluates Fitbit’s recent jump into subscription software, Fitbit Premium. He says the company “sees many opportunities in its subscription business, including a more stable recurring revenue stream and the opportunity” to bundle the software with the hardware, helping push customers to buy the hardware. When ramped up, Premium could be a major revenue generator for the company. However, the analyst believes the subscription business will take some time to ramp and till then he remains on the sidelines.

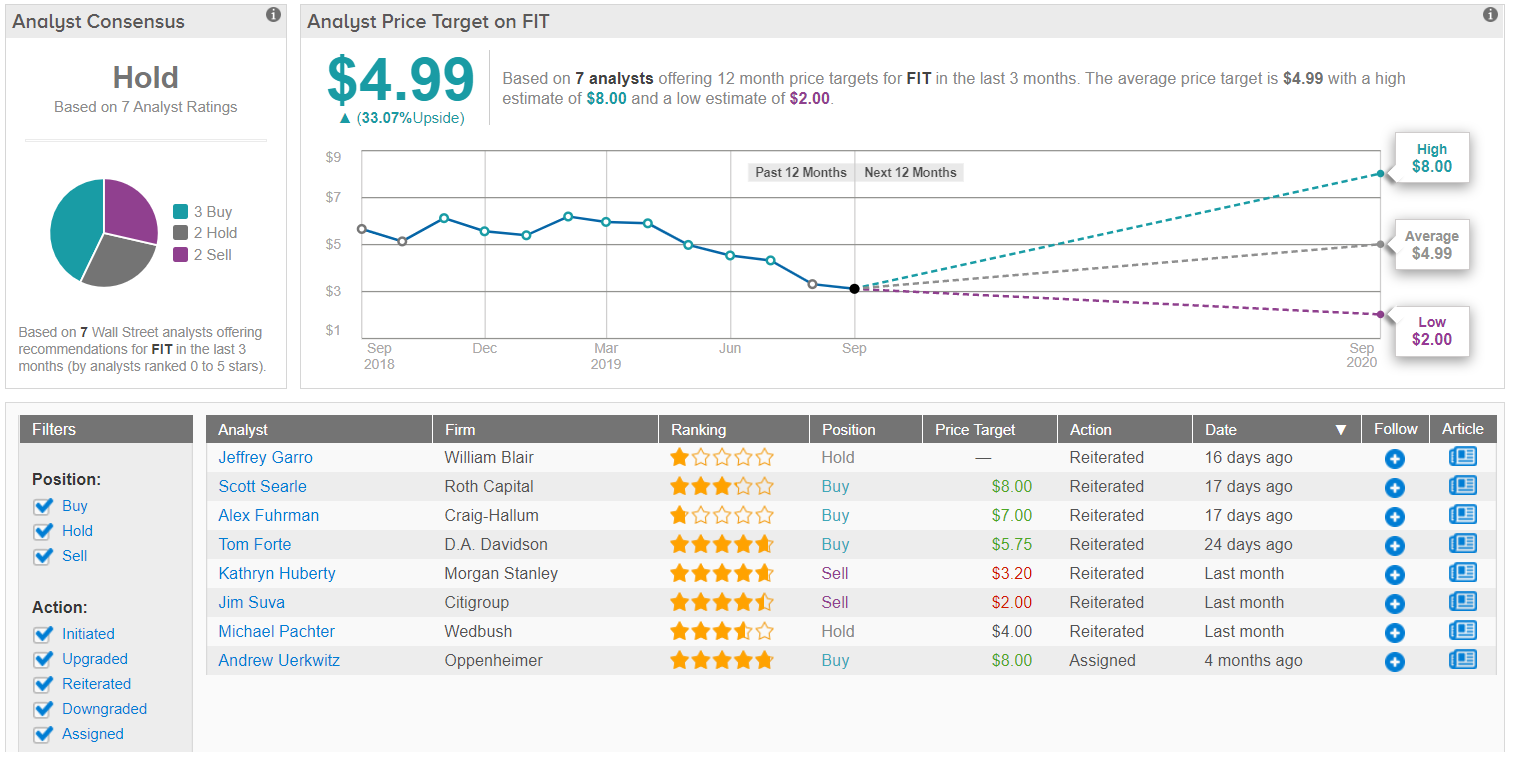

All in all, Wall Street believes Rand is smart to play it safe when it comes to the wearable device maker’s prospects ahead, as TipRanks analytics reveal FIT as a Hold. Out of 7 analysts polled in the last 3 months, 3 are bullish on Fitbit stock, 2 remain sidelined, and 2 are bearish on the stock. With an upside potential of 33%, the stock’s consensus target price stands at $4.99.