If the new year represents a new beginning to some, for others it is just ‘same old same old.’. Fortunately, for Apple (AAPL), ‘same old same old’ will do just fine. The world’s most successful company has started 2020 in exactly the same way it finished 2019: by reaching new all-time highs. The tech giant is up by another 7% since the turn of the year and at the time of writing is trading at $312.68.

So, is Apple stock finally set for a pullback?

According to Wedbush’s Daniel Ives the answer is a “resounding NO.” Incredibly, the 5-star analyst believes we are just at the beginning of a transformational new cycle.

Apple’s current iPhone 11 upgrade cycle is reportedly boasting an uptick of demand in China. Couple this with “jaw dropping” AirPods momentum, and according to Ives, the upcoming FY1Q report will boast positive results and provide strong March guidance as well. The real catalyst for Apple over the next 12 months, though, will be the “impending 5G super cycle.”

The iPhone 12 is expected to rollout in September and will boast 5G capabilities across its entire range. Ives expects demand for the 5G enabled units to be between 200 million to 220 million and marks the figure as “the new line in the sand.”

Furthermore, the analyst argues, the Street has yet to factor in Apple’s $50+ billion revenue stream from its assorted services. These include the newly launched streaming service Apple TV+, the Apple credit card and the well-established App Store and Apple Music, amongst others.

Bottom line, what does it all mean, then? Well, according to Ives, expect Apple to be the first company with a $2 trillion market cap by the end of 2021.

“Apple has potential to be the first $2 trillion valuation given the 5G tailwinds and services momentum potential over the coming years. The services business we assign a $500 billion to $650 billion valuation range given the increasingly importance of this key revenue stream that is getting a new appreciation by investors as Cook & Co. further monetize its golden jewel installed base of what we estimate is currently 925 million iPhones worldwide,” the analyst explained.

Ives, therefore, reiterated an Outperform rating on Apple along with a price target of $350. Should the target be met, in addition to a smartphone, investors’ pockets will be ringing from another 10% addition. (To watch Ives’ track record, click here)

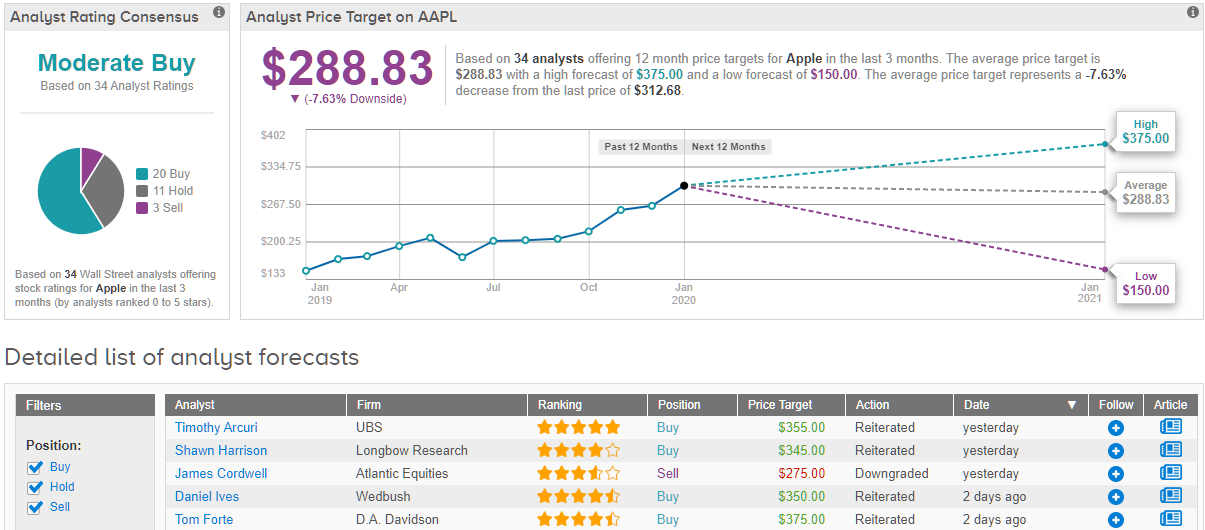

Does the rest of the Street think Apple is on its way to a $2 trillion market cap, too? Not currently. The average price target is $288 and implies possible downside of 9%. According to the rest of the Street, then, we might be waiting a little longer to meet a $2 trillion valued company. (See Apple stock analysis on TipRanks)